The AnC Bio Inc. offices in Seoul.

The scene is of a workday interrupted. An empty coffee cup sits on a desk with papers, power cords and cables strewn about. An executive-style chair idles at a desk. Aside from a pile of boxes stacked in the hallway, there is no other sign of life at the former administrative headquarters of AnC Bio Inc., located on a floor of the glass and steel H&S Tower.

A security guard said neither AnC Bio nor a subsidiary company on the fifth floor has received mail at H&S Tower in two and a half years. If you call the phone number listed on the AnC Bio Inc. website, a real estate firm picks up. The space is for rent.

AnC Bio Inc., now at the center of two fraud probes in South Korea and state and federal regulatory action in the United States, is essentially defunct.

The Seoul-based biotech company is a zombie. While it still exists in the business registry, it has no employees, no factory and no administrative office space.

The once expansive company — with five co-ventures in the United States, South Korea and Japan — boasted to investors that it would develop new flu vaccines and produce regenerative stem cell therapies for damaged heart, spinal cord and skin tissue. The company also promised to manufacture lifesaving medical products including a heart-lung mechanism, a portable dialysis machine and a liver replacement device.

Foreign investors in the Korean and Vermont projects were told that the stem cell therapies and medical devices would generate hundreds of millions of dollars in profits.

The Korean Development Bank in Seoul also believed the AnC Bio Inc. pitch and loaned the company $7.5 million to build a $30 million biotech factory in the small city of Pyeongtaek, an hour south of Seoul by express train. The factory where AnC Bio Inc. planned to conduct stem cell research and manufacture its medical devices was in a Pyeongtaek industrial park near an agricultural area punctuated by plastic greenhouses and metal warehouses.

When AnC Bio Inc. offered to bring its miraculous technologies to Vermont at the height of the Great Recession, state officials enthusiastically embraced the idea, believing the biotech company would create thousands jobs for the gritty Northeast Kingdom region. The deal included the construction of a biomedical manufacturing plant — just like the one in Pyeongtaek — in the Canadian border town of Newport.

The Vermont plant would be financed by EB-5 investor funds, which allows foreigners to put up $500,000 for developments in targeted poor rural or urban areas in exchange for a green card. The developer is obliged under federal rules to create 10 jobs for each investor.

The defunct offices of AnC Bio Inc. in Seoul.

A GRAND VISION

The most popular EB-5 development in Vermont was at Jay Peak Resort in the Northeast Kingdom. While other Vermont developers looked to use $20 million to $50 million in EB-5 investor funds for modest projects, Ariel Quiros, the owner of the resort, and Bill Stenger, its president and CEO, were thinking big. Very big.

Stenger and Quiros raised more than $250 million from 500 investors for a massive expansion at the Jay Peak ski area that included hotels, a water park, an ice rink, three condo complexes, a golf club and other amenities. The two men planned to raise $600 million more to develop a terminal at a regional airport, a marina and conference center on Lake Memphremagog, an office building in Newport, and an elite athletic center at another ski area in East Burke.

But the grandest vision of all was the final project: AnC Bio Vermont. The two developers planned to revolutionize the region with the construction of a state-of-the-art stem cell laboratory and artificial organ manufacturing plant that would draw researchers from the University of Vermont College of Medicine and Canadian university hospitals.

H&S Tower in the Gangnam district of Seoul.

Quiros and Stenger referred to AnC Bio Vermont as the “crown jewel.”

The idea of bringing biotech jobs to the poorest region of Vermont proved irresistible to the state’s politicians. In all, through direct and indirect economic impacts, the developers said in legal documents that AnC Bio Vermont would create 3,000 jobs.

With the backing of the Vermont EB-5 Regional Center, which was responsible for oversight, the two developers in 2009 brought Gov. Jim Douglas to the Pyeongtaek factory, where he signed off on a deal to bring the biotech company to Vermont. His successor, Gov. Peter Shumlin, promoted the project to foreign investors in two separate video clips in 2012 and 2013. A vice president at UVM endorsed the plan, as did Sen. Patrick Leahy, D-Vt.

