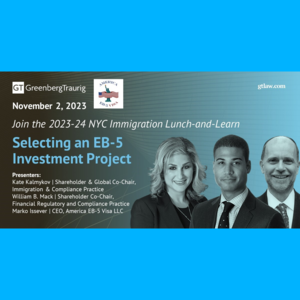

NYC Immigration Lunch & Learn Series

Greenberg Traurig’s Business Immigration and Compliance Group proudly presents our 2023-24 NYC Lunch-and-Learn series

Selecting an EB-5 Investment Project

GT Shareholders Kate Kalmykov and William Mack, along with America EB-5 Visa, LLC's CEO Marko Issever, for an informative discussion about targeted investment with a FINRA-licensed broker-dealer.

The panel will address:

- What is a Reg D Private Placement

- Role of a Broker-Dealer

- Understanding General Solicitation under Rule 506(c)

- Transaction and Project Due Diligence

- EB-5 Immigration Law Considerations

This live event is the first of several to feature insights from our experienced immigration team, along with professionals from our Employment, Tax and Financial Regulatory and Compliance Practice Groups on important topics in employment and investment immigration.

Thursday, Nov. 2, 2023

12:00 - 2 pm ET

Greenberg Traurig

One Vanderbilt Avenue

New York, NY 10017

You can access the entire session for the weblink below:

What is the Role of a Broker-Dealer in an EB5 transaction?

Broker-dealers, although like foreign migration agents, are compensated directly by Regional Centers or the NCEs they manage, serving not only the RCs but, at the same time, the investors. Because all US broker-dealers are regulated entities, they also ensure following proper due process in line with the rules & regulations mandated by their regulators. For example, in our case, at BCW Securities, where we run all our transactions, we are regulated by FINRA, SEC, the State of CT, and most recently by the passage of RIA of 2023, USCIS.

What does that mean in a practical sense?

It means that we must provide not only legal disclosure but also financial disclosure. We must ensure that investments are suitable for all investors we deal with. Many times, the role of the broker-dealer is confused with the one of a securities attorney. Security attorneys must ensure that the offering documents describe the transaction in detail, disclosing potential risks. Of course, the broker-dealers also must make sure that the investors are aware of the content within the offering documents. But their role goes beyond that. To the best of their ability, they have to make sure that their investors understand that content, weigh the pros and cons of the risks, and make an informed decision to proceed or not. If Regional Centers work together with broker-dealers, they will have a better idea of how to structure the transactions fairly. Since the due diligence results of each project will reveal many aspects of the projects, regional centers can structure the transactions more attractively for the investors.

We will cover the criteria we use for due diligence in more detail when we talk about due diligence, but for now, to give a flavor of the role of the broker-dealer, I want to give a couple of examples:

Example 1

One significant feature is the concept of negative pledge. We like transactions whereby, after the repayment of the senior loan, the remaining assets cannot collateralize additional indebtedness. Instead, they collateralize the EB5 loan that moves to 1st position. The JCE refinances or sells the remaining assets to retire its EB5 debt to the NCE. If the investor is ready to be repaid, that is, has fulfilled his sustainment period requirement (however that is defined), the NCE can return its capital. But if there are no provisions in the documents that move the EB5 loan to a senior position after the repayment of the original loan, then you could see that the EB5 investors could end up having little or no collateral backing up their portion of the obligation. The JCE could take another second loan backed by the remaining assets further, diluting their position. Ultimately, what started as a great deal from a capital stack standpoint could end as a disaster.

Example 2

Without giving any names, of course, I will tell you another situation we observed. A typical capital structure in any EB5 transaction is Senior debt on the top, followed by Mezz debt and Developer Equity. Sometimes, we see that there is no Mezz debt. The issuers are relying on the fact that by the time they need the funds to continue building, the EB5 raise will kick in. Otherwise, they would be ready to pump some more equity. We also see a Mezz debt getting tapped to continue the build refinanced by the EB5 raise. In this transaction, EB5 ranked below the developer equity. From a drafting standpoint, the security attorney did nothing wrong. They stated the facts as they were. There was full disclosure. The migration agents promoting the transaction handed the deck to the investors and expected them to notice this uncommon feature of the deal. Of course, when the developer / regional center asked us to promote the transaction, we told them that we had never promoted and would never promote such a deal where EB5 capital is subordinate to developer equity.

Again, I do not want to go into the selection criteria we use for due diligence. All I am trying to do is highlight the value-add of a broker-dealer being in a deal to ensure all players follow best practices.

Transaction and Project Due Diligence

By working with a broker-dealer, investors can mitigate their risks. Like any investment, there are risks associated with EB-5 projects. These risks include losing the invested EB-5 capital if the project developer misuses the funds or not getting the green card if the project fails to create the requisite number of jobs. By utilizing the services of a licensed broker-dealer, investors can select safer projects and stay away from those that would expose them to undue risk. These risks are mainly financial, but an experienced broker-dealer in the EB5 field could also catch other risks, potentially buried in the offering documents such as the PPM, loan documents, business plan, appraisal documents, various guarantees such as 526 denials, building completion, and if available corporate guarantee.

