- Funding Needed

- $417 (Mio)

- EB5 Funding

- $200 (Mio)

- Amount Subscribed

- $417 (Mio)

- EB-5 Investors

- 112

- Investment Amount

- $1,800,000

- Subscription Fee

- 50,000

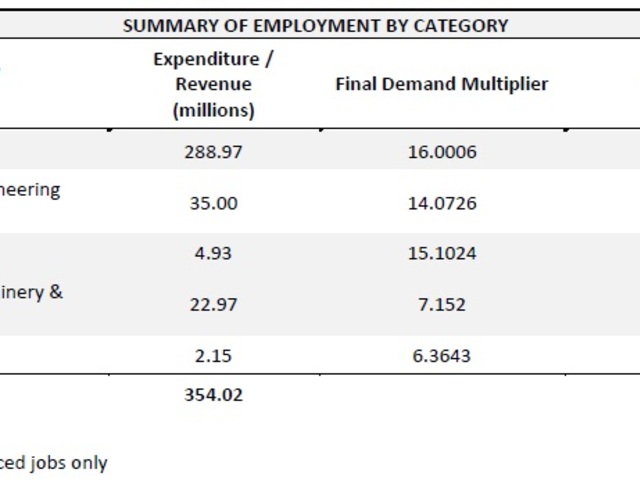

- Job Creation per Investor

- 47.9

- Job Creation (Total)

- 5368

- Category

- Construction

- Sub-Category

- Highway, Street, and Bridge Construction

- Structure

- Loan

- Amount of EB-5 investors anticipated for this phase?

- 400

- Expected Maturity

- 5 years.

- Expected Return

- Uncertain. The limited partners (i.e. the EB- 5 investors) will receive 25% of the profits of the Partnership (i.e. the interest income of up to 0.5% per annum, less the entire costs of operating the Partnership).

- Principal equity in project?

- Yes

- Does this project have approved I-526's?

- Yes

- Does this Regional Center have approved I-526's?

- Yes

- Does this Regional Center have approved I-829's?

- No

- State

- Pennsylvania

- Location

- Bucks County, Pennsylvania.

- Last Update: February 05, 2021 11:17 AM

Funding

Jobs

Investment

Immigration

Location

Your Project was viewed 585 times (totally).

For the last 7 days 0 times.

DVRC Pennsylvania Turnpike / I-95 Interchange Project

- Developer Name

- Pennsylvania Turnpike Commission

Project Description

Pennsylvania Turnpike Commission (PTC), a Pennsylvania State Agency that oversees all the toll roads in the state is overseeing all aspects of construction and operation of the project. PTC will track job creation and be responsible for the job creation.

The PA Turnpike/ I-95 Interchange will be an interchange construction project in southeastern Pennsylvania, whose development will be undertaken in three separate and operationally independent stages: Stage 1, Stage 2 and Stage 3. The Project outlined here will be exclusively concerned with Stage 1, which is then divided into ten separate “contracts” that will go out to bid throughout 2013.

Stage 1 of the project involves the construction of:

• The I-95 mainline flyovers of the interchange between I-95 and the PA Turnpike;

• A new mainline toll plaza west of this interchange;

• Replacement of the existing River Bridge toll plaza with an all-electronic tolling (AET) on road toll facility in the westbound direction; and

• Removal of the existing US-13 interchange toll facility.

The much-needed PA Turnpike/ I-95 interchange will provide motorists with an interchange between Interstate 95 and the Pennsylvania Turnpike, boosting travel efficiency while having a substantial economic impact on the local community.

Project Timeline

Initial construction for advance overhead bridge replacements

began in Fall 2010. Advanced ITS installation and environmental contracts have also commenced. The remaining construction projects are scheduled to commence construction throughout 2013, with Stage 1 to be completed by 2018.

Reports

DVRC Pennsylvania Turnpike / I-95 Interchange Project: Contact Information

- Contact Person

- Frank Manheim

- Address (contact)

- DVRC PENNSYLVANIA TURNPIKE, LP, C/O DELAWARE VALLEY REGIONAL CENTER, LLC, GENERAL PARTNER, 200 West Washington Square, Suite 250 Philadelphia Pennsylvania 19106

- help@thedvrc.com

- Web Site

- www.thedvrc.com

DVRC Pennsylvania Turnpike / I-95 Interchange Project: Investments

- Reg. D?

- Yes

- Reg. S?

- Yes

- Investment type

- Loan

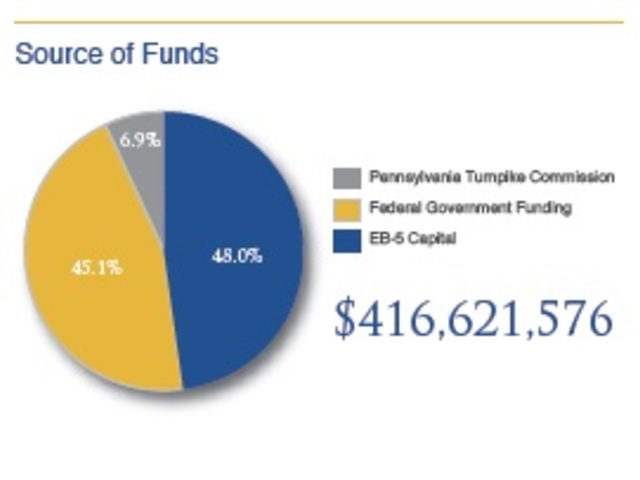

- Total amount of estimated funding required for all phases of development(in Millions)?

- $416.62

- Number of planned phases (projects) in development?

- 1

- Expected time to complete this project or phase of overall development?

- more than 12 months

- Is this a new commercial enterprise or purchase of an existing troubled business?

- New commercial enterprise

- What ratio of equity to debt would best classify the source of overall funding for the project / development?

- 50% equity : 50% debt

- What percentage of overall funding has been raised to date?

- more than 75%

- Does the investor need to be accredited to invest?

- Yes

- What are the expected financial returns for this project?

- Uncertain. The limited partners (i.e. the EB- 5 investors) will receive 25% of the profits of the Partnership (i.e. the interest income of up to 0.5% per annum, less the entire costs of operating the Partnership).

- Are returns paid on the investment prior to maturity?

- Yes

- If Yes, when are they paid?

- Annually

- Can you describe in more detail how returns are paid, and under what conditions? For instance, are they only paid if the project is positive cash flow or profitable. What expenses must be accounted for and paid prior to distributions are paid to investors?

- Returns will be paid provided that sufficient funds are available. After giving effect to certain special tax related allocations, profits and losses for any fiscal year will be allocated amongst the Partners on a class by class basis. 75% shall be allocated to the General Partner and 25% to the Limited Partners. The Limited Partners will reimburse the General Partner for all expenses related to the operations of the Partnership.

- Can you please describe the expected exit strategy and what source(s) of debt or equity are expected to be used to repay the investor’s capital investment?

- At the end of five years, the Borrower will have the option to either repay the loan in cash or to deliver registered tax free municipal bonds. There is no guarantee that such repayment will occur on acceptable terms, if at all.

- Can you please describe the procedure for allowing the investor to sell his interest in the investment and who the buyer might be?

- The acquisition of units is illiquid. The transfer and resale of the units will be restricted, and the units may not be transferred or resold except as permitted under the Securities Act and applicable state securities laws.

- What is the expected term of the investment?

- 5 years.