In all, 133 foreign investors believed the pitch made by Stenger, the general partner for the project, and Quiros, the owner of the Vermont company. Many investors say it was the seal of approval from state officials that gave them confidence AnC Bio Vermont was a legitimate investment.

Together, the immigrants invested $66.5 million in AnC Bio Vermont.

The proposed 10-story biomedical facility in Vermont, however, was never built, and federal regulators say Quiros “pilfered” the money for the project.

The U.S. Securities and Exchange Commission brought charges against Quiros and Stenger in April alleging they misused $200 million in investor funds out of a total of about $350 million raised for AnC Bio Vermont and projects at Jay Peak. The SEC case did not name the Burke Mountain development as a defendant. A class action lawsuit filed in May, which includes Burke, alleges that in all, the developers had $404 million at their disposal and 836 immigrant investors from more than 74 countries were defrauded. The developers also collected an estimated $41.8 million in administrative fees from the investors.

Five of six projects at the Jay Peak ski area were completed with the exception of a condo complex known as Stateside. The Burke Mountain facility was not completed as planned, and construction of AnC Bio Vermont was never begun in earnest. About 400 investors may not be eligible for green cards because they were at the end of the line in the alleged Ponzi-like scheme.

The SEC describes AnC Bio Vermont as “nearly a complete fraud.”

Federal regulators allege that Quiros “looted” AnC Bio Vermont and used money from EB-5 investors as a personal piggybank. The SEC says the Miami businessman stole $30 million just from AnC Bio Vermont for his own use. At least $6 million was siphoned off to an unregistered Korean company associated with AnC Bio Inc., and $6 million more went to business associates of Quiros who never delivered on services and products. Quiros and Stenger, who was the general partner for the project, turned a $3 million profit when they sold the land for the facility to investors.

Quiros, through his attorneys, says he made legitimate profits from development fees that investors were made fully aware of in legal documents. If federal and state regulators had not put a halt to the developments, Quiros says he would have been able to find more investors to fully subscribe Burke and AnC Bio Vermont, and there would have been enough money to complete the construction.

The foreign investors in AnC Bio Vermont, meanwhile, likely won’t get their money back any time soon, and without an act of Congress exempting them from federal immigration rules, they are unlikely to get green cards because no jobs were created.

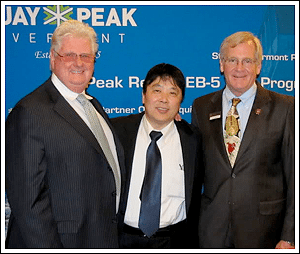

Gov. Peter Shumlin, Jay Peak CEO Bill Stenger, Ariel Quiros, the owner of Jay Peak, and his son Ary Quiros at a ribbon cutting.

THE SOUTH KOREAN CONNECTION

While the story of the largest fraud case in the history of the EB-5 program blossomed in Vermont, it took root half a world away in South Korea years before.

As Stenger wooed the press, politicians and locals in a September 2012 news conference highlighting the AnC Bio Vermont project, his South Korean counterpart was already in trouble.

Auditors for the federal government in Seoul were bearing down on Jong Weon “Alex” Choi, the CEO of AnC Bio Inc., a close business associate of Quiros’ who owned the technology rights for the products that were to be manufactured in Vermont.

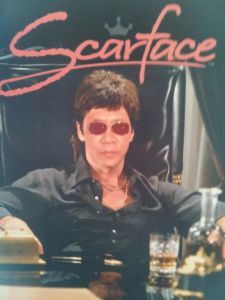

Alex Choi, CEO of AnC Bio Inc. and former president of Jay Construction Management. Facebook image

In 2012, just as the Vermont EB-5 Regional Center was preparing to approve an offering memorandum that would be used to solicit EB-5 investors for the Newport biomedical project, South Korean accountants found that AnC Bio Inc. had been operating at a loss for three years running. In June 2012, the Korean Development Bank authorized the auction of the Pyeongtaek factory to recoup a $7.5 million construction bond. (It was sold in 2014.)