First and foremost, any project due diligence study must pay attention to the following criteria:

- Job-creation: Already created jobs are preferable from a security of the green card perspective, but you must be careful whether it opens the risk of redeployment. There is a trade-off between securing the green card with already-created jobs versus reducing the risk of redeployment with newer projects. That is where having a look at the offering documents comes in handy. It is possible that even though the project created the required jobs, the issuer is not interested in retiring the EB5 earlier than necessary. They might pay off or refinance the senior but keep the EB5 outstanding.

- Security of the capital investment: No investor wants to lose their capital. They want to make sure that the transaction is well-capitalized. They want to make sure that once built, the appraisal report shows a created value that is significantly higher than the capital spent, providing an additional cushion for the EB5. The existence of a committed loan at a comfortable LTV is also a huge plus. A typical EB5 financing structure is 60% Senior, 20% EB5, and another 20% developer equity. Less debt, but not zero debt, and more equity is always preferable. We have a few ratios we look at, which we published in our latest article, published by EB5 Investors Magazine. They are: a) equity as a percentage of total project cost, b) loans and EB5 together as a percentage of the forward appraisal value of the project, and, lastly, c) EB5 as a percentage of the project appraisal after repayment of the loan.

- Speed of adjudication: There are projects in the market that offer expedited processing. While these promise speedy adjudication, investors should be careful to ensure they do not come with undue risk. Again, a broker-dealer can be very helpful in highlighting any hidden above-normal risks, if any, in these projects. There is a provision in the RIA that promises priority processing for rural projects. Although USCIS has not announced any official statement, their actions show they are processing rural projects much faster: in less than a year.

- Return on investment: This consideration is a distant fourth but an important one. All other things constant, and on a risk-adjusted basis projects, projects offering higher yields are preferable.

- Sustainment period: The recent redefinition of the sustainment period will make this a critical consideration criterion when selecting a project. USCIS now states that for purposes of determining the date when the two-year period required by the Immigration and Nationality Act (INA) 203(b)(5)(A)(i) begins, they will generally use the date that the requisite amount of qualifying investment is made to the new commercial enterprise and placed at risk under applicable requirements, including being made available to the job creating entity, as appropriate. In addition, from an immigration standpoint, in the unlikely case that investors fulfill this requirement before filing their I-526 petition, they cannot ask the regional center to pay back their capital. Assuming they have filed the petition, and the job-creating entity had the opportunity to deploy the funds into their project, USCIS will have no issue if the investor receives their capital back after a two-year JCE usage of the funds as long as the project-created requisite jobs credited for the investor. Many projects create all required jobs through bridge financing early on, sometimes even before the EB-5 capital raise begins. Investors will have a chance to demand their capital back two years after their funds are deployed in the project if USCIS does not take issue with EB-5 funds refinancing bridge loans responsible for creating the requisite jobs. They still must ensure that the funds are not idle at the NCE level. USCIS would not call that at-risk. The at-risk period will only start once the JCE starts usage. Whether this policy update and clarification will have any practical impact will depend on the investment terms stated in the PPM. We believe that most strong and established project owners, regional centers, and their developer clients will insist on a minimum five-year term for the EB-5 investment with possible extension rights because large-scale construction projects require longer than 2-3 years periods and the longer investment terms stated in the PPM will rule. While cash-strapped risky projects might offer tenors that match the new guidelines, most conservative investors should stay clear from such projects not to assume undue capital repayment risk.

- Regional Center due diligence: Investors should look at the track record of the RC, including years in the business, projects completed, the number of applicants processed, green cards granted, and capital repaid. The same scrutiny should be performed on the developer using the funds extended to the JCE.

Kate Kalmykov, Global Co-Chair, Immigration & Compliance Practice

Marko Issever, CEO, America EB-5 Visa LLC

William B. Mack, Co-Chair, Financial Regulatory and Compliance

Practice

Greenberg Traurig

America EB5 Visa

Web Page: https://register.gotowebinar.com/recording/6598538049628630276

Source: https://www.americaeb5visa.com/articles-and-interviews

Latest Questions

Popular Questions

Subscribe for News

Securities Disclaimer

This website is for informational purposes only and does not constitute an offer or solicitation to sell shares or securities. Any such offer or solicitation will be made only by means of an investment's confidential Offering Memorandum and in accordance with the terms of all applicable securities and other laws. This website does not constitute or form part of, and should not be construed as, any offer for sale or subscription of, or any invitation to offer to buy or subscribe for, any securities, nor should it or any part of it form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. EB5Projects.com LLC and its affiliates expressly disclaim any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in the website, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting therefrom.