- Have these strategies been used by the Regional Center principals, or project managers in the past and what was the outcome?

- No. This is the Regional Center's first project. The Delaware Valley Regional Center was officially designated as an EB-5 RC by USCIS as of May 27, 2014.

- Have all of the permits and permissions for project development been obtained?

- Yes

- Is there any patented intellectual property essential to this project?

- No

- Are there any other notes or comments to make regarding this investment that would be important for the Investor to know?

- DVRC Turnpike is a Exemplar pre-approved project and potentially provides for a faster processing time. Exemplar Approval allows a regional center to submit project documents to the USCIS for approval before the filing of any I-526 Petitions. If the project documents comply with EB-5 rules, regulations, and guidance, the USCIS will issue a blanket approval of the project documents, and the project documents should not be reviewed with each I-526 Petition filed.

DVRC Pennsylvania Turnpike / I-95 Interchange Project: Fees

- What is the fee for subscribing to the investment (Subscription Fee)?

- 50,000

- Do potential investors need to pay a fee to obtain the operating documents, PPM or other subscription documents?

- No

- If Yes, Is that refundable in the event the investor decides not to invest?

- No

- Could you please describe the procedure for the return of any fees, or fees that are withheld?

- In case of I-526 denial, the escrow agent will release the Fee escrow funds net of breakage costs.

- Could you please describe the procedure for return of escrow in the event of denial of the I-526 by USCIS?

- If any investor’s I-526 Petition is denied by the USCIS or if the investor fails to complete the Immigration Processing for any reason attributable to the investor, including the investor’s failure to meet the U.S. immigration eligibility criteria related to the individual investor, the investor’s failure to provide evidence, or fraud/ material misrepresentation by the investor, then the investor’s subscription funds will be returned after deduction of an administrative fee to compensate for the costs of replacing the investor and other incidental costs. Commercially reasonable efforts will be made to promptly refund the full amount without interest, no later than 190 days after receiving written notice of the I-526 Petition denial. To refund the capital investment amount, PTC’s prepayment of that portion of the Loan will be required.

- Does that include the processing of the I-526, I-829 or any other legal fees associated with the immigration application?

- No

- What is the policy for reimbursing the escrow payment in the event of denial?

- Both investment and subscription fee will be returned if I-526 is rejected.

- If there is no finder or agent, would you reimburse that fee to the investor?

- No

- Do you pay finder’s fees to attorneys?

- No

- Do you pay fees to unlicensed broker’s or agents?

- No

DVRC Pennsylvania Turnpike / I-95 Interchange Project: Risks

Risk Factors

| Risk Factor | Description |

|---|---|

| Limited Operating History | The Partnership was formed on March 25, 2013, and we have no operating history. Our only operation involves managing the Loan to the Pennsylvania Turnpike Commission, or PTC, and depends largely on the future performance and ability of the PTC to make interest and principal payments under the Loan. We cannot assure you that we will achieve any of our objectives. Our sole General Partner, Delaware Valley Regional Center, LLC, was designated as a Regional Center to participate in the EB-5 Program effective May 27, 2014. Accordingly, the personnel within the Regional Center do not have experience in administering the EB-5 Program, which could lead to delays for investors in the process of obtaining a conditional or permanent green card. |

| Debt Servicing | We plan to make the Loan to the PTC for the construction of the Pennsylvania Turnpike/Interstate 95 Interchange Project up to the aggregate amount of funds raised in this offering, which will represent all or substantially all of our assets. As a result, we are subject to the risks of providing financing to a single entity for a single project. Any negative factors affecting the PTC or the Pennsylvania Turnpike/Interstate 95 Interchange Project would have a substantial negative effect on your investment. We cannot assure you that the PTC will have sufficient funds from its operation or will be able to issue additional bonds to repay the Loan upon acceleration or at scheduled maturity or make interest payments due on the Loan. If PTC chooses and is able to issue additional bonds to repay the Loan, the additional bonds will carry the same risk as other fixed income instrument including but not limited to credit risk, interest rate risk, and liquidity risk. See “Risk Factors – Risks Related to the Pennsylvania Turnpike Commission and the Pennsylvania Turnpike/Interstate 95 Interchange Project” below for more detailed discussions regarding the specific risks affecting the PTC’s ability to meet debt service requirements and repay the Loan. |

| Failure to Prepay Loan | The escrow arrangement contemplates that all of the investors’ capital contributions (i.e., $500,000 per each investor) will be released from escrow upon the any single investors’ approval of a I-526 Petition. If an investor’s I-526 Petition is ultimately denied, or the investor fails to complete the Immigration Processing, we plan to make a full refund of his or her investment without interest as promptly as possible, but in any event no later than 190 days after we have received written notice of such denial or failure. To refund the investment amount, we will be relying on the PTC’s prepayment of that portion of the Loan under the applicable prepayment terms. While we will make commercially reasonable efforts to promptly refund the investment from such prepayment, we cannot assure you that the PTC will have sufficient funds to prepay the Loan upon demand or that there will not be any further delay. |

| Lack of Influence in Management | The General Partner will have exclusive management of the Partnership, and the Limited Partners will only have policymaking powers and certain consent rights as expressly provided in the Limited Partnership Agreement. As a result, investors in the Partnership will have not have any day-to-day managerial control over the determination of most issues relating to the business and operations of the Partnership, and will depend on the determinations made by the General Partner. Therefore, you may have little practical opportunity to influence our management, and you may disagree with the decisions that our management makes. |

| Indemnification of GP | Under the terms of the Limited Partnership Agreement, the General Partner (including its members, officers, directors, agents, employees and representatives) will be indemnified by the Partnership to the fullest extent permitted by law, against any losses, judgments, liabilities, expenses, and amounts paid in settlement of any claims sustained by it or any of them in connection with the Partnership, provided that the General Partner has determined, in good faith, that such course of conduct was in, and not opposed to, the best interests of the Partnership and such liability or loss was not the result of gross negligence or willful misconduct, or a breach of the Limited Partnership Agreement on the part of the General Partner or such person. We will not carry any insurance to cover any obligations, and none of the foregoing parties will be insured for losses for which the Partnership has agreed to indemnify. Any such indemnification will only be recoverable from the assets of the Partnership, and the Limited Partners will not have any liability on account of such indemnification. |

| Partnership Registration | The Partnership has not registered as an investment company, which would subject the Partnership to extensive regulation by the SEC under the Investment Company Act. The General Partner is not registered as an investment adviser under the Investment Advisers Act or under any state laws. Accordingly, neither the SEC nor any other federal or state regulatory authority monitors or oversees the Partnership’s investment activities. Except for certain anti-fraud protections, the Limited Partners will not benefit from SEC oversight and some of the other protections afforded by these statutes, which, among other things, requires that an investment company’s board of directors, including a majority of disinterested directors, approve certain of its activities and contractual relationships, and prohibits an investment company from engaging in certain transactions with its affiliates. Further, to the extent registration under or compliance with such statute were to become required, we would incur significant burdens and expenses in connection with such registration. |