In September 2013, the Korea Herald reported that a “Mr. A” (Choi) was arrested and released on bail on charges of stock manipulation, corruption and embezzlement of $10 million from AnC Bio Inc. The Pyeongtaek factory was searched and seized by South Korean prosecutors months earlier, in March that year. Prosecutors also charged the CEO of Sports Seoul 21, a holding company of which AnC Bio was a subsidiary, with corruption and stock manipulation. In connection with the AnC Bio cases, the CEO of Sports Seoul went to jail, news reports show.

Choi’s trial in Seoul is set to start this month, according to a government court schedule, but as is typical of court proceedings in South Korea, the prosecutors’ specific allegations are under seal and cannot be obtained through a records request.

A CLOSE RELATIONSHIP

Choi, 55, is a native of South Korea. Like his longtime friend and business partner, Ariel Quiros, he has operated dozens of interrelated companies ranging from import-export businesses to biotech.

Alex Choi, the CEO of AnC Bio Inc. Facebook profile pic

Choi and Quiros were partners in a number of companies. Some of the businesses are based in Seoul. Others are registered in Florida.

The two men met in 1981, not long after Quiros finished his tour of duty in the U.S. Army in South Korea and married a South Korean woman.

Quiros’ adult children have referred to Choi as “uncle,” but Quiros adamantly denies that Choi is any relation. Whether they are related or not, property records and other documents show the two men had an unusual degree of trust when it came to finances.

Together Quiros and Choi started an import-export business in the early 1980s and shared ownership of a number of other companies, including GSI Corporation, Q Resorts, The Teddy Bear Foundation of Florida and Jay Construction Management. Quiros served as an unpaid “consultant” for AnC Bio Inc. in Korea.

Choi and Quiros also traded real estate in Miami. The two men sold and resold the company offices to each other over a nine-year period. In 2007, Choi purchased the business suite at 111 NE 1st St. from Quiros for $2.4 million — 10 times what Quiros paid for it in 1996. During Choi’s financial troubles in 2012, he sold it back to Quiros for less than $1 million.

The Miami offices for the import-export business and several dozen other companies owned by Quiros have used the address. When VTDigger visited the business suite in 2015, the offices were empty, save for a few cardboard boxes.

GSI Corporation’s Miami office show unpacked boxes, no staff on hand. Photo taken in October 2015 by VTDigger.

Choi is something of a man of mystery. While there is no recent address listed for him in South Korea, he has a presence on Facebook that features a macho profile photo of him in which he is wearing aviator shades, a black dress shirt and gold necklaces under the word “Scarface” scrawled in red above his head.

Over the past decade, Choi has moved every 18 months — each time farther and farther away from Seoul.

Choi seemed to disappear for a while — even on Facebook, where friends in 2012 encouraged him to hang tough during the Korean prosecutors’ investigation. His last known address is more than an hour from the city, while his social media posts promote a portable digital DJ device called Pacemaker (the only product Choi appears to have successfully commercialized).

Though Choi is not named as a defendant in the SEC case, his actions and his companies are central to the fraud allegations.

At the same time that Choi presided over AnC Bio Inc. as the CEO, he served as president of Jay Construction Management from 2011 through 2014. During that period, Choi ceded power of attorney, or signing power for the company, to Quiros for bank transactions and payments for the company, many of which the SEC and state regulators say were improper.

Regulators say Jay Construction Management — under Choi’s oversight and with Quiros holding power of attorney — was the pipeline through which money flowed from AnC Bio Vermont to cover cost overruns and missing investor funds for earlier projects at Jay Peak Resort.

The SEC says Quiros, using Jay Construction Management as the vehicle, commingled $160 million in EB-5 investor funds for the Jay Peak, Burke Mountain and AnC Bio Vermont projects.

While Choi served as president of Jay Construction Management, about $6 million was transferred from Vermont to bank accounts in South Korea held by AnC Biopharm, a company affiliated with AnC Bio Inc.

That was possible because of a special investment agreement that allowed the developers to immediately use $60 million from investors in AnC Bio Vermont. The agreement gave the developers the ability to transfer the money to AnC Biopharm for the purchase of technology rights, distribution rights and equipment for the biotech products to be manufactured in Vermont. Ultimately, AnC Biopharm, which is not a registered company in South Korea, did not deliver on the products or the rights, according to the SEC.

