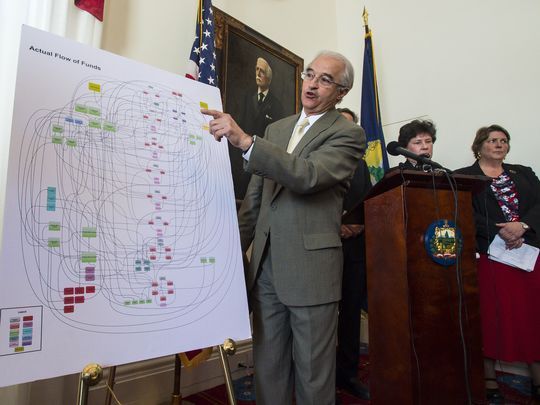

Michael Goldberg announces a settlement with the financial firm Raymond James which will pay contractors and investors owed money in the Jay Peak and Burke Mountain EB-5 projects at the Statehouse in Montpelier on Thursday, April 13, 2017. Goldberg is the federal receiver for Jay Peak and Burke Mountain.

One way or another, Vermont is closing its EB-5 Regional Center after 20 years, following one of the biggest fraud investigations in the federal program's history. Jay Peak partners Ariel Quiros and Bill Stenger are accused by the U.S. Securities and Exchange Commission and the state of misusing $200 million of foreign investors' money.

Both the state and U.S. Citizenship and Immigration Services, which oversees the EB-5 program, agree the Regional Center's days are numbered. Whether those days are few, or many, is up for debate.

This month U.S. Citizenship and Immigration Services told the state of its intent to terminate the state's regional center because it "failed to properly engage in management, monitoring and oversight for many years."

While announcing the federal government's move, Gov. Phil Scott said a recent state review concluded the Regional Center should wind down its work, "given the growth of privately-managed EB-5 regional centers across the country, and recognizing that operating a regional center is a function best performed by a private entity."

EB-5 projects overseen by the Vermont Regional Center have raised $532 million in capital, according to the recent state review of the program. The majority, $423 million, was related to Jay Peak projects. The Regional Center was formed in 1997.

If the federal government decides to shut the center down quickly, as many as 200 investors — some invested in projects not associated with the fraud allegations — could be left without a path to a permanent green card, the main reason most put up $500,000 each to participate in the EB-5 program.

Commissioner of the Department of Financial Regulation Michael Pieciak at the Statehouse in Montpelier on Thursday, January 5, 2017

Michael Pieciak, commissioner of Vermont's Department of Financial Regulation, said the investors who have not yet secured conditional green cards — the first step in the process — are spread among EB-5 projects at Jay Peak, Mount Snow and Trapp Family Lodge.

"If the Regional Center shut down tomorrow, those investors would lose the ability to get any immigration benefits," Pieciak said. "The projects would either have to refund them the money or the investors would have to leave their investments in place without any prospect of getting a green card."

Both options are bad, Pieciak says. Most of the projects have already "deployed the funds" from investors, meaning it would be a strain to refund the money, he said. As for leaving the investments in place, Pieciak believes that's "untenable" for the investors, because they probably made the investments only to get a green cards in the first place.

Pieciak and Michael Schirling, secretary of the Agency of Commerce and Community Development, have recommended to USCIS that it wind down the Regional Center over time, giving investors the chance to get their green cards. If USCIS decides against that course of action, Pieciak said the state is prepared to appeal.

Then-Attorney General William Sorrell speaks during a news conference in Montpelier on Thursday, April 14, 2016, after the Securities and Exchange Commission alleged that Ariel Quiros, owner of the Jay Peak resort and Bill Stenger, president and CEO of Jay Peak, misused more than $200 million of EB-5 immigrant investor funds. He is seen with a chart that purports to show how Stenger and Quiros allegedly diverted funds.

How long would it take to wind down the Regional Center the way the state wants to do it?

"It could take as long as 10 years," Secretary Schirling said. "That's largely in the hands of USCIS and how quickly they move once construction is completed."

Given the uncertainty surrounding the EB-5 program in Vermont, does the federal program and investment dollars it brings have a future in the state?

