China’s Louisiana Purchase: New Orleans’ own Battle of Algiers

Despite pending litigation, New Orleans is continuing bid for EB-5 investments to develop city 10 years after Katrina

This article is the final installment of a three-part series on China’s role in redeveloping southern Louisiana called China’s Louisiana Purchase. The first part investigated links between Chinese government officials, Chinese gas giant Shandong Yuhuang and Gov. Bobby Jindal. The second part explored allegations of environmental racism by the predominantly black community where the plant will be built.

A New Orleans government–contracted company stands accused of stealing millions of dollars from foreigners who sought citizenship through the U.S. investor immigrant — or EB-5 — system by investing in a cluster of would-be businesses in an underserved black community, still devastated by Hurricane Katrina. But even with litigation pending in that case, municipal authorities are continuing to seek EB-5 investments.

Under the EB-5 system, individuals from overseas — a vast majority of applicants hail from China — have a shot at a green card if they invest at least $1 million (or $500,000 in targeted areas of higher unemployment) in a project that will create at least 10 American jobs for a minimum of two years. The investment, by law, must be at-risk — meaning they may not be insured. Allegations of fraud lodged against regional centers, which are private entities accredited by U.S. Citizenship and Immigration Services, across the United States are rampant, as evidenced by the Securities and Exchange Commission website, which in recent months issued a blanket warning against EB-5 fraud.

About a year after Katrina, in October 2006, then–New Orleans Mayor Ray Nagin signed a 30-year exclusive contract with NobleOutreach-NOLA LLC, a regional center that connects EB-5 visa seekers with projects. New Orleans appears to be the only city government in the U.S. with a company contracted to welcome EB-5 investments, according to Yiminchaoshi, a Chinese-language website for EB-5 investors.

NobleOutreach told investors it would use their money to build a hotel, conference center and restaurant in a high-poverty, high-crime neighborhood of Algiers, situated just across the Mississippi from the glittering French Quarter. What was slated to revive the local economy remains a blighted lot — a common sight here and in the Lower 9th Ward. And now a lawsuit in state court charges that NobleOutreach and its leadership established a complex network of companies designed to extort $15.5 million from 27 international investors, most of them from China.

‘Humanitarian investment’

A promotional video still featured on the New Orleans NobleOutreach website lauding the Algiers projects that never were describes such investments as having a strong humanitarian component. “Community rebuilding — the community of New Orleans that had significant devastation and dramatic economic impacts as a result of Hurricanes Katrina, Gustav and others,” says William “Bart” Hungerford, a Maryland businessman and NobleOutreach’s president, in the video. “This program is a program that is amazingly a win for everyone involved.”

Current New Orleans Mayor Mitchell J. Landrieu is featured prominently in the video, with Hungerford and NobleOutreach Executive Vice President Timothy O. Milbrath at a ceremony at the Algiers hotel site.

“We believed it to be a humanitarian investment with sound financial returns, together with an accelerated route to citizenship,” one of the former investors told Al Jazeera, on the condition of anonymity so as not to affect their litigation and continuing bids for U.S. citizenship.

What followed, according to court filings from the plaintiffs obtained by Al Jazeera, is that Hungerford and Milbrath directed $6 million from the investors’ fund into Bay-NOLA-Management, a consulting company based in Maryland. An additional $1.8 million went to high salaries for Hungerford, Milbrath and their wives “for which they provide little to no services,” the court filings allege. More cash was funneled into some 30 enterprises that are owned by Hungerford and Milbrath and are listed as defendants in the litigation, the filings say.

The fund bought into three PJ’s Coffees in upscale areas, a cocktail bar and eatery called Maurepas Foods and Rita’s Tequila House on touristy Bourbon Street, which created jobs in New Orleans. But in 2011 investors received a letter saying that according to Citizenship and Immigration Services regulations, only jobs created at the Algiers hotel — which has not been realized — would count toward the investors’ EB-5 status.

The investors filed a complaint in federal court in March 2012, saying Hungerford, Milbrath, their wives and associated enterprises created a complex network of companies that did not invest the cash in the proposed project, which would have resulted in green cards. In July 2014 judges determined that the case did not merit a federal trial. Attorneys for the plaintiffs confirmed that they have filed a new case in state court.

