The Wharf Development Team Seeks $800M Refinancing Deal

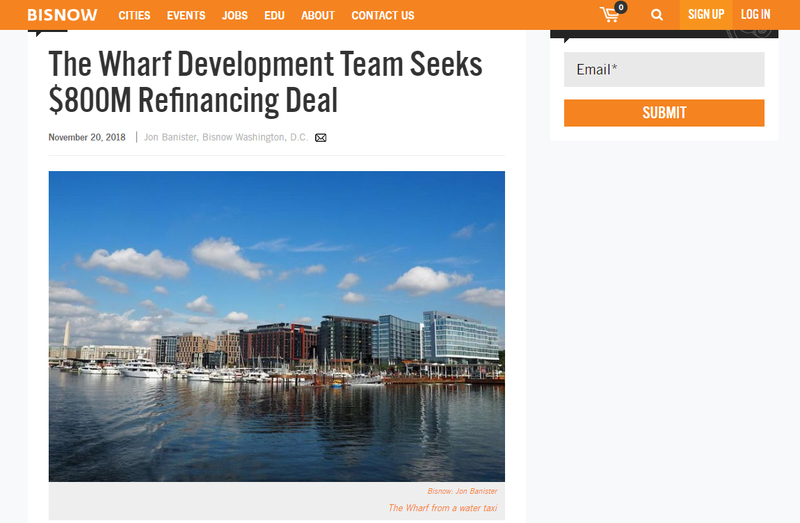

The 1.4M SF first phase of The Wharf delivered over one year ago, and now the developers behind the Southwest D.C. development are looking to refinance the project ahead of its next phase.

The development team of Madison Marquette and PN Hoffman, plus equity partner PSP Investments, retained Eastdil Secured to help it seek a five-year loan totaling up to $800M on the completed first phase, Commercial Mortgage Alert reports.

The loan would retire Phase 1's existing debt, which included a $400M financing package led by Wells Fargo, in which several other banks participated.

The first phase features three hotels, two office buildings, two apartment buildings, two condo buildings, a 6,000-person concert venue and dozens of restaurants and retailers. The condominium buildings will not be included in the refinancing package.

"We are pleased to be working with Eastdil Secured in arranging first mortgage financing for The Wharf, a landmark urban waterfront revival district in Washington, D.C., - financing that offers a truly generational investment opportunity," Madison Marquette Chairman Amer Hammour said in a statement provided to Bisnow.

"The Wharf has already created unparalleled value with an exceptional sense of place for residents, tenants, workers and visitors and enjoys a very high success and occupancy rate across all of its uses.

Madison Marquette is also seeking up to $760M to finance the project's second phase, CMA reports. The 1.2M SF Phase 2 would be built directly to the east of Phase 1 and would include three office buildings, two residential buildings and a hotel along the waterfront. The full development is expected to cost $2.5B.

Mentions

States

- Washington

Securities Disclaimer

This website is for informational purposes only and does not constitute an offer or solicitation to sell shares or securities. Any such offer or solicitation will be made only by means of an investment's confidential Offering Memorandum and in accordance with the terms of all applicable securities and other laws. This website does not constitute or form part of, and should not be construed as, any offer for sale or subscription of, or any invitation to offer to buy or subscribe for, any securities, nor should it or any part of it form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. EB5Projects.com LLC and its affiliates expressly disclaim any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in the website, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting therefrom.