Nationwide EB-5 Investment Falling, But Foreign Investor Program Still Financing Several New D.C. Projects

At least seven new D.C. developments are currently moving forward with funding through the EB-5 program, even as visa backlogs and political uncertainty have decreased the overall flow of money coming into the U.S. from foreign investors seeking residence in exchange for investing in construction projects.

Foulger-Pratt broke ground last week on Press House at Union District, a $200M project that included $34M from EB5 Capital. A Bethesda-based regional center that collects and deploys money through the foreign investment program, EB5 Capital has helped finance several developments in the NoMa-Union Market neighborhood in recent years.

It is currently pooling investors to help finance Eckington Park, a nearby multifamily project from Foulger-Pratt, and 300 M, a planned NoMa apartment building from Wilkes Co. EB5 Capital also helped finance The Highline at Union Market, a 318-unit project delivering this spring.

In March, EB5 Capital closed on a $44.5M deal for Douglas Development's 1900 Half St. SW, a redevelopment of a former Coast Guard building on Buzzard Point into 453 apartments with retail. In Capitol Hill, it is helping finance Foulger-Pratt's Beckert's Park project and CAS Riegler's 1401 Penn. Of the 26 projects EB5 Capital has financed, half of them have been in D.C.

"We're fortunate that it's an international city, a lot of our investors like it, but it's an undeveloped city that is still developing," EB5 Capital Senior Vice President Brian Ostar told Bisnow.

EB5 Capital is just one of a host of regional centers that funnel money from foreign investors into U.S. projects. The EB-5 program allows foreign individuals to obtain a visa to the U.S. if they invest $1M into the U.S., and the threshold is lowered to $500K if the money goes into selected areas local governments have targeted as needing employment growth.

The program continues to finance projects throughout the country, but the overall investment volume and number of new investors has fallen significantly over the last three years.

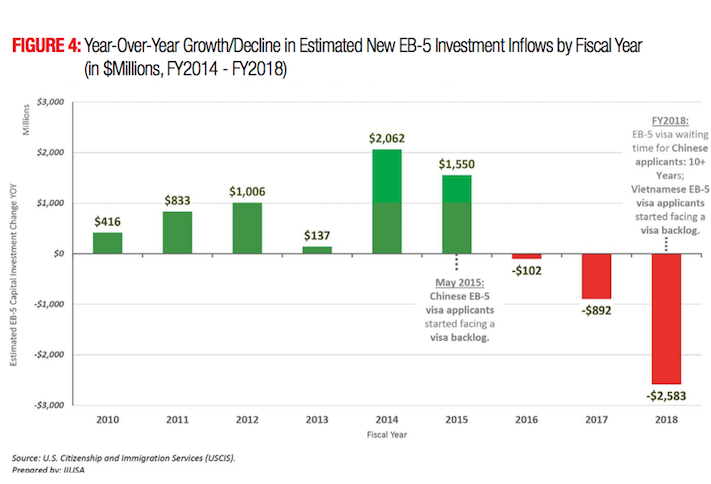

A graph from IIUSA's report showing year-over-year trends in EB-5 investment flow

The total volume of EB-5 investment into the U.S. grew every year from 2010 to 2015, but it declined significantly from 2016 to 2018, according to a report from IIUSA, a trade association for the EB-5 industry.

The IIUSA report estimates EB-5 investments made in the U.S. in fiscal year 2018 totaled $2.9B, down from $5.6B in FY2017. The number of new investors applying through the EB-5 program dropped 47% from FY2017 to FY2018, according to IIUSA, reaching its lowest level since 2013.

The drop comes primarily as a result of decreasing EB-5 investment from China, which has consistently contributed a majority of the program's funding. A growing backlog has forced Chinese investors to wait up to 15 years to receive their visas through the EB-5 program, IIUSA Policy Analyst Lee Li said.

"China, with strong demand for EB-5 visas, is very important to support a lot of projects," Li said. "The longer they may have to wait for their visa, this is one of the factors that prohibits them from making decisions to invest in EB-5."

A rendering of Douglas Development's 1900 Half St. SW project

Another factor slowing the investment flow is the uncertainty over the program's future. Congress has passed a series of short-term extensions of the program in recent years, but advocacy groups like IIUSA are pushing for a long-term reauthorization that can restore certainty to the marketplace.

The U.S. Office of Management and Budget is working to revise the regulations governing the EB-5 program, and some industry experts fear the changes could put the program's future in jeopardy. The program has faced high-profile challenges in recent years such as lawsuits and fraud scandals, and some members of Congress have criticized the program.

IIUSA Executive Director Aaron Grau said the organization is working with the Real Estate Roundtable, the U.S. Chamber of Commerce and other groups to lobby Congress to give the program long-term reauthorization.

"With everybody singing from the same song sheet, it really sends a clear message to Congress that there's not going to be any political blowback, at least from the industry, with regard to a decision [being] made," Grau said. "It gives us a strong leg up for a real chance at long-term authorization."

The decreasing volume of EB-5 investment forces regional centers to compete for their share of a shrinking market. Li said some regional centers like EB5 Capital have diversified to receive investment from non-Chinese countries that are growing their EB-5 contributions, but some have been hurt by the market's decline.

"Projects are able to get investments, but it becomes more and more difficult, and it's more and more hypercompetitive for the market," Li said. "For EB5 Capital and a few regional centers that have been diversifying portfolios, maybe it's better for those regional centers to mitigate the impact of China because they have footprints in other markets. But for a lot of regional centers, it would not be so easy."

A rendering of Foulger-Pratt's Eckington Park project

EB5 Capital has investors from 59 countries, Ostar said, and its biggest markets today are India, Vietnam, South Korea and Russia. IIUSA found that investor filings from India, Vietnam and South Korea increased in FY 2017 by 66%, 30% and 38%, respectively.

"Not many Chinese are doing it right now, which positioned us well because we were always global, so we haven't been too hurt from that," Ostar said.

The diversification has allowed EB5 Capital to continue to move new real estate deals forward. It typically structures its financing as mezzanine debt, coming in after a senior loan from a bank.

Developers say EB-5 money is more attractive than most sources of mezzanine debt. Foulger-Pratt Managing Director Michael Abrams said the EB-5 financing allows developers to realize greater returns at a time when macro trends like rising construction costs and land prices are working against them.

"The higher leverage is just a more efficient use of our capital, and it just shrinks the equity component to a more manageable level," Abrams said. "It boosts returns by probably 200 to 300 basis points, and as deals get tighter, that certainly is attractive."

Mentions

States

- District Of Columbia

Videos

Subscribe for News

Site Digest

Join Professionals on EB5Projects.com →

Securities Disclaimer

This website is for informational purposes only and does not constitute an offer or solicitation to sell shares or securities. Any such offer or solicitation will be made only by means of an investment's confidential Offering Memorandum and in accordance with the terms of all applicable securities and other laws. This website does not constitute or form part of, and should not be construed as, any offer for sale or subscription of, or any invitation to offer to buy or subscribe for, any securities, nor should it or any part of it form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. EB5Projects.com LLC and its affiliates expressly disclaim any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in the website, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting therefrom.