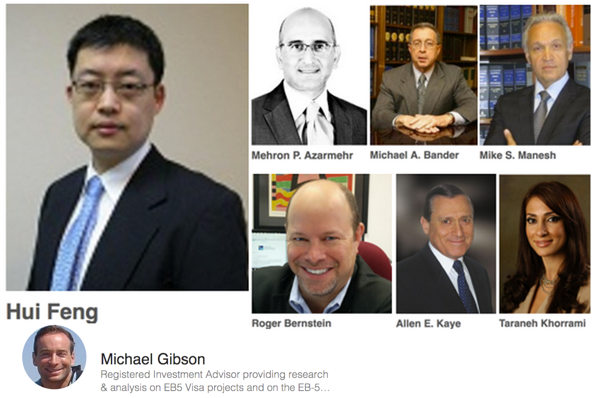

Seven EB-5 visa immigration attorneys charged by SEC with violating U.S. securities laws

The SEC announced yesterday that it has charged seven U.S. immigration attorneys who specialize in providing services to immigrant investors seeking an EB-5 visa with violating U.S. securities laws by offering EB-5 investments while not registered to act as brokers.

“Individuals and entities performing certain services and receiving commissions must be registered to legally operate as securities brokers if they’re raising money for EB-5 projects,” said Andrew J. Ceresney, Director of the SEC Enforcement Division. “The lawyers in these cases allegedly received commissions for selling, recommending, and facilitating EB-5 investments, and they are being held accountable for disregarding the relevant securities laws and regulations.”

According to the SEC’s orders instituting settled administrative proceedings against several other lawyers and firms for broker registration violations:

- Various EB-5 regional centers or their managers paid commissions to the attorney or law firm for each new investor they successfully sold limited partnership interests.

- These payments were separate from legal fees received to provide legal services to the same clients.

- The lawyers and firms engaged in activities necessary to effectuate the transactions, such as recommending one or more EB-5 investments, acting as a liaison between the regional center and the investor, or facilitating the transfer or documentation of investment funds to the regional center.

- The lawyers thereby acted as unregistered brokers in violation of Section 15(a)(1) of the Securities Exchange Act of 1934.

Without admitting or denying the SEC’s findings, the following six individuals and firms agreed to cease and desist from acting as unregistered brokers:

- Austin, Texas-based Mehron P. Azarmehr and Azarmehr Law Group, who agreed to pay disgorgement of $30,000, prejudgment interest of $2,965, and a penalty of $25,000.

- Miami-based Michael A. Bander and Bander Law Firm, who agreed to pay disgorgement of $228,750, prejudgment interest of $19,434, and a penalty of $25,000.

- Miami-based attorney Roger A. Bernstein, who agreed to pay disgorgement of $132,500, and prejudgment interest of $8,243.

- Hoboken, N.J.-based attorney Allen E. Kaye.

- Los Angeles-based attorney Taraneh Khorrami, who agreed to pay disgorgement of $60,000, prejudgment interest of $7,843, and a penalty of $25,000.

- Los Angeles-based Mike S. Manesh and Manesh & Mizrahi, who agreed to pay disgorgement of $85,000 and prejudgment interest of $11,159.

The following is an example of a typical finding in these cases:

A seventh attorney, Hui Feng, chose not to settle and is the subject of SEC litigation in a pending case. He is reported to have collected nearly $1.2 million in fees already and has contracted to receive another $3.1 million from the various EB-5 Regional Centers that engaged his firm.

Here is the first page of the complaint filed by the SEC against Hui Feng:

The SEC alleges that New York-based immigration attorney Hui Feng and the Law Offices of Feng & Associates not only acted as unregistered brokers by selling EB-5 investments to more than 100 investors, but they also defrauded clients by failing to disclose they received commissions on the investments in breach of their fiduciary and legal duties. They also allegedly defrauded some entities offering the EB-5 investments.

“We allege that Feng abused his role as an immigration attorney to illicitly operate as a broker and engage in a scheme to secretly receive commissions for selling EB-5 securities,” said Michele Wein Layne, Director of the SEC’s Los Angeles Regional Office.

The SEC’s complaint against Feng and Feng & Associates alleges violations of Section 17(a) of the Securities Act of 1933 and Section 10(b) of the Exchange Act and Rule 10b-5. They also are charged with violating Section 15(a) of the Exchange Act. The complaint seeks disgorgement, prejudgment interest, and penalties along with permanent injunctions.

So a few questions:

1. Regional Centers have been paying immigration attorneys success based fees for as long as the program has been around. There are probably several hundred who have been paid tens of millions of dollars in fees, so why just make a case after these seven?

2. Do investors/clients have any remedy against these and other attorneys who have taken fees without disclosing them in the event of a loss or harm through their actions?

3. Apart from the alleged violations of securities laws, are there not Bar ethics rules which prohibit this activity? What implications do these actions have for attorneys who may face disciplinary action for their conduct?

3. What about the Regional Centers (aka the "Promoters") that paid the immigration attorneys these fees? If the SEC is claiming that securities laws were violated then shouldn't they take action against those Centers?

4. If, as many suspect, the SEC is building their cases against several Regional Centers that paid not only these, but other visa attorney's fees, then what will happen to them once those actions are announced? Will USCIS terminate the Center's designation for violating securities laws? If those Centers are terminated, what will happen to all of their investor's petitions?

For those doing EB-5 due diligence for investors it may be prudent to ask the Center they are researching if they have ever made a payment to any of the above individuals, or any other non-registered broker / agent / finder as there is the potential that the next action the SEC takes may be against the Center and Promoters who may have also violated securities laws which could cause the investor both the loss of the petition for residency as well as their capital investment.

Mentions

- UNITED STATES SECURITIES AND EXCHANGE COMMISSION

- Mehron P. Azarmehr

- Azarmehr Law Group

- Michael A. Bander

- Bander Law Firm

- Roger Bernstein

- Allen E. Kaye

- Mike S. Manesh

- Manesh & Mizrahi, APLC

- Hui Feng

- Law Offices of Feng & Associates

- U.S. Citizenship and Immigration Services

Litigation Cases

- UNITED STATES SECURITIES AND EXCHANGE COMMISSION vs Hui Feng & Law Offices of Feng & Associates

- UNITED STATES SECURITIES AND EXCHANGE COMMISSION vs Michael A. Bander & Bander Law Firm

- UNITED STATES SECURITIES AND EXCHANGE COMMISSION vs Allen E. Kaye

- UNITED STATES SECURITIES AND EXCHANGE COMMISSION vs Mike S. Manesh & Manesh & Mizrahi, APLC

- UNITED STATES SECURITIES AND EXCHANGE COMMISSION vs KEFEI WANG

- UNITED STATES SECURITIES AND EXCHANGE COMMISSION vs Mehron P. Azarmehr & Azarmehr Law Group

- UNITED STATES SECURITIES AND EXCHANGE COMMISSION vs Roger Bernstein

- UNITED STATES SECURITIES AND EXCHANGE COMMISSION vs Taraneh Khorrami, Esq.

States

- California

- Florida

- New Jersey

- Texas

Securities Disclaimer

This website is for informational purposes only and does not constitute an offer or solicitation to sell shares or securities. Any such offer or solicitation will be made only by means of an investment's confidential Offering Memorandum and in accordance with the terms of all applicable securities and other laws. This website does not constitute or form part of, and should not be construed as, any offer for sale or subscription of, or any invitation to offer to buy or subscribe for, any securities, nor should it or any part of it form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. EB5Projects.com LLC and its affiliates expressly disclaim any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in the website, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting therefrom.