Snowmaking Upgrades Considered For Burke Mountain

More Jobs Must Be Created For Investors In EB-5 Project

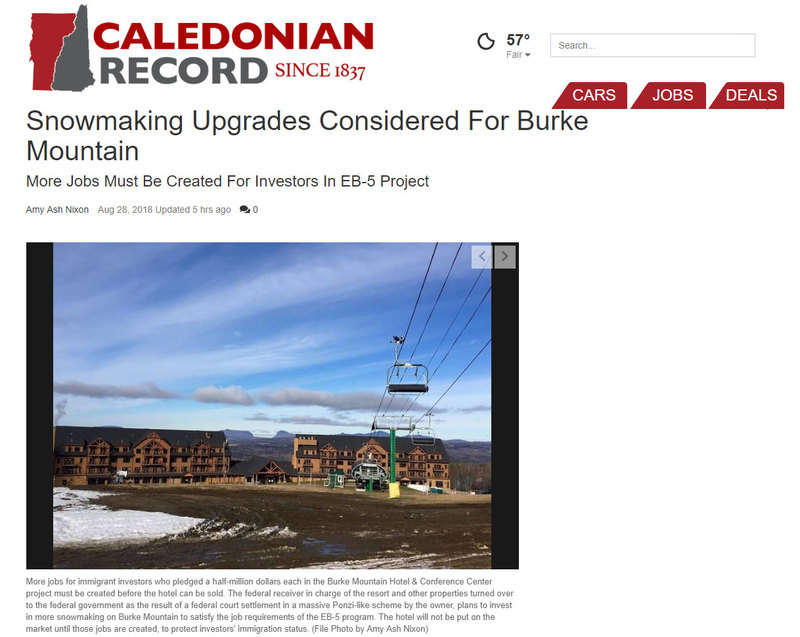

Burke Mountain may see its snowmaking equipment bolstered in a move planned by the federal receiver in charge of the resort.

Michael Goldberg – appointed the federal receiver of Burke Mountain, Jay Peak and other assets of businessman and former owner Ariel Quiros in April 2016 – said more jobs must be created for EB-5 investors in the Burke hotel project, and the snowmaking expansion would create construction jobs – and improve the economic prospects for Burke Mountain.

In an interview on Friday, Goldberg said to satisfy the EB-5 program job creation requirements for the Burke project, he needs to still create jobs for about 10 of the nearly 120 investors so that their permanent green cards, promised through the EB-5 investment in economic development projects in targeted regions, can be issued.

“We are exploring to create new jobs vastly improving the snow-making on the mountain,” said Goldberg. “It’s only in the exploration stage right now.”

Goldberg recently said the need to create more jobs associated with the Burke hotel construction project would mean that an earlier plan to try to sell the resort this year will now be on hold.

The snowmaking investment will not happen in time for this year’s ski season, said Goldberg.

Kevin Mack, general manager at Burke Mountain, said on Monday that future snowmaking plans “are not close to being finalized. Any investment in Burke Mountain, Michael’s been great about recognizing that beyond the hotel, the resort has a number of infrastructure improvements that long have been needed, and snowmaking is just one of them.”

“If Michael wants to look favorably on Burke, we appreciate that,” said Mack, who said the past two months have been the strongest for the hotel since it opened, “We’re hitting a lot of the benchmarks we set, and we’re very excited about that.”

The plans would “require a significant investment,” said Goldberg, who said the added capacity would position Burke with one of the strongest snow-making systems for a New England resort, giving it a competitive edge.

“It would involve increased capacity in the pond water storage, and would involve running new pipes along the mountain for infrastructure and a lot of improvements needed to make snow,” said Goldberg.

While plans for the project are early, Goldberg did say, “We are dealing with engineers and everything already, and are looking at funding sources and all that. We are probably a few months away from deciding.”

Goldberg said having a guarantee of snow cover for visitors to Burke Mountain will make the resort and its new hotel/conference center more economically viable.

