Investor Q&A with Dan Shields on 260 Kent

Questions can be made by calling: +1-917-421-9919

To get access to this event please contact support@eb5projects.com

Talking points of the event :

- Investment is held in escrow and will not be released to fund the project until investor's individual I-526 immigration petition is approved

- Projected to create over 2,600 jobs or 47 jobs per investor - nearly 5 times the required amount

- The project commenced construction in June 2017 (see recent picture attached)

- The developer, Two Trees Management (www.twotreesny.com), has been building commercial real estate properties in the New York City area for over 40 years.

- Two Trees has invested over $115 million of its own equity and will maintain nearly $100 million after the EB-5 capital is released. As indicated in the PPM and supporting documents, the developer will not recover this $100 million capital investment until the EB-5 investors have been paid their preferred return and recovered their investment capital in full

- The full amount of funds necessary to construct the building has already been committed through a $175 million bond offering (backed by Wells Fargo, JPMorganChase and M&T Bank) and $128 million from Two Trees

- The EB-5 portion of the capital structure represents less than 10% of the total capital structure

- 60% of the operating cash flows after payment of expenses, debt service and taxes will be set aside in a sinking fund account earmarked to return capital to EB-5 investors

About 260 Kent Avenue

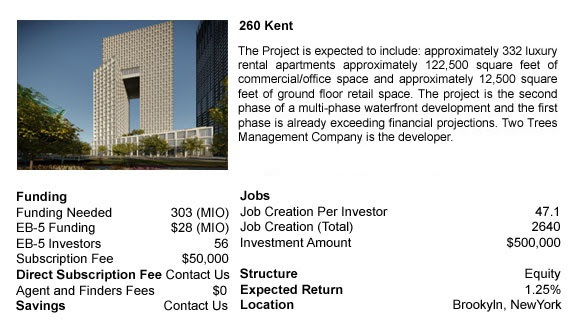

260 Kent Avenue, located on the corner of Grand Street in Williamsburg. The tower will be the second ground-up building to be developed as part of the Domino Sugar Factory redevelopment mega-project, which will have a total build-out of five buildings once complete. The architecture firm behind the design of 260 Kent Avenue is COOKFOX Architects.

The Project is expected to include: approximately 332 luxury rental apartments approximately 122,500 square feet of commercial/office space and approximately 12,500 square feet of ground floor retail space. The project is at the second phase of a multi-phase waterfront development and the first phase is already exceeding financial projections.

Two Trees Management Company is the developer. SHoP Architects is the master planner and James Corner Field Operations is designing the six-acre waterfront promenade that will span the entire former Domino Sugar Refinery site, World Architecture reported.

Dan Shields

Dan Shields earned his law degree from the Cardozo School of Law and his MBA from the Wharton School of Business. He is a veteran of the real estate finance industry with nearly 20 years of experience. He currently serves as President and Chief Executive Officer of AscendAmerica LLC, a boutique real estate finance firm he founded in May 2013.

Prior to establishing AscendAmerica, Dan was responsible for M&T Bank’s New York City Commercial Real Estate Department: a nearly $8B loan portfolio which experienced virtually no losses or defaults during the 2008-09 global financial crisis.

Drawing from his years of experience in finance, real estate, law and regulatory compliance, Dan created AscendAmerica to become a premier provider of capital to finance large-scale commercial real estate development in and around New York City. Dan’s deep broad and dynamic relationships with top tier developers in New York, New Jersey, Pennsylvania and Connecticut, allow him to bring highly prized and greatly sought-after opportunities to international investors. He is also a Registered Securities Representative and holds Series 79 securities registration. Projects will be vetted, well structured and compliant with legal and regulatory frameworks.

Further, Dan’s deep understanding of commercial real estate, credit and regulatory compliance has enabled him to emerge as an expert on EB-5 strategy in a short period of time. Due to his effectiveness and reputation for integrity, honesty and fair dealing, Dan can leverage resources within the EB-5 industry to identify foreigners interested in more than “immigration investment” and reduce the lead-time usually perceived as the downside to EB-5.

Latest Questions

Popular Questions

Subscribe for News

Securities Disclaimer

This website is for informational purposes only and does not constitute an offer or solicitation to sell shares or securities. Any such offer or solicitation will be made only by means of an investment's confidential Offering Memorandum and in accordance with the terms of all applicable securities and other laws. This website does not constitute or form part of, and should not be construed as, any offer for sale or subscription of, or any invitation to offer to buy or subscribe for, any securities, nor should it or any part of it form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. EB5Projects.com LLC and its affiliates expressly disclaim any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in the website, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting therefrom.