| Development & Construction Risks | The PTC Project will be subject to a number of risks, including: • lack of sufficient, or delays in availability of, financing; • changes to plans and specifications; • engineering problems, including defective plans and specifications; • shortages of, and price increases in, energy, materials, and skilled and unskilled labor, and inflation in key supply markets; • delays in obtaining or inability to obtain necessary permits, licenses, and approvals; • changes in laws and regulations, or in the interpretation and enforcement of laws and regulations, applicable to construction projects; • labor disputes or work stoppages; • disputes with and defaults by contractors and subcontractors; • personal injuries to workers and other persons; • environmental, health, and safety issues, including site accidents and the spread of viruses; • weather interferences or delays; • fires, hurricanes, and other natural disasters; • geological, construction, excavation, regulatory, and equipment problems; and • other unanticipated circumstances or cost increases. The occurrence of any of these development or construction risks could increase the total costs, or delay or prevent the construction. Unanticipated cost increases may require the PTC to raise or borrow additional capital to complete construction of the PTC Project, which may negatively affect its ability to service or repay the Loan. |

| Decline in PTC's Revenues | The actual amount of future toll revenues collected by the PTC depends upon a number of factors, including rates established by the PTC and the level and composition of traffic on its system. Many of these factors are beyond the control of the PTC. The PTC is obligated under the terms of various financing documents to fix and revise tolls at levels that will generate revenues (together with other available moneys) sufficient to pay all of its obligations under the Funding Agreement for the Loan, to construct and maintain its system, and to pay debt service obligations and other amounts payable to the Pennsylvania Department of Transportation or the Commonwealth of Pennsylvania. However, the amount of traffic on the system cannot be predicted with certainty and could decline due to general economic conditions, diversion of some traffic to alternative non-toll routes to avoid toll rate increases or because of increased fuel costs, increased mileage standards, higher fuel taxes, or other factors. There is insufficient data to assess these risk factors fully. However, based on historical variations in such factors and the recent toll increases, we expect that the PTC will have sufficient revenues to meet its payment obligations, including payment obligations with respect to the Loan. |

| Adverse Financial Conditions | Adverse changes in the PTC’s financial condition could result in a failure to make its payments, or a delay in payments, to the Partnership with respect to the Loan. In addition to a potential decline in revenues, the PTC’s financial condition could be adversely affected by a number of factors that include: • increased and/or unanticipated costs of operation and maintenance of the system; • decreased toll revenues due to declines in usage or otherwise; • work stoppage, slowdown or action by unionized employees; • growth in and improvements to competing mass transit systems; • complete or partial destruction or temporary closure of the system due to events beyond the control of the PTC; • increased unfunded pension benefits; and • increased unfunded healthcare and other non-pension post-employment benefits. |

| Adverse Financial Conditions of Third Parties | Adverse changes in the financial condition of certain third party financial institutions may adversely affect the PTC’s financial position. Different types of investment and contractual arrangements may create exposure for the PTC to such institutions including: • risk to the PTC’s investment portfolio due to defaults or changes in market valuation of the debt securities of such institutions; • counterparty risk related to swaps used by the PTC to hedge its cost of funds; and • risk of rating changes of the PTC’s credit enhancers or liquidity providers that may adversely affect the interest costs on the PTC’s variable rate debt or that may render such variable rate debt unmarketable. |

| Legislative Actions | From time to time legislation is introduced in the Pennsylvania General Assembly that may affect the PTC and therefore may affect certain of the assumptions on which the Partnership’s business model is based. We cannot predict if any of those bills or other legislation will be enacted into law, or how any such legislation may affect the PTC’s ability to timely pay the Loan. |

| Available Remedies | The remedies available to us on an event of default under the financing documents for the Loan in many respects depend upon regulatory and judicial actions that often are subject to discretion and delay. Under existing constitutional and statutory law and judicial decisions, our remedies for a default may not be readily available or may be limited. |

| Denial of I-526 Petition | While we intend that this offering and the provisions of the Limited Partnership Agreement will enable the Limited Partners to satisfy the EB-5 requirements under the USCIS law and regulations, we can provide no assurances that the USCIS will grant an investor’s I-526 petition or that an investor or his or her immediate relatives will be able to obtain immigrant visas, conditional permanent residence, or unconditional lawful permanent resident status. |

| High Regulation | The EB-5 Program was created in 1990 by the U.S. Congress, which has accorded broad regulatory powers to the Department of Homeland Security and in particular to the USCIS in administering the EB-5 Program. The regional center pilot program was first created in 1992. Any changes to a regional center’s scope including geographic area, industry, economic methodology, or any other type of material deviation from the original designation application requires the filing of an amendment application with USCIS. While we will strive to coordinate with USCIS to achieve our investors’ immigration goals, we cannot assure you that USCIS employees will take a consistent position on many of the issues arising under the EB-5 Program, and we cannot assure you that USCIS regulations, precedent case law, and policies will not change in the future. Because the laws, regulations, and USCIS interpretations applicable to our investments are subject to change at any time, we cannot assure you that we will not be required to substantially change our investment policies in the future. |

| Quotas on Immigration Visas | The EB-5 Program was created as an employment-based, fifth preference, immigrant visa category for certain qualified individuals seeking permanent resident status on the basis of their investment in a new U.S. commercial enterprise that creates jobs and benefits the U.S. economy. Under the current provisions of the EB-5 Program, 10,000 immigrant visas are available per year. Of the 10,000 immigrant visas available annually, 3,000 are specifically set aside for those who apply under the EB-5 Regional Center Pilot Program. USCIS has stated in informal quarterly Stakeholder meetings that all 10,000 of the EB-5 numbers are available to regional center investors, despite the carve out for 3,000 in the regulations. However, USCIS’ interpretation of how the EB-5 immigrant visa numbers can be allocated can change at any time. Moreover, we cannot assure you that there will be a sufficient number of immigrant visas available each year to account for all investors who subscribe to this offering. |

| Change in Immigration Laws | The U.S. Congress and/or other government agencies may discontinue or change some provisions of or the entire EB-5 Program. Changes to and/or elimination of the EB-5 Program in its entirety may adversely affect the investors. The EB-5 Regional Center Pilot Program is set to expire on September 30, 2015. We cannot assure you that the EB-5 Regional Center Pilot Program will be renewed or extended beyond September 30, 2015, or that the U.S. Congress will allocate sufficient immigrant visas for the EB-5 Program to provide visas for all investors who subscribe to this offering. In addition, the USCIS may cease to give deference in the future to state designation letters with respect to geographical areas classified as Targeted Employment Areas. |

| Allocation of Visas on First Come First Served Basis | Currently, 10,000 fifth preference immigrant visa numbers are allocated annually to alien investors, their spouses, and qualifying children. EB-5 visas are allocated by the U.S. Department of State on a first come first served basis based on the date an investor’s I-526 petition is filed with the USCIS. If more visas are sought than are available, a delay in the processing of an investor’s immigrant visa or adjustment of status to permanent residence could occur. We cannot predict the exact length of time an investor could wait until such a visa becomes available. Any unexpected delay could negatively affect the ability of investors under this offering to receive EB-5 visas and could also negatively affect the ability of the investor’s children who are nearing the age of 21 to obtain an immigrant visa. |

| Delay in Resident Status | The USCIS processing times are fluid; the process times found on the USCIS website are not always accurate. The USCIS may issue a Request for Evidence (RFE) or a Notice of Intent to Deny (NOID) during the adjudication of the investor’s I-526 Petition. The RFE or NOID can result in extensive delays in individual I-526 Petitions as well as project adjudication. Likewise, the USCIS may put an entire project on hold to consider policy issues related to this offering, which may result in extensive delays in adjudication. |