In previous projects at Jay Peak, investors were told their money would be held in escrow and used only for construction of the project they invested in. However, the SEC says the money was not in fact held in escrow, but was commingled and used for a variety of construction projects and other purposes.

Through the special technology agreements and the Jay Construction Management company, Quiros allegedly tapped $30 million from AnC Bio Vermont for his personal use. He also distributed $7.9 million to North East Contract Services, a company run by his longtime business associate Bill Kelly, according to the SEC.

In testimony to the SEC, Stenger, the general partner for AnC Bio Vermont, did not dispute allegations that the developers had decided to use the money to pay for other projects. The developers are accused of running a “Ponzi-like” scheme that started when Quiros purchased Jay Peak using investor funds intended for future development projects.

Stenger told regulators he had hoped proceeds from AnC Bio Vermont would bankroll future developments, including an office building in Newport and the planned terminal at the regional airport.

The proposed AnC Bio plant to be built in Newport.

KOREA’S PATRONAGE SYSTEM

The H&S Tower where the AnC Bio Inc. offices once operated is one of the smaller structures in the high-end Gangnam district of Seoul. High-rise office buildings and apartments dominate the skyline. Mountain ridges rim the city, and Namsan Mountain looms at the center of this metropolis of 10 million people.

The skyscrapers are an expression of human ambition against all odds. The Korean peninsula was overrun by the Japanese military in the 16th, 18th and 19th centuries in the waning years of the feudal Joseon Dynasty. The city of Seoul endured the indignity of Japanese occupation in World War II and then was reduced to rubble during the Korean War, a civil conflict that ensued after the failed reunification of South Korea and North Korea.

Still, given a chance to chart their own course as an independent nation, the South Korean people have completely rebuilt their country as a democratic nation. They now are a leader in the global tech boom. Today, South Korea, with a population of 55 million, is the fourth-largest economy in Asia.

The nation’s economic success can in large part be attributed to a history of aggressive government support for entrepreneurs, especially in the tech industry. Corporate titans are often very closely tied to government officials who have used taxpayer money to back entrepreneurs through subsidies, federal bank loans and other incentives. Companies have, in turn, given government officials perks and even cash in return for influence. This climate of corruption has also tainted the biotech industry.

Exposés about the alleged corruption of President Park Geun-hye have led to massive demonstrations. Every Saturday since early November a river of more than 1 million people have joined demonstrations on a closed section of eight-lane highway that stretches from downtown Seoul to the Blue House, the president’s residence.

Park, now subject to impeachment proceedings, is accused of using her influence to funnel money from 10 corporations into a foundation run by a woman who has been a close confidante and adviser. At recent protests, demonstrators have surrounded the Blue House, holding hands and singing.

The Korean people, who are famous for their integrity (check out this video), have a low tolerance for the kickbacks and favors that have become commonplace in business and government circles. South Koreans are also highly literate (55 percent graduate from college) and have a more Western outlook than their peers in other Asian countries. A large percentage — 30 percent — are Christian, census figures show.

South Koreans say President Park’s alleged corruption is an extension of the policies set by her father, Park Chung-hee. He took power in 1963 and ruled the country during a formative 16-year period in which South Korea rebuilt its economy and leveraged money from the Korean equivalent of the U.S. Federal Reserve to back emerging tech and manufacturing companies like Samsung and Hyundai.

Professor Ha-Sung Jang, a well-known economist at Korea University, says the current business structure with the close ties between business and government is not benefiting the Korean people. Only one-sixth of the more than 3 million registered businesses in Korea pay taxes. The top 100 companies together generate 60 percent of the nation’s profits but employ only 4 percent of people here. And too often, Jang says, corporations use shell companies to hide profits.

Government money and influence have been used to foster biotech developments since the early 2000s.

AnC Bio Inc. was part of a new wave of biotech in South Korea that included stem cell research, cell generation, genetic engineering, medical diagnostic devices and biomedical devices.