"That's the big question, isn't it?" said Win Smith, owner of Sugarbush Resort in Warren.

Smith used the EB-5 program to raise $20 million from 40 foreign investors to continue the modernization of Sugarbush, which began soon after Smith bought the resort with a group of local investors in 2001. In March 2013, Smith told the Burlington Free Press Sugarbush "would not have made it without the EB-5 program."

"We used it at a time right after the financial crisis, when traditional financing was not readily available," Smith said this week.

Sugarbush Resort owner Win Smith said Sugarbush needed the EB-5 program to survive in the wake of the 2008 financial crisis.

Smith believes that in the short term, it's going to be very difficult for projects associated with Vermont to use the EB-5 program.

"I've always thought it was a good program," Smith said. "When something like that happens it's going to take a while to heal, for credibility to come back."

Vermont traded heavily on that credibility. The Regional Center's website still touts the "Vermont Difference," with promises of state oversight and independent and qualified regulatory authority monitoring.

Most EB-5 regional centers are privately run.

Michael Gibson, a Miami-based EB-5 investment adviser, is a longtime critic of the Vermont Regional Center and Jay Peak, raising questions as far back as 2007 about the viability of the projects in the Northeast Kingdom, and the center's oversight.

Jay Peak resort summit.

Gibson says there were plenty of red flags the state should have picked up on at Jay Peak, including the fact that Bill Stenger was raising all of the funds needed for the projects through EB-5 investors.

"This massive expansion didn't seem economically viable," Gibson said. "They didn't have any funding, 100 percent had to come from EB-5 investors. That was a warning sign. If you can't get anyone in the state to fund expansion, that's all I need to know."

"It's finished for Vermont," Gibson added. "I do not foresee another EB-5 investment in Vermont being successfully funded again."

Pieciak told a group of lawmakers this week that it was a mistake for Vermont to get involved in the EB-5 program at all, given the lack of clarity in the federal program.

The rules governing the EB-5 program have become more clear over time, Pieciak said, "but they're sort of ever changing as well."

"Even that initial decision for the state to sort of take that on, was probably not the right decision," Pieciak said.

As for the future, Pieciak points out that Vermont is surrounded by dozens of private EB-5 regional centers in New Hampshire, Massachusetts and New York. He believes it's more likely than not that one of those centers will expand into Vermont.

Greg Vartanian is a director at the New England Regional Center for Economic Development, Inc., in Boston.

Vartanian said it's "too early to tell" if private centers such as his would expand into Vermont.He said he has spoken to a lot of people abroad who've done business with the Vermont Regional Center over the years, and that they were "shocked" by the news it would be closing.

"In a business based on trust, it's a hard pill to swallow," Vartanian said.

Mentions

- Vermont EB5 Regional Center

- Jay Peak - Q Burke Mountain Resort, Hotel and Conference Center L.P.

- UNITED STATES SECURITIES AND EXCHANGE COMMISSION

- U.S. Citizenship and Immigration Services

- Ariel Quiros

- Bill Stenger

- The AM Wealth Management Group of Raymond James

- Sugarbush Ski Resort

- Michael Gibson

- Greg Vartanian

- New England Regional Center for Economic Development Inc.

Litigation Cases

- State of Vermont vs Bill Stenger & Ariel Quiros

- UNITED STATES SECURITIES AND EXCHANGE COMMISSION vs Ariel Quiros & Bill Stenger

States

- Vermont

Videos

Subscribe for News

Site Digest

Join Professionals on EB5Projects.com →

Securities Disclaimer

This website is for informational purposes only and does not constitute an offer or solicitation to sell shares or securities. Any such offer or solicitation will be made only by means of an investment's confidential Offering Memorandum and in accordance with the terms of all applicable securities and other laws. This website does not constitute or form part of, and should not be construed as, any offer for sale or subscription of, or any invitation to offer to buy or subscribe for, any securities, nor should it or any part of it form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. EB5Projects.com LLC and its affiliates expressly disclaim any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in the website, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting therefrom.