“The setback of the first lawsuit has left a bitter taste to all the Chinese investors,” a plaintiff said. Although they see this as an issue involving federal immigration law, the plaintiffs still “hope to prove our claims, recover our losses and resume our path to getting a green card” in Louisiana court.

The legal proceedings don’t appear to have dissuaded New Orleans’ government from seeking EB-5 investors.

On Oct. 1, 2014, the administration of New Orleans Mayor Mitchell Landrieu published a call for proposals to redevelop the site of the former World Trade Center at 2 Canal Street in the heart of the city’s business district.

“The property presents an exceptional real estate development opportunity offering potential historic tax credits and EB-5 eligibility at a time when the New Orleans real estate market, tourism industry and economy are experiencing robust growth,” the proposal reads.

It remained unclear whether the Landrieu administration was seeking EB-5 investments with the assistance of NobleOutreach, but corporate filings show that the exclusivity agreement signed under the previous administration appears to remain in effect.

The Landrieu administration did not respond to multiple requests for an interview. NobleOutreach, Hungerford, Milbrath and NobleOutreach’s legal council also did not respond to interview requests.

Lose-lose deal for Algiers?

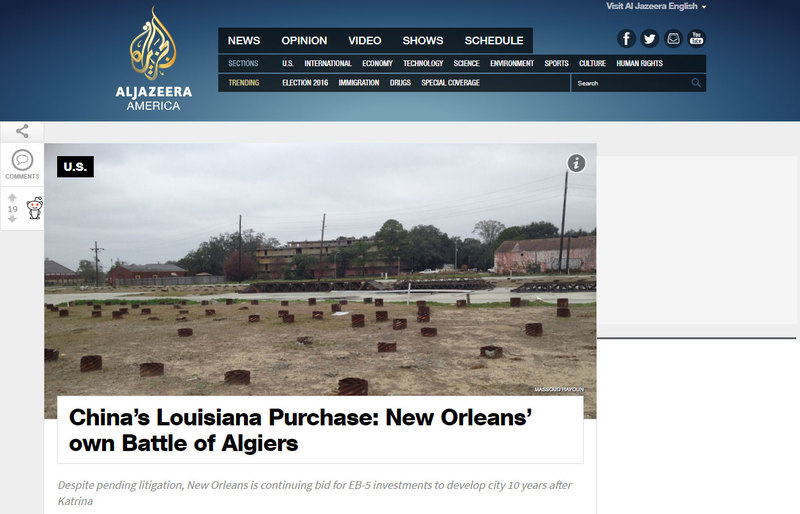

It’s fairly easy to find an empty, blighted lot in Algiers. But the empty lot at 3000 Gen. De Gaulle Drive appears to have become a flashpoint for local residents’ frustration with development authorities.

Five years after breaking ground, New Orleans’ signature snowy egrets harvest scraps and rodents amid rusty girders that would have been the foundations of a hotel, conference center and restaurant.

Almost immediately after the groundbreaking ceremony in 2010, said Tabitha Nelson, who works at an adjacent payday lending office, “They packed up and left. Isn’t that weird?”

“This is a black neighborhood,” said Nelson, who is black. “Residents were hoping for business.”

It’s not a conventional area for a hospitality project. There are few taxis on Gen. De Gaulle Drive, the main thoroughfare, and a trip to the French Quarter just across the river can take over an hour on the often unreliable RTA bus system.

The hotel would have been flanked by a gold-for-cash consignment store and the payday lender where Nelson works. She said that the location, combined with rampant theft and violence at night, would make for a “no good” New Orleans holiday experience.

Mentions

- NobleOutReach, LLC

- William B. Hungerford

- Timothy O. Milbrath

- U.S. Citizenship and Immigration Services

- UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Litigation Cases

States

- Maryland

Securities Disclaimer

This website is for informational purposes only and does not constitute an offer or solicitation to sell shares or securities. Any such offer or solicitation will be made only by means of an investment's confidential Offering Memorandum and in accordance with the terms of all applicable securities and other laws. This website does not constitute or form part of, and should not be construed as, any offer for sale or subscription of, or any invitation to offer to buy or subscribe for, any securities, nor should it or any part of it form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. EB5Projects.com LLC and its affiliates expressly disclaim any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in the website, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting therefrom.