Stem cell research, in particular, has involved the “collusion” of medicine and government authorities, according to professor Ryu Young-jun of Kangwon National University. Ryu is famous for blowing the whistle in 2005 on his superior, Dr. Woo-Suk Hwang, who faked human cloning experiments at Seoul National University, one of the most prestigious colleges in South Korea.

In an article for the Korean online newspaper Money Today published earlier this month, Ryu said “(Researchers) will claim impossible treatments in order to receive research funds from the government or investors without a blink in the eye.”

More than 1.5 million people participated in a peaceful demonstration in Seoul earlier this month.

THE PYEONGTAEK-NEWPORT CONNECTION

Thirteen years ago Byeung-gu Min, a medical engineer at Seoul National University, hoped to perform a miracle. The research professor had worked for 20 years to invent an artificial heart, and he believed the device would prolong life for people with heart failure.

Min finally had the opportunity to test his artificial heart on a patient with end stage heart failure in France. The patient died of liver failure after 12 days, sources say.

Min then redesigned the artificial heart device as an outside-the-body mechanism called the T-PLS or Twin Pulse Life Support machine. He obtained a patent for it in 2004, and the Korean Food and Drug Administration approved the device for testing that year. That same year, he received patents for a portable dialysis machine he called the C-Pak and an artificial liver device known as E-Liver.

The Twin Pulse machine is unique in that it is designed to force blood into the heart vessels of a patient experiencing a heart attack. Most life support machines on the market supply an even blood flow to the heart. The devices are typically used to bypass the heart while patients are waiting for or recovering from surgery.

In an initial phase of human testing of the Twin Pulse machine involving 50 cases, only 10 patients experienced success. An academic journal published a description of two test cases.

As Min was preparing for the testing phase, he sold his company NewHeart Bio to Alex Choi.

Choi owned a company called Bioheart Korea, or BHK, which specialized in stem cell therapy for the regeneration of heart tissue. Bioheart Korea was later renamed AnC Bio Inc.

Choi leveraged the stem cell technology and the three medical devices to obtain support from the South Korean government. Under the business name BioHeart Manufacturing, Choi obtained permission in 2006 to build the factory in Pyeongtaek. BioHeart Manufacturing received construction loans through the Korean Development Bank, and the factory was built in 2007.

AnC Bio Inc. once owned this factory in Pyeongtaek, South Korea.

But by the spring of 2009, Choi was in trouble. Auditors with the HanWool accounting firm said he was not forthcoming with BHK’s financials, and the company was delisted from the Korean stock market.

That stock market delisting appears to have precipitated a name change. The company was rechristened AnC Bio Inc., according to the Financial Times and Reuters, and Choi sold shares of the company that year to a large conglomerate, Sports Seoul 21, which had subsidiaries in biotech, mining, media and construction.

Choi tapped Ike Hwan Lee, a stem cell scientist, to serve as president, and one of professor Min’s students, Kyungsoo “Jake” Lee, to run the operation. Under Ike Lee’s leadership, the company expanded its products to include a flu vaccine and a new co-venture with a Japanese company for the stem cell heart regeneration technology.

Meanwhile, the Jay Peak developers were setting up a beach head for AnC Bio Inc. in Vermont through a deal with the state using EB-5 immigrant investor funds. Gov. Jim Douglas was scheduled to visit the Pyeongtaek factory in October 2009 to give the state’s stamp of approval for the project. Just weeks beforehand another name change was in the works. Sports Seoul 21 was renamed AnC Bio Holdings Inc.

Gov. Jim Douglas of Vermont and Gov. Moonsu Kim of Gyeong-gi province.

Douglas was invited to tour the factory and sign the agreement allowing AnC Bio Inc. to form the partnership with AnC Bio Vermont, its sister company in the United States. The new company would raise money to build a $50 million facility in Newport that would look just like the Pyeongtaek factory.

The ceremonial signing with Douglas was conducted with some fanfare. Choi and his Vermont partners — Stenger and Quiros — led the festivities. The provincial governor was on hand. And a reporter from Poli People, a Korean business magazine that was one of the Sports Seoul 21/AnC Bio Holdings media companies, was there to record the historic moment.

