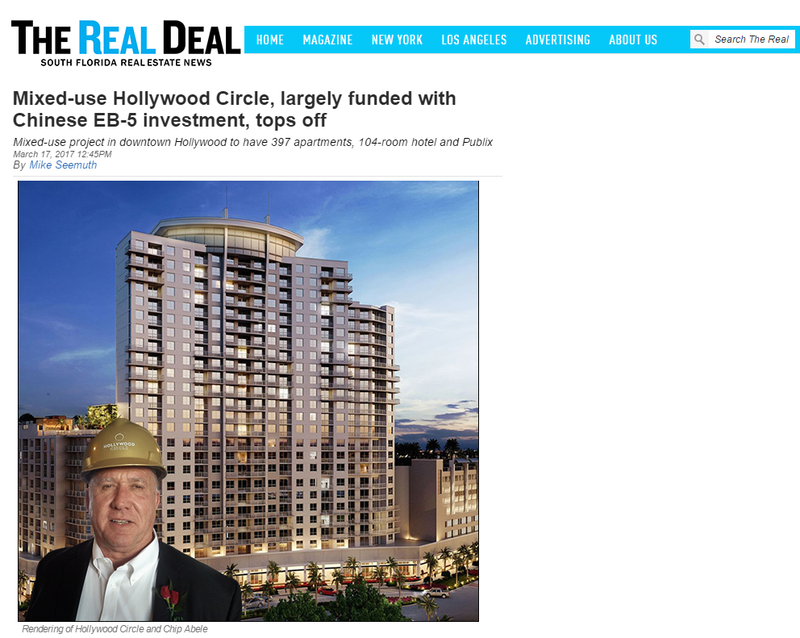

Mixed-use Hollywood Circle, largely funded with Chinese EB-5 investment, tops off

Years in the making, Hollywood Circle, a mixed-use project rising in downtown Hollywood that is largely funded by Chinese EB-5 investors, has topped off.

The 25-story building will have 397 rental apartments and a 104-room boutique hotel, plus a restaurant spanning nearly 10,000 square feet and a 46,744-square-foot Publix supermarket.

“We made a commitment to Publix to open their store the first week of November, and that is probably the absolute earliest we’d be able to get a CO (certificate of occupancy) for any part of the building,” lead developer Chip Abele told The Real Deal, at a topping-off party Thursday evening.

Mentions

States

- Florida

Securities Disclaimer

This website is for informational purposes only and does not constitute an offer or solicitation to sell shares or securities. Any such offer or solicitation will be made only by means of an investment's confidential Offering Memorandum and in accordance with the terms of all applicable securities and other laws. This website does not constitute or form part of, and should not be construed as, any offer for sale or subscription of, or any invitation to offer to buy or subscribe for, any securities, nor should it or any part of it form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. EB5Projects.com LLC and its affiliates expressly disclaim any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in the website, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting therefrom.