JAY PEAK PROJECTS UNDER SEC INVESTIGATION

Dignitaries break ground on a proposed EB-5 project in Newport last month. No state officials attended the ceremony.

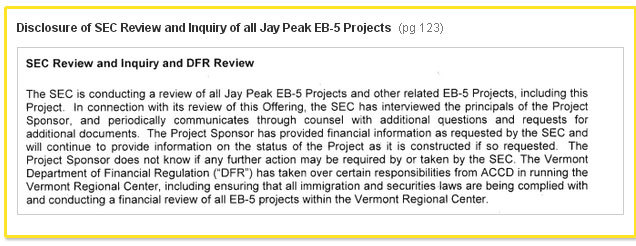

The Securities and Exchange Commission is investigating Jay Peak ski resort’s EB-5 projects in the Northeast Kingdom.

Documents obtained by VTDigger show the federal regulatory agency is conducting a review and inquiry. The principals of the Jay Peak companies, Bill Stenger and Ariel Quiros, have been interviewed, and the SEC has asked the developers for financial information.

The SEC will not confirm or deny that a probe of the Jay Peak projects is underway.

The state has required the developers to disclose the investigation to investors as part of amended offering documents for AnC Bio Vermont, a biotech company in Newport, and Q Burke, a ski resort in East Burke.

Stenger and Quiros are using $545 million in immigrant investor funds through the federal EB-5 visa program to expand Jay Peak Resort, Q Burke, and AnC Bio Vermont. Through the program, foreign investors can obtain a green card and eventually permanent residency in exchange for a $500,000 investment. More than 800 immigrants have invested in eight projects. Six of the projects have been completed; two are slated for or under construction, and two other planned developments do not have approval for EB-5 funds through the Vermont EB-5 Regional Center.

Last summer, the state suspended its agreement with the developers for AnC Bio Vermont and Q Burke. In the intervening 12 months, neither project has been fully reinstated.

The state gave AnC Bio “partial approval” in March on two conditions: Money from any new immigrant investors must be held in escrow; and those funds may not be released until the department has completed a full financial review of the project or “on an investor-to-investor basis upon I-526 petition approval by USCIS, in order to put the funds ‘at risk.’”

The Department of Financial Regulation has asked the developers to also hold money in escrow for Q Burke and suggested that the developers could get a bridge loan for the project. Stenger and Quiros have balked at the idea, insisting that it will “cripple” the project’s ability to continue construction.

“DFR has requested all projects use an escrow account but realizes that in the case of QBurke Resort Hotel the project is already underway and that escrowing funds would not work for an already under construction project,” Stenger said by email. “We are working with DFR right now cooperatively to assure the review is complete and construction funds are fully available to the project.”

For more than a year, the state has demanded that Quiros and Stenger provide financial details and complete information about the ownership structure of the more than 30 entities affiliated with the Jay Peak, Q Burke and AnC Bio Vermont projects.

In January, the state shifted regulation of EB-5 programs from the Agency of Commerce and Community Development, which has oversight of the Vermont EB-5 Regional Center, to the Department of Financial Regulation, which enforces state banking and securities laws.

State officials believed the securities division would have better luck wresting documents from the developers, but Stenger and Quiros have yet to comply with the state’s requests for complete financial records.

Susan Donegan, commissioner of the Department of Financial Regulation and the chief regulator of state securities law, also required the developers to issue amended offering documents for investors in the AnC Bio Vermont and Q Burke projects. As part of that requirement, Stenger and Quiros must disclose to investors that the SEC is investigating all six Jay Peak projects.

Donegan says she has “no ability to comment” on the SEC investigation.

Stenger says the SEC review is “fully voluntary and is something that many large projects are participating in nationwide.”

“We welcome the voluntary review and have cooperated fully and will continue to,” Stenger said in a statement. “This oversight makes good projects like ours better and we have been fully cooperative, as I have said.”