Douglas was clearly wowed. The Vermont governor told Poli People that he was impressed by the wide array of products AnC Bio had to offer. He especially liked the idea of the portable dialysis machine, which he believed would be a groundbreaking technology that “is going to transform how health care is delivered.”

“I think there is great demand for biotech both in our country and around the world, and because Vermont is such a good fit for this type of company I think we can position ourselves as a real leader,” Douglas said.

Three years passed as Stenger and Quiros built out the massive redevelopment of Jay Peak. And officials with the state of Vermont, charged with overseeing the projects through its EB-5 Regional Center, were doing all they could to help the developers create jobs in the historically depressed Northeast Kingdom region.

While his colleagues in Vermont were ambitiously forging ahead with $282 million in construction projects, Choi and the CEO of AnC Bio Holdings, HongHee Jung, got into hot water with federal prosecutors in Korea. The two men were charged separately with corruption, stock manipulation and embezzlement.

Choi, who did not open his books to Korean auditors in 2011 as required under federal law, was charged with stealing $10 million from his companies in 2012, according to the Korea Herald.

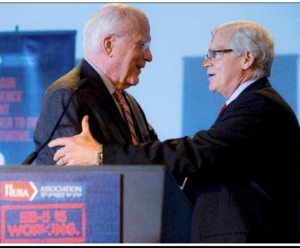

Rapid USAs Visas CEO Douglas Hulme, left, a representative of Shen law firm, center, and Bill Stenger, right.

As Choi’s company floundered, Stenger and Quiros were battling their own dumpster fire in 2012. Douglas Hulme, a business partner who handled investor solicitations for the Jay Peak projects, broke ranks and declared to 100 immigration attorneys that he no longer had faith in the developers’ financial representations.

In May that year, Hulme talked with state officials about his concerns. But instead of fully addressing his allegations of anomalous accounting at Jay Peak, the state, in June of that year, accused him of operating as an unregistered broker dealer.

Not long after, Stenger and Quiros ramped up their push to launch AnC Bio Vermont. They came up with a new plan that doubled the project estimate to $110 million from 220 investors with a promise that construction of the building would completed in 2014 and revenues would start rolling in right away.

The two men held a daylong press conference at the end of September 2012 that featured speeches from state politicians — the congressional delegation and the governor’s office — in Newport.

In October that year, the Vermont EB-5 Regional Center approved the biomedical facility, and Stenger, who had close ties with state and federal politicians, got Gov. Peter Shumlin and Sen. Patrick Leahy to write letters of support for the biomedical factory in Newport that were used in legal documents for investors.

Sen. Patrick Leahy and Jay Peak developer Bill Stenger.

Stenger also solicited support from Dr. John N. Evans, a special adviser to the president of the University of Vermont. Evans wrote a letter to Stenger on Oct. 5, 2012, supporting the AnC Bio Vermont proposal as part of the developers’ investor pitch.

“In our discussions with representatives from AnC Bio it is clear that there are many areas where research collaborations can be developed,” Evans wrote.

UVM offered to share equipment with AnC Bio, provide internships for UVM students with the company, allow AnC Bio scientists to participate in academic activities and provide educational programs for potential workers at the biotech plant in Newport.

The university also rented office space to Jake Lee, the head researcher for AnC Bio Vermont, Evans said.

After Shumlin easily won re-election in November 2012, his campaign manager and chief of staff, Alex MacLean, went to work for Stenger. At the end of December the governor appeared in the first of two promotional videos for the developers. In this one, he lauds Choi’s work in the biomedical industry and encourages immigrants to invest in AnC Bio Vermont and the Jay Peak projects.

In a second video, he tells investors that the projects, including AnC Bio Vermont were “audited” by the state. Shumlin later recanted that statement and said he had misspoken. The regional center did not have the authority to subpoena financial records and was never able to review the developers’ books.

Ariel Quiros, left, whispers to Gov. Peter Shumlin at a press conference at Jay Peak Resort.

In South Korea, Choi’s legal and financial problems intensified, and he lost ownership of the Pyeongtaek factory in 2014 when it was sold at auction.

