Related, which raised $600M for Hudson Yards project through visa program, tops list

If a program gave a developer $600 million in cheap financing, how much would the developer spend fighting for its right to exist?

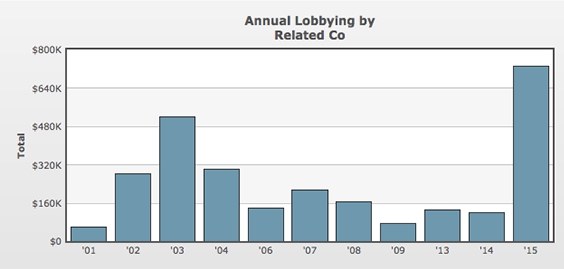

In 2015, the Related Companies spent at least $730,000 in lobbying fees related to the viability of the EB-5 visa program, according to data from OpenSecrets.org, a website that tracks lobbying expenses and campaign finance, created by the nonprofit Center for Responsive Politics.

EB-5 offers foreign investors a green card in exchange for a $500,000 minimum investment in the U.S. economy.

Developers adore it because it’s a relatively cheap source of financing. Some prominent politicians, however, have said that it upends the usual immigration process and is rife with fraud and abuses.

With the program up for renewal on Dec. 11, Related and other major players are shelling out big sums to ensure its continuity.

Related’s lobbying spend of $730,000, for example, is far more than the $120,000 it spent on lobbying in 2014. This year, the lion’s share of its fees – some $690,000 – went to law firm Greenberg Traurig, which has a robust EB-5 practice.

Still, that expenditure is a tiny fraction (0.12 percent) of what Related has raised in EB-5 funds for its Hudson Yards megaproject, about $600 million.

Laura Foote Reiff, a Greenberg Traurig attorney who is a founding member of the EB-5 Immigration Coalition, which supports reauthorizing EB-5, did not return a request for comment.

Related did not immediately respond to requests for comment. But CEO Jeff Blau has said the company is “working hard” to keep EB-5 alive. The developer also has an in-house EB-5 regional center that acts as a conduit for foreign investment.

“EB-5 has been a tremendous help for us because it allowed us to put in early infrastructure before construction,” Blau said last month at a conference hosted by NYU’s Schack Institute of Real Estate.

Joining Related in lobbying for EB-5 was CIM Group, which spent $480,000 in 2015, up from $280,000 in 2014, according to OpenSecrets. This year, the investment firm hired law firm Brownstein Hyatt Farber Schreck to monitor “EB-5 and related matters,” according to OpenSecrets.

When EB-5 comes up for a vote this month, lawmakers are expected to make significant changes to the program. One proposed change would remove New York City’s status as a TEA, or targeted employment area, a designation that allows a minimum investment of $500,000 instead of $1 million. Other proposed changes would raise the minimum investment amount in a TEA from $500,000 to $800,000.

“EB-5 has brought a tremendous amount of investment into New York City,” said Mona Shah, an immigration attorney who specializes in EB-5 cases. “The developers do not want New York City to be pushed out.”

Forest City Ratner spent a combined $140,000 on lobbying in 2014 and 2015, according to the database. More than 1,100 foreign investors pumped $577 million into Pacific Park Brooklyn, a joint venture between Forest City Ratner Cos. and Greenland USA.

Silverstein Properties shelled out $20,000 in EB-5 related lobbying fees, OpenSecrets data show. Like Related, the firm has an in-house EB-5 regional center, which raised $250 million from investors to finance its hotel and condo project at 30 Park Place. Silverstein is also looking to raise $500 million in EB-5 financing to fund the construction of 2 World Trade Center.

http://therealdeal.com/blog/2015/12/02/for-related-whats-730k-if-it-means-keeping-eb-5-alive/

Mentions

- Related Companies

- Gotham City Regional Center (Silverstein Properties Regional Center )

- Hudson Yards Manhattan Tower A-1 - A-8

- Atlantic Yards III / Pacific Park

- Greenberg Traurig, LLP

- Laura Reiff

- Mona Shah

States

- New York

Videos

Subscribe for News

Site Digest

Join Professionals on EB5Projects.com →

Securities Disclaimer

This website is for informational purposes only and does not constitute an offer or solicitation to sell shares or securities. Any such offer or solicitation will be made only by means of an investment's confidential Offering Memorandum and in accordance with the terms of all applicable securities and other laws. This website does not constitute or form part of, and should not be construed as, any offer for sale or subscription of, or any invitation to offer to buy or subscribe for, any securities, nor should it or any part of it form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. EB5Projects.com LLC and its affiliates expressly disclaim any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in the website, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting therefrom.