| Active Participation | The EB-5 program requires that the investor be “active” in the management of the investment by engaging in the management of the New Commercial Enterprise, either through day-to-day managerial control or through policy formation. Our Limited Partnership Agreement describes the responsibilities of each investor and mandates that each investor participate in the management of the entity to the extent set forth in the Limited Partnership Agreement. Those responsibilities were designed to comply with the requirements of the EB-5 Program in effect as of the date of this memorandum. If the management rights accorded to the investors in the Limited Partnership Agreement fail to satisfy the management requirements of the EB-5 Program, then the investors may not receive an EB-5 visa. |

| Motion to Reopen EB-5 Designation | USCIS may, of its own accord, reopen the Regional Center’s EB-5 designation for any reason, including concerns regarding job creating activities, economic development for which it was certified to perform, or concerns over the immigration, securities, or corporate formation documents submitted to USCIS at the time of the initial regional center designation application or subsequent amendment filings. This circumstance could negatively affect the ability of investors in this offering to receive EB-5 visas. |

| Termination of RC Designation | USCIS may terminate the Partnership’s designation as the Regional Center at any time if it determines that the Regional Center is no longer promoting job creation or the kind of local economic development for which it was initially certified to perform. This termination could negatively impact the ability of investors under this offering to receive EB-5 visas. |

| General Immigration Risks | The process of obtaining conditional resident status and permanent resident status involves many factors and circumstances that are not within our control. These include the investor’s past history, history of alcohol and drug use, criminal history, past membership or association with certain political, social, or religious groups, immigration visa backlogs, potential changes in immigration laws and regulations (including laws and regulations specific to the EB-5 Program), and quotas established by the U.S. government limiting the number of immigrant visas available to qualified individuals seeking permanent resident status under the EB-5 Program. Although the Partnership has been structured with the objective of providing Limited Partners with eligibility for conditional and permanent resident status under the EB-5 Regional Center provisions of the U.S. immigration laws, we cannot assure you that you will obtain approval of your particular immigrant application. Purchase of Units does not guarantee conditional resident status or permanent resident status in the U.S. Furthermore, we cannot assure you that conditional resident status, if granted, will be converted to permanent resident status. |

| Partnership not Meeting Requirements | For EB-5 immigrant investors to convert their conditional lawful permanent resident status to lawful permanent resident status within the allotted two years time, our investment in the PTC Project must indirectly create 10 full-time U.S. jobs for each $500,000 investment. For example, if we raise the anticipated total offering amount of $200 million, the PTC Project will be required to create and sustain at least 4,000 new jobs. The PTC Project may or may not achieve, and may or may not sustain, the required number of jobs as predicted by the economic report prepared by Dr. Mike Evans of Evans, Carroll & Associates, Inc. If the PTC Project is not able to create the number of jobs (direct, indirect or induced) necessary to achieve compliance with the EB-5 Program, investors could lose any U.S. conditional lawful permanent resident status issued in connection with the PTC Project. If an investor receives conditional lawful permanent resident status but later does not receive lawful permanent resident status, we have no obligation to refund any of the investor’s capital contribution to the Partnership or otherwise redeem the investor’s Units. |

| TEA Designation | USCIS regulations and interpretations hold that the Targeted Employment Area, or TEA, is not determined until the time of investment or the time of I-526 Petition filing, whichever is earlier. The unemployment statistics used to determine the TEA could change based on new unemployment rate data at the time of the investor’s investment or filing of the I-526 Petition, and the PTC Project may not be in an area with an unemployment rate of 150% or more of the national average. If the USCIS deems the PTC Project to not be in a TEA at the time of an investor’s investment, the I-526 Petition could be denied. |

| Job Creation | The estimated number of jobs to be created by the PTC Project and its operation is the result of the findings of an Economic Impact Study prepared by Dr. Mike Evans of Evans, Carroll & Associates, Inc. The estimates are based on assumptions and projections that may prove to be incorrect. If the projected number of jobs to be created is incorrect, our fulfillment of the conditions of the EB-5 Program could be placed in jeopardy. Further, this could result in the denial of the removal of conditions on the investor’s residency in the U.S. (i.e., I-829 denial). |

| Background Check | According to USCIS policy, no application for lawful permanent residence will be approved until a definitive FBI fingerprint check and Interagency Border Inspection Services (IBIS) check are completed and resolved favorably. An EB-5 immigrant investor’s background (or that of an immediate family member) may not meet the USCIS criteria for conditional or permanent residency in the U.S. For example, among other criteria, the following may be grounds for denial of immigration benefits for the immigrant, and/or other members of the immigrant’s family: having a communicable disease or other dangerous contagious disease; having been at any time involved with, trafficking in, or taking, illegal drugs; having been convicted of certain crimes; having committed fraud or misrepresentation to a U.S. government official; or having violated U.S. immigration laws in the past. If an investor receives conditional lawful permanent resident status but later does not receive lawful permanent resident status, we have no obligation to refund any of the investor’s purchase price, including the subscription fee, or otherwise redeem the investor’s Interest. Other security checks could be required by the USCIS, Department of State, or other governmental agencies, which could delay adjudication of the I-526 Petition or the subsequent application for an immigrant visa or conditional lawful permanent resident status. |

| Funds Lawful & Traceable | EB-5 immigrant investors must demonstrate to the USCIS that the funds invested in the Partnership were obtained through lawful means. Likewise, each EB-5 immigrant investor must document, to the satisfaction of the USCIS, the source of these funds, whether earned through income, sale of real estate, sale of stock, gift, loan, divorce settlement, etc. The investor must to the best of his or her ability trace the funds from the time they were earned through the time they were invested in the Partnership. The USCIS will retain ultimate authority in deciding whether the investor has met his or her burden of proof with respect to tracing and demonstrating the lawful source of the investment funds. Before executing the subscription agreement, the EB-5 immigrant investor must be prepared to present to the General Partner all documents relevant to the lawful source of funds and tracing of these funds. |

| Residency Requirements | EB-5 immigrant investors who obtain conditional or lawful permanent resident status must intend to make the U.S. their primary residence. Lawful permanent residents who maintain their primary residence outside the U.S. risk revocation of their U.S. residence status. Each prospective EB-5 immigrant investor should consult a competent immigration attorney to review the likelihood that the investor’s immigration objectives will be achieved. The Partnership has to work with the PTC Project to meet the job creation and retention requirements of the EB-5 program to ensure that sufficient jobs are created when our investors file for the removal of the condition of their permanent residency. If an investor fails to obtain or later loses his or her lawful permanent resident status due to his or her failure to comply with the residency requirements of the EB-5 Program, we have no obligation to refund any of the investor’s capital contributions and the subscription fee. |

| Core Project Components | The USCIS stated in late 2009 that “[t]he business plan in the Form I-526 petition may not be materially changed after the petition has been filed” and that “the capital investment project identified in the Form I-526 petition must serve as the basis” for adjudication of the I-829 petition. The memorandum also directed USCIS adjudicators to review whether there was a material change in “capital investment structure,” “job creation methodologies” and “eligibility requirements” after the filing of the I-526 petition. We refer collectively to the items that cannot be materially changed as the “Core Project Components.” If the USCIS decides that there has been a material change to the Core Project Components, investors must file new I-526 Petitions. This presents a second opportunity for the USCIS to deny the I-526 Petition and, even if approved, requires investors to re-start the conditional residency process and resulting two-year period. This would consequently delay removal of the conditions on permanent residency and the path to citizenship. In addition, dependents who turned 21 after filing of the original I-526 Petition would no longer be eligible to attain permanent resident status via an investor’s newly filed I-526 Petition. Our Core Project Components are currently in final form. We do not anticipate making a material change to any of the Core Project Components after the filing of any investor I-526 Petitions. However, fluctuations in the regional or national economy, changes in the Pennsylvania Turnpike/Interstate 95 Interchange Project, extended processing times of the USCIS, or any number of other factors may force us to modify our Core Project Components. The USCIS may deem such modifications to be material changes, possibly leading to the negative consequences described in the preceding paragraph. |