The 2014 auction of the Pyeongtaek factory caught the attention of the Vermont EB-5 Regional Center.

Brent Raymond, the head of the center, and John Kessler, general counsel, raised questions about Choi’s financial dealings, his relationship to Quiros, expenditures made by Jay Construction Management and allegations that Ike Lee, the president of the company, had inflated his credentials. (Lee said he was a graduate of Harvard Medical School, when in fact he had worked at an affiliated hospital.)

When Raymond and Kessler couldn’t get answers, they suspended the Burke and AnC Bio Vermont projects in August 2014. That meant Stenger and Quiros could no longer solicit investors for the two projects. As money from new investors dried up that year, construction of the 84 Stateside condos at Jay Peak and a hotel at Burke, both already underway, ground to a halt.

When state officials asked about the financial status of AnC Bio Inc. in Korea, Stenger insisted that Choi was not the subject of any investigation and cited as proof an affidavit from a Korean law firm in Seoul.

In addition, Stenger and Quiros told investors and the state that the name of the company was AnC Bio Korea, an entity that is not registered in the Korean business registry. When questions were raised about the Choi investigation, both men referred to AnC Bio Korea instead of AnC Bio Inc.

The fraud the state has heard about, Stenger insists, involves a different entity, AnC Bio Holdings Inc., and a different CEO, Honghee Jung.

Stenger also told state officials that AnC Bio Vermont was “structured organizationally to protect itself” and investors.

The regional center was not satisfied with Stenger’s answers and officials were miffed, despite patient prodding, that he and Quiros refused to produce financial documents.

When the developers did not fully comply with the center’s requests, the agency ceded financial oversight for all EB-5 projects, including the Quiros and Stenger developments, to the Vermont Department of Financial Regulation in January 2015. The department had the expertise — and subpoena power — to conduct a probe.

The state finally launched an investigation in March 2015. (The SEC started its review and inquiry in 2013.)

At about the same time the state probe began, public records show that Shumlin pushed to give the AnC Bio Vermont and Burke projects “partial approval,” despite the misgivings of Susan Donegan, the state’s chief financial regulator. That meant, after a eight-month suspension, the developers could now solicit new investors for the two projects. Donegan required Stenger and Quiros to hold the money in separate escrow accounts and go through a third party approval process for expenditures that was reviewed by the state.

It is not clear how many investors bought into AnC Bio Vermont between March 2015 and March 2016. Documents show that Stenger was soliciting investors in Johannesburg as late as March 31, less than two weeks before the SEC brought charges.

Bill Stenger thumbs through architectural renderings of pending developments at a press roundtable in September 2013.

PROMISES UNFULFILLED

Stenger told investors that FDA approvals for the artificial organs were pending, but the SEC says those approvals were never sought. The Jay Peak president wrote a letter to the FDA in 2011 asking about protocols for FDA trials, but did not follow up with an application.

In addition, Stenger and Quiros projected unrealistic revenues from AnC Bio Vermont clean room laboratories, mechanical devices and stem cell research, according to the SEC. Over a five-year period, the developers said the facility would generate $659 million by 2018. An economic expert who testified for the SEC in May said the facility would make $204 million in revenues at most — if the AnC Bio Vermont facility opened in 2014 as planned.

But a groundbreaking for the facility was not held until May 2015. Only $2 million in pre-construction work was complete by the spring of 2016 when federal regulators brought charges.

While the feds say AnC Bio Vermont is a fraudulent project, Quiros maintains in court filings that the project remains viable. His attorneys cite a Frost and Sullivan marketing study, which claims that AnC Bio’s “organ-assist productions will not only be highly competitive in the global market, but will be leaders in setting new standards for the industry.” The study says “the company is well positioned to provide new, leading-edge stem cell therapies for cardiovascular disease.”

Quiros’ attorney says there is potential for AnC Bio Vermont “to be completed and any alleged shortfalls can be attributed to good faith, contractually protected management decisions.”