“Just the fact that if people want to come to the mountain for a week, they want to know there’s going to be snow,” said Goldberg. “So this would help that people would be ensured that there is snow. It will help the hotel and the whole community of Burke,” he said of the hoped-for added snowmaking capacity at the mountain.

Goldberg said the resort and hotel being stronger is in the region’s best interest.

“When (Burke Mountain visitors) come to Burke to ski they go into town and spend money at the restaurants and they go into town to shop and they go to the gas station, as we do better, the whole town does better.”

The required number of jobs per investor – each investor pledged $500,000 each to the project – is ten jobs, said Goldberg, who said somewhere between 60 and 80 jobs need to be created to satisfy the immigration and EB-5 requirements.

“It’s not a ton, I need jobs for fewer than 10 investors of the 121 investors in the Burke project,” said Goldberg. Three of those original investors dropped out “not through anything to do with us,” so jobs must be created for 118 investors total now, he said Friday, “We have jobs for between 110 and 112,” of those 118 investors in the Burke project.

Goldberg said the work on the construction project and infrastructure will count toward those remaining needed jobs.

“It won’t happen this ski season, hopefully it will happen for the following ski season,” said Goldberg.

Goldberg said, “It’s a little unclear when Burke will be put on the market … Somewhere within the next couple of years.”

While Goldberg’s most recent update on the receivership entities’ finances, including Jay Peak Resort, show that Burke continues to lose money, he said in recent days, “Each month we’ve been setting a record on occupancy and economics, so the hotel is definitely improving month by month.”

In a recent nearly 200-page filing in U.S. District Court in Miami, Fla., where the federal case against Quiros brought by the federal Securities and Exchange Commission (SEC) is housed, Goldberg offered an extensive update on both ski resorts and the receivership overall.

Quiros has since that time settled with both the SEC and the State of Vermont’s attorney general, surrendering more than $80 million in real estate and bank accounts, including the two ski resorts in Vermont’s Northeast Kingdom which Goldberg will ultimately position for sale.

His former business partner, Bill Stenger, has also settled with state and federal authorities.

Of Burke continuing to lose money, Goldberg, in his recent update filed in federal court, stated, “This loss is not uncommon for a hotel that is not even two years old and is still building clientele. This summer has seen record bookings for the Burke Hotel and it is becoming apparent that the Burke Hotel is actually an all-season hotel.”

Goldberg writes, “The Receiver and his management company are optimistic that the Burke Hotel’s performance will continue to improve next year and can operate close to break-even, or even become profitable.”

Mentions

- Jay Peak - Q Burke Mountain Resort, Hotel and Conference Center L.P.

- Ariel Quiros

- Bill Stenger

- UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Litigation Cases

- MICHAEL I. GOLDBERG vs The AM Wealth Management Group of Raymond James & Ariel Quiros & Joel Burstein

- JAMES B. SHAW, JOHANNES EIJMBERTS, and LORNE MORRIS Individually and On Behalf of All Others Similarly Situated, vs The AM Wealth Management Group of Raymond James & Bill Stenger & Joel Burstein & Ariel Quiros

- ALEXANDRE DACCACHE, on behalf of himself and all others similarly situated vs Ariel Quiros & Bill Stenger & The AM Wealth Management Group of Raymond James & Joel Burstein

- State of Vermont vs Bill Stenger & Ariel Quiros

- UNITED STATES SECURITIES AND EXCHANGE COMMISSION vs Ariel Quiros & Bill Stenger

States

- Vermont

Securities Disclaimer

This website is for informational purposes only and does not constitute an offer or solicitation to sell shares or securities. Any such offer or solicitation will be made only by means of an investment's confidential Offering Memorandum and in accordance with the terms of all applicable securities and other laws. This website does not constitute or form part of, and should not be construed as, any offer for sale or subscription of, or any invitation to offer to buy or subscribe for, any securities, nor should it or any part of it form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. EB5Projects.com LLC and its affiliates expressly disclaim any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in the website, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting therefrom.