| Backlog in EB-5 Immigrant Visa Category | Approximately 10,000 visas are available each year in the EB-5 immigrant visa category. Before 2012, the U.S. Department of State had not issued more than 4,218 visas in any year since the EB-5 category’s creation in 1990. However, the EB-5 Program has recently experienced an increase in usage. The U.S. Department of State issued 3,463 visas to EB-5 investors in the fiscal year 2011 and 7,641 visas to EB-5 investors in the fiscal year 2012. The issuance of 10,000 visas in any one or more years could create a backlog in the EB-5 category, which could result in a qualified investor not receiving his or her conditional green card until a visa becomes available. This holdup could in turn delay (a) an investor’s entry to the U.S. if the investor is consular processing or (b) the filing of the investor’s adjustment of status application if the investor is already in the United States. Visa backlogs that delay an investor’s receipt of a conditional green card will also delay the filing of his or her I-829 Petition, which could negatively affect the investor’s ability to prove requisite job creation and remove the conditions to permanent residency. |

| Arbitrary Offering Price | We have arbitrarily determined the offering price for the Units, the returns proposed to be paid to Limited Partners, and the other terms of the Units, and those terms do not bear any relationship to assets acquired or to be acquired or any other established criteria, or quantifiable indicia for valuing a business. No representation is being made by us that the Units have or will have a market value equal to their offering price or could be resold (if at all) at their original offering price. The offering price for the Units should not be considered an indication of the actual value of the Units or the price at which the Units may be transferred. |

| No Public Market | You should view the acquisition of the Units as illiquid, and you must be prepared to hold your investment indefinitely. There is no public market for the Units, and it is highly unlikely that one will ever develop. We currently have no plans to make a public or registered offering of the Units. The Units will not be listed on a securities exchange or quoted on a quotation system. You may never be able to resell your Units, or you may only be able to resell them later at a substantial discount from the purchase price. Thus, you should consider the Units to be a long-term investment. |

| Resale of Transfer of Units | We are offering through this memorandum the Units (a) to qualified accredited investors under an exemption from registration contained in Section 4(2) of the Securities Act of 1933 and Rule 506 of Regulation D under the Securities Act, and (b) to certain non-U.S. person outside the United States in offshore transactions in reliance Regulation S under the Securities Act. The transfer and resale of the Units will be restricted, and consequently the Units may not be transferred or resold except as permitted under the Securities Act and applicable state securities laws. You will be required to agree that you will not resell the Units except under an effective registration statement or pursuant to an exemption from registration, both at the federal and state levels. You must acquire the Units for investment purposes only and not with a view to distribution or for resale. In addition, the Limited Partnership Agreement prohibits the transfer of your Units except as provided for by the Limited Partnership Agreement. Because of these restrictions, you should not expect that you will ever be able to sell your Units before we are liquidated and our remaining assets, if any, are distributed to the Limited Partners. |

| No Independent Council | The Limited Partnership Agreement has not been reviewed by an attorney on behalf of the Limited Partners. Each investor is therefore urged to consult with (a) his or her own attorney regarding the terms and provisions of the Limited Partnership Agreement and all other related documents, and (b) his or her own accountant and financial advisor as to the financial information and projections provided. |

| Limited Partnership Agreement | The Limited Partnership Agreement allocates Partnership profits and losses in very specific ways that differ from the relative economic investments of the Limited Partners. The Limited Partnership Agreement is intended to accommodate these special allocations and to do so in a manner that should satisfy the alternate test for substantial economic effect under the regulations of the U.S. Internal Revenue Service (the “IRS”), but we cannot assure you that the IRS will agree that we have met this test and that the IRS will not otherwise challenge the validity of these special allocations. If the allocations contained in the Limited Partnership Agreement are not respected for tax purposes, the Limited Partners may pay tax on income they will never be entitled to receive. |

| Partnership Classification | Subject to the discussion of “publicly traded partnerships” provided below, under U.S. Treasury regulations concerning the classification of entities for U.S. federal income tax purposes, a domestic “eligible entity” such as the Partnership that has two or more members will default to, or may elect classification as, a partnership for U.S. federal income tax purposes. The General Partner intends to treat the Partnership as a partnership for U.S. federal income tax purposes. An entity that would otherwise be classified as a partnership for U.S. federal income tax purposes may nonetheless be classified as an association taxable as a corporation if it is a “publicly traded partnership.” The General Partner intends to operate the Partnership so it will not be treated as a publicly traded partnership. We believe that it is unlikely, given the current regulations, that this classification would be successfully challenged. We cannot assure you, however, that the IRS will respect our election. If we are not treated as a partnership, we are likely to be treated as a corporation for tax purposes. In that event, we would pay tax at corporate tax rates on our income, and any distributions to the Limited Partners would likely not be deductible to us but would be taxed again as dividends to the Limited Partners. Dividends are generally taxable as ordinary income. Further, the Limited Partners would not be able to deduct any losses of the Partnership. |

| Insufficient Distributions | We will elect to be treated as a partnership for federal income tax purposes, which means that the members will be subject to tax on their proportionate shares of our income regardless of the amount we actually distribute. Our distributions, if any, may be insufficient to cover the tax obligations of the Limited Partners arising from their investment, and we cannot assure you that we will have sufficient cash to make any such distributions. In that event, you will be required to pay tax on income you have not received, and may never receive. |

| Passive Activity Income or Losses | Even though we are engaged in an active trade or business, the Limited Partners do not materially participate in the operation of that trade or business. Therefore, we anticipate that the income and losses of the Limited Partners will be treated as passive activity income and losses. If the IRS successfully argued that a Limited Partner did materially participate in that business in a capacity other than as an investor in that business, then that Limited Partner’s share of our income and losses would not be treated as passive and could not generally be used to offset income or losses from other passive activities. |

| Deduction of Losses | The Partnership is not designed to produce losses for the Limited Partners and has not registered as a tax shelter with the IRS. To the extent that we do produce losses, however, those losses will likely be treated as passive activity losses that the Limited Partners could only deduct against income from other passive activities they may have. Unused passive losses would be carried forward to succeeding tax years until they could be used. In addition, the Limited Partners may not be allowed to deduct losses due to their lack of tax basis in their limited partnership interests at the time the losses are incurred, or because the losses are capital losses that exceed the amount of capital gains the Limited Partner has plus (for taxpayers other than corporations) up to $3,000 ($1,500 in the case of a married individual filing a separate return) worth of ordinary income per year, or because the losses exceed the amount the Limited Partner is deemed to be at risk with respect to his or her investment in us. |

| Control over Audit of Tax Returns | Under the Limited Partnership Agreement, the General Partner, as tax matters partner, has the authority to negotiate and resolve any disputes with the IRS, and the Limited Partners generally must adjust their tax returns accordingly. As a consequence, the Limited Partners may suffer adverse tax adjustments without a meaningful opportunity to question those adjustments. |

| Change in Tax Laws | The tax laws change frequently, and sometimes these changes are effective retroactively or before appropriate adjustments can be made to alleviate any adverse consequences. Because an investment in the Partnership is anticipated to be a long-term, illiquid investment, the Limited Partners are exposed to the risks of these ongoing changes in the tax laws. |

| Management's Time | The General Partner and its members, partners, officers, and employees will devote to the Partnership as much time as the General Partner deems necessary and appropriate to manage the Partnership’s business. The General Partner and its affiliates are not restricted from forming additional investment funds, entering into other investment advisory relationships or engaging in other business activities, even though such activities may be in competition with the Partnership and/or may involve substantial time and resources of the General Partner and its affiliates. These activities could be viewed as creating a conflict of interest in that the time and effort of the members of the General Partner’s officers and employees will not be devoted exclusively to the business of the Partnership, but will be allocated between the business of the Partnership and other business activities of the Regional Center. |

- What strategies are you employing to mitigate those risks?