The design for the AnC Bio Vermont facility resembles the Pyeongtaek factory. The 33,000 square foot structure, which was to be located near Newport, was seen as a panacea for the economic ills that have dogged the region for decades. Residents hoped that Stenger, a local hero, would help save the Northeast Kingdom economy with thousands of biotech jobs.

People in Pyeongtaek also expected to see hundreds of workers employed at the local AnC Bio Inc. factory. But residents say the building sat largely empty from the time it was built in 2007.

And the Pyeongtaek factory was never used in the way Choi advertised to investors.

Instead of lifesaving devices and stem cell therapies, AnC Bio Inc. made Applicell, a cosmetic cream that was sold door to door like Mary Kay products.

Meanwhile, AnC Bio Inc. in South Korea still exists in cyberspace. While its stock is no longer traded, Naver, the Korean version of Google, lists a price and heaps praise on the company’s prospects for growth.

But the products Choi promised to investors in the Pyeongtaek factory operation appear never to have materialized.

Medical devices are tested in phases with increasingly larger pools of patients. A final trial would typically be conducted on hundreds of patients. There is no scientific literature showing the artificial heart machine ever progressed past the Phase I human trial on 50 subjects. Nor is there literature available on the efficacy of Min’s artificial kidney and liver devices, and neither appears to have garnered approval from the Korean Food and Drug Administration for human trials.

The stem cell heart regeneration therapy, which received KFDA approvals for two clinical trials, including one for 330 patients, doesn’t appear to have progressed to the final trial phase and was never made available commercially, based on information provided by company websites. Prominent scientists have questioned the efficacy of stem cell injections as a regenerative therapy for damaged heart tissue.

Back in Vermont, John Evans at UVM said he read about the SEC charges in the paper “like everybody else,” but he doesn’t feel duped by Stenger or regret that he was a booster for the project.

“It was in the early stages. … There are lots of startup companies that start in a community like this, and part of a university’s responsibility is to provide whatever assistance to those when we can,” he said.

Ike Lee doesn’t return phone calls. Evans doesn’t know where Jake Lee is now. At some point, the AnC Bio researcher stopped coming into the office.

The South Korean scientists who were working in Vermont seem to have disappeared, along with Choi.

Alex Choi, left, with Ike Lee for the ANC Bio Vermont groundbreaking in May 2015.

https://vtdigger.org/2016/12/27/anc-bio-vermont-troubles-began-south-korea/

Mentions

- Vermont EB5 Regional Center

- UNITED STATES SECURITIES AND EXCHANGE COMMISSION

- Ariel Quiros

- Bill Stenger

- Patrick Leahy

- Peter Shumlin

- Jay Peak - AnC Bio Vermont

- Jay Peak - Q Burke Mountain Resort, Hotel and Conference Center L.P.

- Jay Peak Resort - Golf & Mountain Suites

- Jay Peak Resort - Hotel Jay & Conference Center

- Mount Snow - West Lake Water Project LLC

- SHENLAW, LLC

Litigation Cases

- Chinese investors vs SHENLAW, LLC & Darren Silver & Darren Silver & Associates, LLP & Schnader Harrison Segal & Lewis LLP & Ting Geng, Esq. & The Law Offices of Geng & Zhang PLLC & Leslie I. Snyder, P.A. & Ruben Flores & The Flores Group & Cheng Yun & Associates, PLLC & Dai & Associates, P.C.

- Chinese investors vs SHENLAW, LLC & Jianming Shen

- State of Vermont vs Bill Stenger & Ariel Quiros

- UNITED STATES SECURITIES AND EXCHANGE COMMISSION vs Ariel Quiros & Bill Stenger

States

- Vermont

Securities Disclaimer

This website is for informational purposes only and does not constitute an offer or solicitation to sell shares or securities. Any such offer or solicitation will be made only by means of an investment's confidential Offering Memorandum and in accordance with the terms of all applicable securities and other laws. This website does not constitute or form part of, and should not be construed as, any offer for sale or subscription of, or any invitation to offer to buy or subscribe for, any securities, nor should it or any part of it form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. EB5Projects.com LLC and its affiliates expressly disclaim any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in the website, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting therefrom.