“The number of projects in the USA went from a few dozen 7 years ago to many hundreds today,” Stenger said in an email. “It is logical that SEC review and guidance would be seen and indeed we are seeing this. Several operating clarifications have come from the SEC to all EB-5 projects in the past few months some, no doubt, as a result of this national review.”

Donegan says it’s the first time she’s heard of a “voluntary review.” “I don’t understand what he means,” she said in an interview.

Patricia Moulton, secretary of the Agency of Commerce and Community Development, says she “doesn’t know anything about what the SEC may or may not have.”

“But there is no doubt the SEC is reviewing a lot of EB-5 projects around the country,” Moulton said. “It wouldn’t be unusual if there were some inquiries into these kinds of projects.”

In a May 22 memo, Brent Raymond, director of the state’s EB-5 regional center, warned that the DFR’s release of the amended private placement memoranda for AnC Bio Vermont and Q Burke, and resulting disclosure about the SEC investigation to VTDigger, puts investor money at risk.

Raymond asked the Department of Financial Regulation to protect investors from a media backlash by freezing any remaining funds for the Jay Peak, AnCBio and Q Burke projects.

A news report on the federal probe, Raymond said, would be damaging to investors because it would expose the “many layers of inadequately disclosed business entities, new principals and gross misrepresentations” at Jay Peak.

Sources say the SEC probe of the Jay Peak projects started with a focus on Quiros and may be linked to an allegation made by Douglas Hulme, chief executive of Rapid USA Visas, an immigration firm that severed ties with Stenger and Quiros in 2012. In a letter to more than 100 immigration attorneys, Hulme announced that he had “terminated relations” with Jay Peak because he “no longer has confidence in the accuracy of representations” made by Jay Peak, or in the “financial status and disclosures” of the limited partnerships for six projects at the resort, including the Tram Haus, Hotel Suites I and II, Penthouse Suites, Golf and Mountain Suites and Stateside.

James Candido, who was the director of the state regional center at the time, dismissed the allegations. He said he found “no issues” with Jay Peak’s financials.

INTENSIFIED FEDERAL SCRUTINY OF EB-5

Since 2013, SEC has stepped up enforcement reviews of EB-5 projects. The federal regulatory agency charged a Chicago developer with defrauding immigrant investors early that year. Anshoo Sethi allegedly used false and misleading information to solicit investors in a $145 million hotel and conference center project. The Chicago Convention Center attracted investments from 250 investors but was never built. The SEC shut down the project in February 2013.

Since then, the federal regulatory agency has issued warnings to investors about signs of fraud, including layers of companies run by the same individuals.

The EB-5 program has also come under scrutiny for approving the visas of immigrants who have been accused of committing fraud and money laundering. Deputy Homeland Security Secretary Alejandro Mayorkas has also been accused of giving certain EB-5 projects special treatment.

The U.S Customs and Immigration Service terminated four regional centers in fiscal year 2014 because two were the focus of criminal complaints and another was shut down for misallocation of investor funds.

Sen. Patrick Leahy, D-Vt., who helped to create the EB-5 program, is working on federal reauthorization of the program, which he says has “generated billions of dollars in capital investment and created tens of thousands of jobs across the country.” Flaws in the program, however, need to be remedied, Leahy said in a statement. The legislation would establish an “integrity” fund that would be used to investigate fraud; require background checks for developer principals; require disclosures regarding business risks and conflicts of interest; and require more oversight of projects and monitoring for securities compliance.

STATE QUESTIONS DEVELOPERS’ REPRESENTATIONS TO INVESTORS

For more than a year, Raymond has been scrutinizing the AnC Bio Vermont business plan and fielding complaints about the Jay Peak projects in the wake of allegations that the developers secretly converted immigrant investors’ ownership stake in the Tram Haus Lodge, the first project at the Jay Peak Resort, into unsecured loans.

While Raymond declined to be interviewed for this story, documents show that he has raised probing questions with the developers and their attorneys, Primmer Piper Eggleston and Cramer, and even his colleagues at the Department of Financial Regulation about “inadequate disclosures” and “misrepresentations” he says have been made by the developers.