- The 400 investors have a 34% job creation cushion since it is anticipated that 5,368 jobs will be created.

- What strategies are you employing to mitigate those risks?

- The DVRC Turnpike EB-5, the project is owned and operated by Pennsylvania Turnpike, a Pennsylvania State Government Agency. The project is entirely government backed and guaranteed by Pennsylvania State Government Agency and the recourse will be to the state government rather then to a private developer.

DVRC Pennsylvania Turnpike / I-95 Interchange Project: Structure

- Has the Principal invested their own equity in the project?

- Yes

- Can you identify the terms and conditions of the offering, including the interest and repayment details?

- Interest only payments of 2% per annum will be made semi-annually during the term of the loan with the principal amount due and payable at maturity. The term of the loan is 5 years. The loan may be repaid in cash or by delivering bonds.

- What will the funds be used for (ie. infrastructure development of existing military base, development of a film studio, etc)?

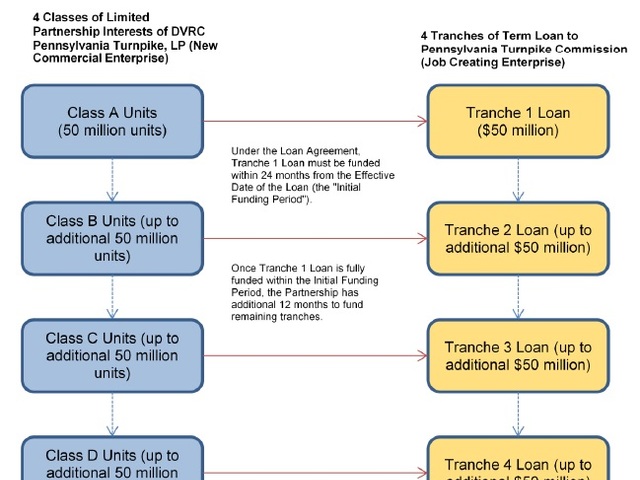

- The proceeds will be used to create a multiple-draw term loan facility for PTC in the aggregate principal amount of up to $200 million consisting of four successive tranches of $50 million each. PTC plans to use the Loan to partially fund the PTC Project. The funds will be used for the construction of the Pennsylvania Turnpike/ Interstate 95 Interchange Project.

- Are financial statements or records available from the borrower?

- Yes

- Is collateral on the investment or loan provided?

- Yes

- If Yes, can you specify what the collateral is?

- The loan will be secured under a senior debt indenture of PTC (i.e. it will enjoy the same protection as PTC municipal bonds) and backed by toll revenues. The Pennsylvania Turnpike Commission is a tax-free municipal bond issuer and currently carries an A1 rating from Moody’s Corporation and an AA rating from the Fitch Group.

- What would best describe the investment structure of the project?

- Limited Partnership

- What percentage of the investment will be made by the General Partners, Regional Center or Project Principals?

- less than 10%

- What would best describe the Principal's oversight of the project?

- Day to Day, direct oversight

Capital Stack Table

| Type | Name of Financial Institution | Amount | Terms | |

|---|---|---|---|---|

| Debt | EB-5 Investors | $200 million | Expected | The EB-5 proceeds will be used to create multiple- draw term loan facility for the Pennsylvania Turnpike Commission (the developer) in the aggregate principal amount of $200 million consisting of four successive tranches of $50 million each. These proceeds will be used to partially fund the PTC Project, which is the first of three phases. All EB-5 proceeds will be applied to the hard construction costs. |

| Equity | Federal Government | $188 million | Committed | This amounts to just over 45% of total capital requirement. Federal Highway Administration published an official Record of Decision verifying the need for the project and its support in funding. This federal funding is derived from two sources: 1) Approximately $1.2 million remaining congressional earmark funds to be converted and made available from Safe, Accountable, Flexible, Efficient Transportation Equity Act in 2005 and from the FY 2008 Appropriation Act. 2) Additionally, Pennsylvania Department of Transportation(PennDOT) is providing a total of $186.8 million in federal “spike” funding for the project, cash-flowed over the Federal Fiscal Years (FFYs) 2013-2019. The funds are provided from a Statewide Line Item, and are additional funds to the Delaware Valley Regional Planning Commission Region. |

| Equity | Pennsylvania Turnpike Commission (PTC , the "Developer") | $27.6 million | Committed | This represents the developer's equity portion and amounts to 6.7% of the total capital. PTC normally holds an equity stake in its development projects. |

DVRC Pennsylvania Turnpike / I-95 Interchange Project: EB-5

- Is this a loan?

- Yes

- If the investment into the project is a loan, is the borrower a:

- Government (public) entity

- Can you best describe your operating procedure for the filing of the I-526?

- The foreign national is free to choose their own attorney with no review from you

- Does this project have approved I-526's?

- Yes

- Does this project have approved I-829's?

- Yes

- Does this Regional Center have approved I-526's?

- Yes

- Does this Regional Center have approved I-829's?

- No

- How many previous projects have been completed within this Regional Center?

- 0

- Is any of the subscription fee refundable in the event of a denial of the I-526 by USCIS?

- Yes

- Amount of EB-5 investors anticipated for this phase?

- 400

- What percentage of overall funding is expected to be sourced from EB-5 investors?

- translation missing: en.percentage_funding_from_investors.25_50

- Are non EB-5 investor’s allowed to participate?

- No

Project Exemplar Approval

- Does this Project have Exemplar Approval?

- Yes

- 2014-05-27

- Date of Exemplar Approval:

Requests for Evidence

- Does this Project have Exemplar Approval?

- No

I-526

- I-526 Approved:

- 371

- Date of first I-526 Submission:

- 2014-10-21

I-829

This data was last updated on:July 11, 2019 11:19 AM

DVRC Pennsylvania Turnpike / I-95 Interchange Project: EB-5

- Has this project been the subject of a USCIS/SEC/FBI/DOJ/AAO Review, Notice, Investigation or Action

- No

This data was last updated on:July 11, 2019 11:19 AM

DVRC Pennsylvania Turnpike / I-95 Interchange Project: Job Creation

- Is Regional Center located within a Targeted Employment Area (TEA)?

- No

- Is this a Public / Private partnership?

- No

- Job creation methodology

- RIMS II

- Does the job creation rely on direct jobs, capital expenditure, or a combination?

- Capital expenditure, Indirect & Induced

- How many jobs are expected to be created in total? (Indirect & Induced)

- 5368

- How many jobs are expected to be created in per investor? (Indirect & Induced)

- 13.42

- How are jobs allocated to the pool of investors?

