Investment group eyes Palm House as foreclosure trial is delayed

Palm House as it looked on Jan. 13, 2016.

An investment group that includes an owner of the still-unfinished Palm House hotel-condominium on Royal Palm Way is preparing to make an offer soon to buy the beleaguered development, an attorney has told the Daily News.

“We’re hoping that we will have a viable purchase offer” by the end of the month, C. Brooks Ricca, of the West Palm Beach law firm C. Brooks Ricca & Associates, said Friday.

Real estate investor and developer Ryan Black

Ricca represents real estate investor and developer Ryan Black, 33, who has been identified in court documents as owning 1 percent of the Palm House property at 160 Royal Palm Way. Ricca would not disclose how much money might be offered for the property.

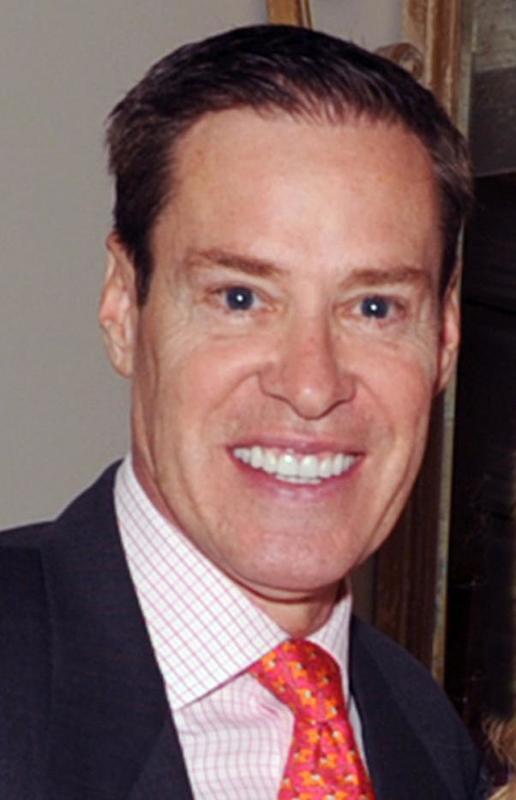

Robert V. Matthews

Word about the impending offer came as the project’s primary developer, Robert V. Matthews, 60, of Palm Beach sat in federal custody after being arrested early Thursday on money-laundering and fraud charges. One of Matthews’ attorneys, Palm Beach real estate lawyer Leslie R. Evans, 70, was arrested the same day, after a grand jury in Connecticut issued a multi-count indictment against the two men for financial improprieties related to the Palm House.

Leslie R. Evans

Evans was released on a $250,000 bond, and Matthews awaits a detention hearing today. News of their arrests was broken Thursday by the Daily News.

In cases related to Thursday’s indictment, Gerry Matthews — Robert Matthew’s brother — and Palm House construction executive Nicholas Laudano pleaded guilty this month in plea agreements with the U.S. Attorney’s office for the Connecticut District. Commercial real estate broker Gerry Matthews pleaded guilty to a single felony count of conspiring to commit wire fraud, which included, in part, the movement of funds in and out of a savings account in his name. Laudano’s plea agreement required him to plead guilty to two felony counts — conspiracy to commit bank fraud and taking part in an illegal monetary transaction.

On Thursday, a circuit court judge in West Palm Beach agreed to delay for 90 days a foreclosure trial involving the Palm House property. The trial was to have started today.

The renovation project at the Palm House stopped abruptly in October 2014, and the doors have remained padlocked since. The property has racked up about $2.5 million in town fines, the majority related to construction delays.

Matthews and Evans, along with “their co-conspirators, agents and others,” illegally used money from foreign investors, administered through the federal EB-5 program, “for the personal gain” of Matthews and others, according to the indictment.

If convicted of all counts, Matthews would face a maximum imprisonment sentence of 320 years; Evans could be sentenced to 230 years.

The alleged scheme involved moving investor funds through bank accounts in Connecticut and Florida to pay Matthews’ credit card debts, to assist in his purchase of a 151-foot yacht and to buy two properties — including a house used by Matthews as a residence — in Washington Depot, Conn., according to the indictment and a press release about the case released Thursday by the Connecticut U.S. Attorney’s office.

During a pre-trial hearing Thursday at the Palm Beach County Courthouse in the Palm House foreclosure case, Judge Donald W. Hafele learned of Matthews’ arrest from Matthews’ attorney, Christopher W. Kammerer of Kammerer Mariani Law Group in West Palm Beach.

Matthews bought the Palm House property in 2006 and announced it would undergo a major remodeling project. He lost it in foreclosure in 2009 to Wellington real estate investor Glenn Straub, according to civil-court documents.