In a series of memos that started in May 2014, Raymond and John Kessler, general counsel for the Agency of Commerce and Community Development, have called into question the following actions:

• The Jay Peak developers have promoted the proposed Renaissance office building project and the Newport Marina and Conference Center on the company’s website and at trade shows, even though the projects have not been approved for EB-5 investments.

• AnC Bio Korea no longer has leased office space in the headquarters it sold off at auction in Seoul last year. Raymond went to the offices and found they had been vacated. The Seoul office is mentioned in the amended private placement memorandum. The unplanned sale of the building in Korea, and subsequent information about the biotech company’s rocky financial history triggered the state suspension of the MOU with AnC Bio Vermont.

• The regional center has never received any communication about whether AnC Bio Korea was dissolved under the equivalency of a bankruptcy, notice of its status with creditors, or information about whether the transfer of technology was protected against creditors, according to Raymond. He says Korean documents show the company owed $15 million to creditors when the headquarters was auctioned off in May 2014.

• The immigrant investors in Hotel Jay, also known as Phase II, have not received an exit strategy plan for repayment of their $500,000 investments, and Raymond is receiving complaints. “There were only 35 investors in Phase I,” Raymond wrote in an email to Stenger. “There are 145 investors in Phase II. Your letting them know you are focused on how they decide to pay off investors will potentially save you and the Regional Center a lot of angry investor correspondence and REPUTATIONAL DAMAGE. Reputational damage from the Phase I exit has been VERY damaging to the RC’s reputation.” (Emphasis is Raymond’s.)

Oana Dancuta, a Romanian immigrant who now has permanent residency and lives in Rochester, New York, is a phase II investor who says she has not received an exit strategy plan from Jay Peak more than five years after she invested in the Hotel Jay project. Stenger has told her it could be another year before investors see a plan for the return of her investment.

• Raymond says the developers have not disclosed or explained familial relationships and “self-dealing” relationships and closely held interests among various business entities and management structures. Ariel Quiros, Ary Quiros, his son, Okcha Quiros, his wife, Jongweon Choi and Bill Stenger are the principals of several dozen interrelated companies.

DEVELOPERS FAIL TO PROVIDE ADEQUATE INFORMATION

The state says for more than a year Stenger and Quiros have failed to provide adequate financial information and material disclosures about the interconnected companies based in Miami, Seoul and Vermont.

While the developers have said they have complied with the state’s requests, Raymond and Moulton have been unhappy with Stenger and Quiros’ slow and selective communication. In January, the regional center turned over the AnC Bio Vermont and Q Burke cases, which are still under state suspension, to the Department of Financial Regulation for a complete financial review.

Full approval of AnC Bio and Q Burke has been delayed because Stenger and Quiros have not responded to requests for information in a timely way. According to memos from state officials, the developers have not complied with requests for basic financial information for AnC Bio and Q Burke, such as bank statements and budgets.

Stenger rejects that assessment. “The financial data that is being provided is being assembled for DFR,” he said in an email. “There has been no delay just end of fiscal year and end of ski operations to contend with. All the financial materials are being assembled to be shared with DFR.”

In January, the developers were in a hurry for the state to approve AnC Bio in order to schedule a spring groundbreaking ceremony.

By March, midway through the financial review of AnC Bio, the developers switched tack and insisted that state regulators prioritize the financial review of Q Burke instead.

Only 16 of 44 requests for financial documentation had been satisfied for AnC Bio Vermont. A spreadsheet provided to the securities division of DFR shows that the following documents were still missing: monthly bank statements and reconciliations, general ledger, budgets and third party financial statements for June 2013-March 2015; a detailed job cost report; a list of owners and ownership interests; purchase and sales agreements; account signing authority; budgets and actual expenditure reports; tax returns for 2013 and 2014; and identification of accounting software.