- Jobs will be allocated to investors in the order in which each such investor’s permanent residency commences. An investor’s permanent residency shall be deemed to commence on the date (a) that such investor’s Application for Adjustment of Status (I-485) is approved by the USCIS or (b) that such investor first enters the United States on an immigrant visa. This allocation process will continue until all EB-5 jobs have been allocated to the investors.

- Can you describe the job creation model? For instance, is it based on capital injection, or on a direct job creation and indirect job multiplier, or other?

- RIMS II is based on an accounting framework called an I-O table. For each industry, an I-O table shows the industrial distribution of inputs purchased and outputs sold. A typical I-O table in RIMS II is derived mainly from two data sources: BEA's national I-O table, which shows the input and output structure of nearly 500 U.S. industries, and BEA's regional economic accounts, which are used to adjust the national I-O table to show a region's industrial structure and trading patterns. Using RIMS II for impact analysis has several advantages. RIMS II multipliers can be estimated for any region composed of one or more counties and for any industry, or group of industries, in the national I-O table. The accessibility of the main data sources for RIMS II keeps the cost of estimating regional multipliers relatively low. Empirical tests show that estimates based on relatively expensive surveys and RIMS II-based estimates are similar in magnitude.

- Can you please describe what role a Public sector entity or government body has, if any, in overseeing has in overseeing the commercial operation, the accounting or tracking of the job creation, funding, issuing bonds, or any other investment or audit role that they might perform?

- Pennsylvania Turnpike Commission (PTC), a Pennsylvania State Agency that oversees all the toll roads in the state is overseeing all aspects of construction and operation of the project. PTC will track job creation and be responsible for the job creation.

DVRC Pennsylvania Turnpike / I-95 Interchange Project: Reporting

- Do you offer periodic reports to investors on the status of the investment?

- Yes

- If so, what is the frequency of these reports?

- Annually

- Are these reports produced by you, or by an independent third party such as a auditing or accounting firm?

- Yes

- If performed by a third party firm, can you please provide details of the scope of the audit and what the report released entails?

- The Regional Center will hire and maintain staff from time to time appropriate in number and experience to meet the recordkeeping and reporting requirements of EB-5 qualifying regional center operations. The records, data, and information include the regional center’s administration, oversight, and management plan; biographical and other relevant investor data; total regional center investment; and job creation totals. The Regional Center will also retain outside counsel and/or consultants to help us comply with applicable USCIS reporting requirements. The outside counsel and/or consultants will work with us to assemble and draft all necessary regional center business and investor documentation required by the USCIS for an I-526 Petition.

- Do you have a third party firm that performs employee payroll & HR record keeping services for the project?

- Yes

- If Yes, can you provide the name of that firm?

- Jacobs Engineering

- Do you have a third party firm that performs I-9 verification?

- No

- If No, do you perform I-9 verification of the employees?

- No

- Would you have any objection to an accounting or law firm performing an audit on the payroll, employment or financial records of the project?

- No

- If you lease space in your facility to third party firms, are they willing to allow an audit of their employment records for the purposes of verifying employment?