“In August 2013, Robert Matthews reacquired control of the property through an entity called Palm House, LLC,” said Thursday’s press release. “However, Robert Matthews’ brother, Gerry Matthews, was listed in incorporation documents as owning 99 percent of Palm House, LLC.”

Gerry Matthews served only as “nominal” owner, according to the indictment.

The other 1 percent was held by Black, according to civil-court records. The indictment of Robert Matthews and Evans does not refer to Black by name but does identify a “Minority Owner-1.” The document says Minority Owner-1 “had secured additional financing for Robert Matthews, and owned the remaining” 1 percent.

The foreclosure action revolves around a $27.5 million mortgage loan on the property made around August 2013 by Straub, who filed his foreclosure suit for nonpayment in September 2014.

Straub’s company lent the money to 160 Royal Palm LLC, the Palm House’s ownership company. The loan was structured as part of a “purchase money mortgage” deal, meaning that Straub’s company lent the buyer money to complete the sale.

‘We’re just thankful’

Black, who heads his own company, R Black Global, told the Daily News on Thursday that he welcomed the indictments against Robert Matthews and Evans and the guilty pleas by Gerry Matthews and Laudano.

“We’re just thankful that they are finally moving forward with this,” he said about the federal investigators. “We have been pushing against this for years. We’ve been actively in communication with them for the past year.”

Black said he is hoping that the property can be stabilized and that the EB-5 investors can get what they expected when they made their investments. Under the federal program, foreign investors and their families can be expedited for permanent immigration visas — so-called green cards — if they make at least a $500,000 investment in a project that would ultimately employ 10 or more people. A group of more than 50 EB-5 investors, mostly from China and Iran, filed in 2016 a lawsuit in federal court in West Palm Beach against Palm House developers, alleging they were defrauded out of more than $50 million.

“I think the property is valuable, and I would like to (be able to) make the EB-5 immigration status viable, so they can get their green cards,” Black said.

The Palm House property today is overseen by court-appointed receiver Cary Glickstein, the outgoing mayor of Delray Beach. On Friday, Glickstein said that the court has authorized him to pursue an agreement with a brokerage firm to market the property for sale. Any sale would also have to be signed off on by the court.

“Pursuant to court order, we are proceeding to the market — to market the property — and we have a hearing later this month to sign that agreement. After that point, the property will be presented to the world, and we expect there to be a lot of interest in it. Whether we actually get to a sale, that’s really within the court’s purview,” Glickstein said.

Specific allegations

On Friday, an attorney for Gerry Matthews emailed to the Daily News a statement from his client, a Connecticut resident.

“After a lifetime of commitment to my family and my community, I could not be more remorseful for my actions and have promptly taken this first step in remedying the situation. While I have not now or ever received any benefit from my role in this matter, I acknowledge fully and accept responsibility for my actions,” Gerry Matthews said in the statement released by Connecticut attorney George G. Mowad II of Yamin & Grant LLC.

The indictment released Thursday detailed how Laudano — as part of a conspiracy scheme with Robert Matthews, Evans and others — used a “shell company” to buy a house at 115 Lower Church Road in Washington Depot in 2014. Robert Matthews had lost that property in foreclosure, and the shell company improperly masked to the seller that Robert Matthews was actually the buyer, according to the indictment.

The conspiracy also involved a letter Evans sent to the auction house that conducted the foreclosure sale, the indictment said. “In the letter, Evans falsely and fraudulently represented to Auction.com that Laudano and his company” had provided $2.75 million to Evans, from which the down payment on the property would be drawn, according to the indictment. But Laudano never provided those funds to Evans, and the down payment instead “came from comingled client funds” in a trust account administered by Evans, according to the indictment.

The conspiracy continued when the same ownership company later took an illegal loan secured by the Lower Church Road property, the indictment said.

The indictment also lists wire transfers alleged to involve EB-5 money that was transferred to various accounts between January 8, 2014, and June 23, 2014.

Evans, through his attorney, has denied the charges against him. An attorney for Matthews couldn’t be reached.

Mentions

Litigation Cases

States

- Florida

Securities Disclaimer

This website is for informational purposes only and does not constitute an offer or solicitation to sell shares or securities. Any such offer or solicitation will be made only by means of an investment's confidential Offering Memorandum and in accordance with the terms of all applicable securities and other laws. This website does not constitute or form part of, and should not be construed as, any offer for sale or subscription of, or any invitation to offer to buy or subscribe for, any securities, nor should it or any part of it form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. EB5Projects.com LLC and its affiliates expressly disclaim any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in the website, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting therefrom.