In a report to Donegan, Christopher Smith, director of capital markets for DFR, says nothing had been uploaded to a state online dropbox for AnC Bio. “Bill Kelley responded to the document request by stating everything the accountants needed was in the binder produced to the DFR on March 9. This is not true.”

Michael Pieciak, deputy commissioner of the securities division says: “Bottom line, Kelly & Co. have not produced anything.” (Kelly is Jay Peak’s legal adviser.)

As of early May, DFR had received “minimal” documentation from Q Burke.

The Department of Financial Regulation has also asked for Raymond James bank account spreadsheets for the Jay Peak projects that list each investor, amounts of money released, the dates money went to Jay Peak or was deposited in the Raymond James account. None of this information was provided to the state.

THE SHUMLIN ADMINISTRATION’S ROLE

The Shumlin administration, which has publicly supported all of Jay Peak’s EB-5 projects (the governor helped Stenger solicit investors in Miami in 2011 and in China in 2013) has pulled back in recent weeks.

Gov. Peter Shumlin declined to comment on whether the state continues to support the AnC Bio project, which could bring as many as 2,300 jobs to Newport.

While state officials have been prominent in groundbreaking ceremonies for past projects, no one from the administration attended the recent kickoff for AnC Bio in Newport on May 14. (Since then, no excavation has taken place, and there are no construction crews on site.)

Moulton said she and her staff at the agency were “too busy” with the end of the legislative session to attend.

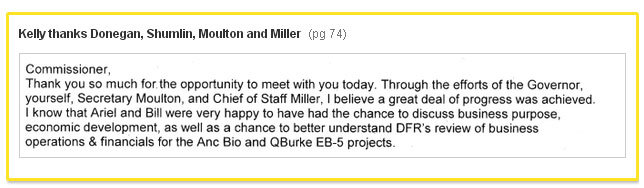

But amid ongoing questions about whether the developers have made accurate financial representations, Shumlin helped to negotiate the partial approval with the developers in a meeting March 27 in an apparent attempt to end the stalemate between the developers and the Department of Financial Regulation.

Kelly, who has described himself as “counsel” for Jay Peak, thanked the governor for his efforts.

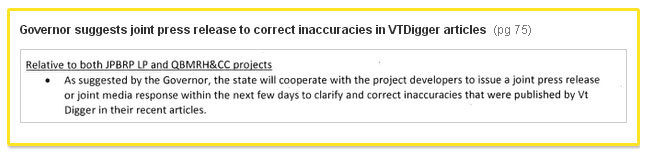

He also thanked the governor for offering to have the state issue a joint a press release with Jay Peak correcting “inaccuracies” in VTDigger stories about AnC Bio Vermont. (The release was never issued.)

At the meeting, Donegan agreed to give AnC Bio “partial approval” to market the project, as long as new money from investors is held in escrow. Full approval is pending a financial review by DFR. In a news release, Stenger billed the state decision as full approval.

“The governor has been very clear he wants us to do our job,” Moulton said. “He recommended we have an important job to do in a regulatory capacity. It’s not unusual for us to meet with him about these projects. He’s telling us to do what we need to do.”

Shumlin has received $22,000 in campaign contributions from Quiros, Stenger and entities they are affiliated with, according to reports to the Vermont Secretary of State’s Office.

Shumlin declined to comment on his involvement in the regulatory decision.

http://vtdigger.org/2015/06/24/jay-peak-projects-under-sec-investigation/

Mentions

States

- Vermont

Videos

Subscribe for News

Site Digest

Join Professionals on EB5Projects.com →

Securities Disclaimer

This website is for informational purposes only and does not constitute an offer or solicitation to sell shares or securities. Any such offer or solicitation will be made only by means of an investment's confidential Offering Memorandum and in accordance with the terms of all applicable securities and other laws. This website does not constitute or form part of, and should not be construed as, any offer for sale or subscription of, or any invitation to offer to buy or subscribe for, any securities, nor should it or any part of it form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. EB5Projects.com LLC and its affiliates expressly disclaim any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in the website, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting therefrom.