- No

DVRC Pennsylvania Turnpike / I-95 Interchange Project: Media

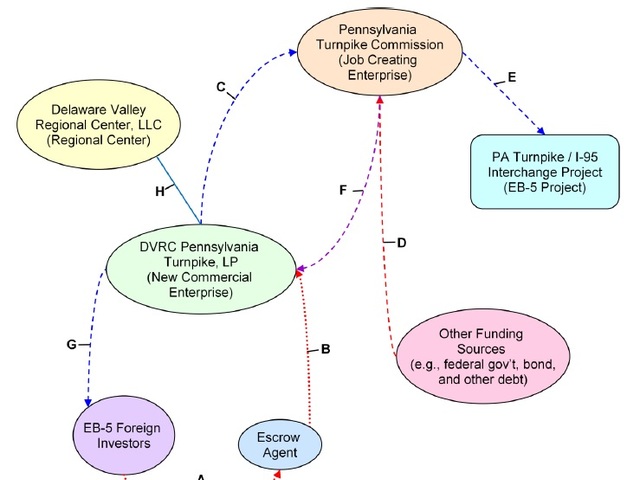

Diagram of EB-5 Financing Structure

Limited Partnership Interests & Term Loan Tranches

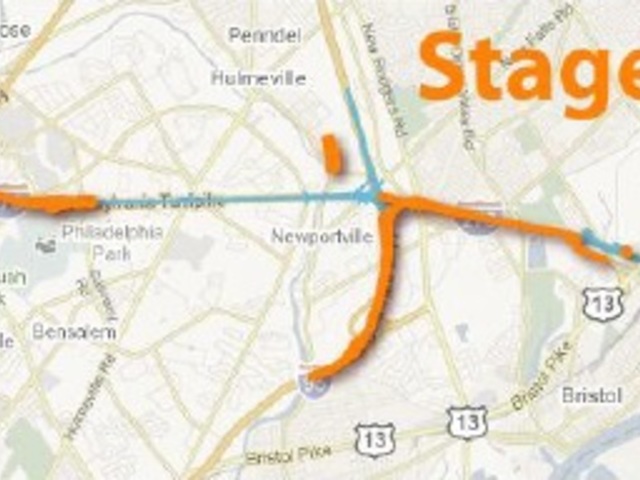

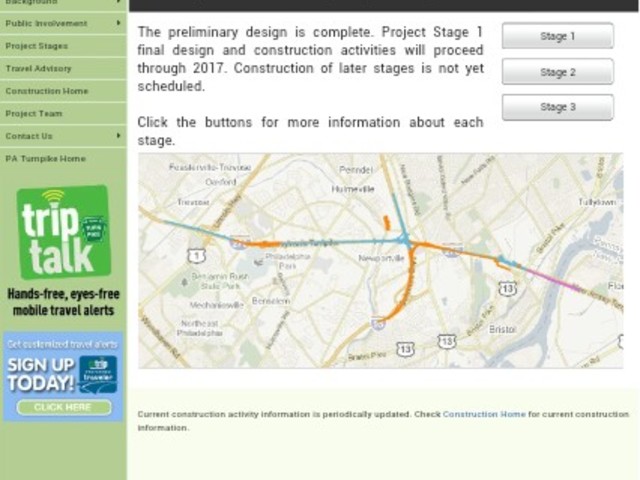

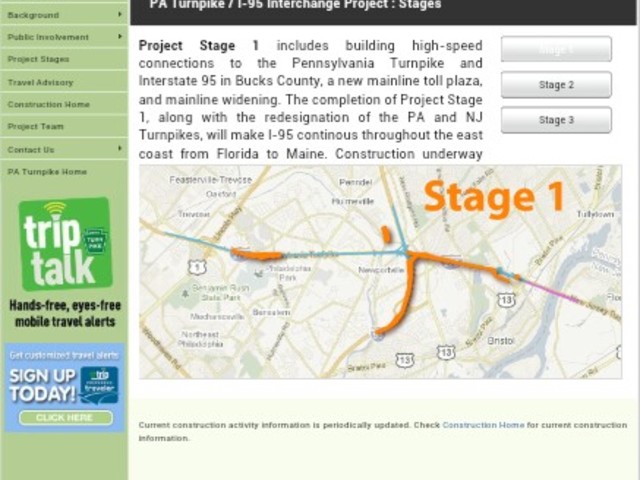

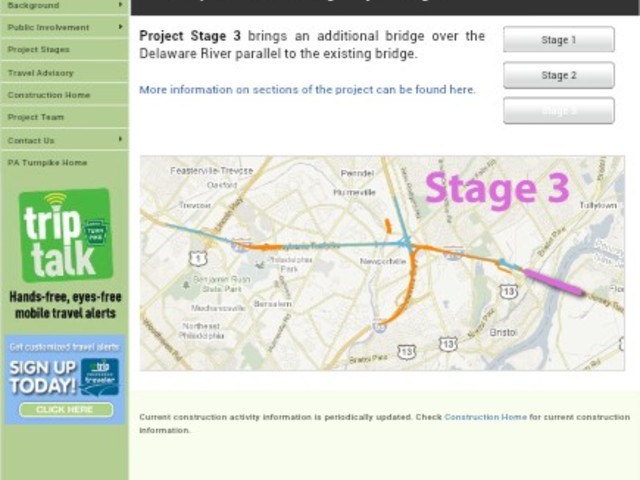

Reconfigures the Pennsylvania Turnpike toll system and re-routes I-95 onto the Pennsylvania Turnpike by building the main movements of the interchange along with associated highway widening. Construction began in 2010.

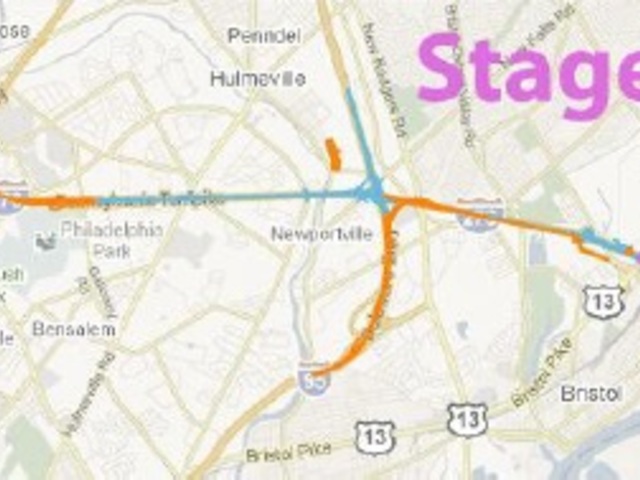

Constructs the remaining six ramp movements of the I-276/I-95 interchange and the remaining highway widening. Construction is anticipated to begin in 2020 at the earliest.

Constructs an additional bridge over the Delaware River parallel to the existing bridge. Construction is anticipated to begin in 2025 at the earliest.

The image of the PA Turnpike/I-95 Interchange shows the proposed project site where the I-95 crosses the PA Turnpike.

Summary of Employment by Category

Project Summary

Resources links

Project Overview

Project : Stages

Travel Advisory

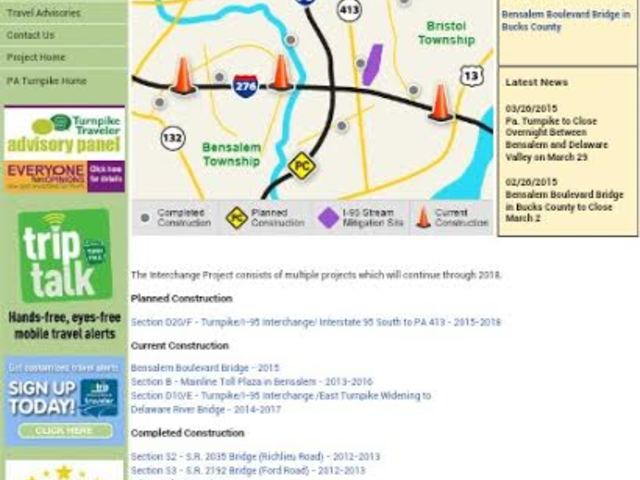

Construction Advisories

Construction Q&A

Travel Advisories

Contact Details

Project : Stage 1

Project : Stage 2

Project : Stage 3

Files & Documents

- Download: _495MM_Penn_Turnpike_2015A_-_ORDMAT.pdf

PENNSYLVANIA TURNPIKE COMMISSION

TURNPIKE REVENUE BONDS, SERIES A OF 2015 SERIES A-1 (FIXED RATE) SERIES A-2 (SIFMA FLOATING RATE NOTES)

Created: June 05, 2015 02:26 AM - Download: Final_PTC_Order_Summary_1145a.pdf

Pennsylvania Turnpike Commission (A1/A+/A+)

495,270,000* Pennsylvania Turnpike Commission (A1/A+/A+) Series A of 2015

Created: June 05, 2015 02:41 AM - Download: I-95_Expenditures_CY2012_to_CY2017_Quarterly_Totals_Per_Service_Area_Upd....pdf

PA Turnpike / I-95 Interchange Project Actual Project Costs

PA Turnpike / I-95 Interchange Project Actual Project Costs - Calendar Year 2012 through Calendar Year 2017

Created: August 02, 2017 12:58 PM

DVRC Pennsylvania Turnpike / I-95 Interchange Project : Escrow

- Escrow: Yes

Escrow Agent: Banc of California

• If Tranche 1 is not raised on or before April 26, 2015, then an extension from PTC will be sought. If the extension is not given, the offering will be terminated and the escrow agent will return all funds, without interest.

• If Tranche 1 is raised on or before April 26, 2015, then the offering will be continued till the earlier of April 26, 2016 or the date the maximum offering amount is sold. Investors who subscribe after the Tranche 1 closing will deliver their subscription proceeds to the escrow agent, which will disburse them in accordance with the release trigger conditions provided in the escrow agreement.

• The escrow agent will release the investors’ Capital Contribution escrow funds on or before April 26, 2015 if the escrow agent has received a copy of Form I-797, Notice of Action, evidencing approval of any one single investor’s I-526 Petition by the USCIS and a written disclosure of wire transfer.

• Under the escrow agreement, after the initial closing, the escrow agent will release each investor’s Capital Contribution once a written direction has been received.

• If any investor’s I-526 Petition is denied by the USCIS or if the investor fails to complete the Immigration Processing for any reason attributable to the investor, including the investor’s failure to meet the U.S. immigration eligibility criteria related to the individual investor, the investor’s failure to provide evidence, or fraud/ material misrepresentation by the investor, then the investor’s subscription funds will be returned after deduction of an administrative fee to compensate for the costs of replacing the investor and other incidental costs.

• Commercially reasonable efforts will be made to promptly refund the full amount without interest, no later than 190 days after receiving written notice of the I-526 Petition denial. To refund the capital investment amount, PTC’s prepayment of that portion of the Loan will be required. It cannot be assured that PTC will have sufficient funds to prepay the Loan upon demand or that there will not be any further delay.

• In case of I-526 denial, the escrow agent will refund the Fee escrow funds net of any breakage costs.

News & Updates

News & Updates 12

Due Diligence

Securities Disclaimer

This website is for informational purposes only and does not constitute an offer or solicitation to sell shares or securities. Any such offer or solicitation will be made only by means of an investment's confidential Offering Memorandum and in accordance with the terms of all applicable securities and other laws. This website does not constitute or form part of, and should not be construed as, any offer for sale or subscription of, or any invitation to offer to buy or subscribe for, any securities, nor should it or any part of it form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. EB5Projects.com LLC and its affiliates expressly disclaim any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in the website, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting therefrom.