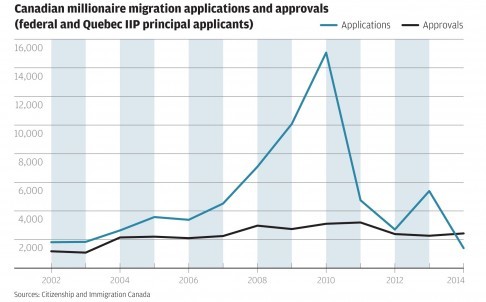

Larry Wang has helped thousands of rich Chinese get to Canada. He’s no fan of new immigration policies

For the first time in recent years, wealth migration applications to Canada fell below approvals in 2014. However, a backlog of Quebec Immigrant Investor Programme applications will likely help maintain approval levels for a few years. Figures shown here include only principal applicants, not dependents. Graphic: SCMP

Larry Wang has quietly helped shape modern Vancouver, though few in the city have probably heard of him - unless they used his services to get here.

As the president of one of China’s top immigration consultancies, Well Trend United, Wang has helped thousands of rich Chinese move to Canada. He says his company, which employs hundreds of consultants around China, has enjoyed two decades of success, having “risen to become one of the largest, most influential immigration consulting firms in China on the back of … Canadian immigration programmes”.

Larry Wang, president of Chinese immigration consultancy Well Trend United.But he’s not a huge fan of what he sees in those programmes lately.

Canada’s two largest wealth-migration vehicles were long the Federal and Quebec Immigrant Investor Programmes, which have brought about 200,000 rich newcomers since 1986. Most of them likely settled in greater Vancouver, and most have been Chinese.

But in 2012, the FIIP was frozen, then shut down last year, to be replaced by the Immigrant Investor Venture Capital pilot programme, a scheme which had only attracted six applications worldwide, as of June. The QIIP, meanwhile, last year introduced a tough set of documentation benchmarks, demanding minutiae of applicants’ sources of wealth and income, and applications are down 74 per cent.

In short, Chinese millionaire migration to Canada is in a state of flux.

“We knew from the get go that the IIVC would attract very little interest, in spite of the Canadian government's claim that it was a replacement for the FIIP,” Wang told me this week. “If the goal of the IIVC was to attract the same applicants for the FIIP, then it was a woefully misguided and ill-designed attempt. On the other hand, if the goal was to attract the only six people in the world who don't think the IIVC is a terrible programme, mission accomplished!”

Beijing-based Wang says the big problem with the IIVC, at least as a replacement vehicle for the once-popular FIIP, is a question of target audience.

“The Chinese investor applicants who applied for the FIIP and pre-revamp QIIP were typically well-established, already successful businesspeople in their late thirties or older, who achieved their success with neither English nor French language skills, not the younger, entrepreneurial start-up types for which the IIVC was presumably designed,” says Wang.

As for the QIIP, the new documentation rules, as well as a sense of uncertainty, are deterring some of Wang’s clients. “Putting in the time and effort to compile the documents is just the first step,” Wang says. “After a review of the documentation, an interview may be required. Further documentation may be requested. A further review by the federal government is the final stage before visa issuance. At any step along the way, and it is a long way, three years at least, it may be refused.”

[Incidentally, federal data show that 89 per cent of QIIP immigrants end up leaving the French-speaking province for elsewhere in Canada, but Wang says his firm encourages Quebec-bound clients to actually stay there and become part of Quebec society. “It simply makes good business sense for us to encourage this,” says Wang. “Otherwise the QIIP will be shut down.”]

Wang also sees increased competition for millionaire migrants “with the very popular American EB-5 programme and the increasingly popular European programmes coming on to the scene”.

This is not to say that China’s wealthy have turned away from Canada entirely; it remains a popular choice for what Wang calls “the traditional reasons” - quality of life and a good quality of education for their children.

“The interest is definitely still there but suitable programs are not,” says Wang. “If the IIVC is to be replaced by a suitable programme, if the QIIP relaxes their documentation requirements, if more PNPs [Provincial Nominee Programmes] re-open - there are many IFs here - then you will see the numbers return to Canada.”

Yet a pragmatic assessment means that risk has become a major concern, too, in the wake of Ottawa’s axing of the FIIP and subsequent dumping of more than 50,000 applicants and family members from the immigration queue. Most were Chinese. It was a decision that appalled Wang, whose firm helped organise opposition to the move.

Himself a Canadian citizen, who emigrated in the mid-1980s before returning to China to found his business a decade later, Wang sees the IIP’s ruthless termination and Ottawa’s treatment of his clients as a stain on Canada’s reputation, and one that carries racist overtones.

“This is the same country that imposed a head tax on Chinese immigrants and you can understand why many in China believe Canadian immigration policy is anti-Chinese,” says Wang. “Thus, Chinese applicants prefer an immigration programme that is stable and with a measure of guarantee. After all, human nature is averse to risk.”

Key dates in Canadian wealth migration

2010: Federal IIP applications halted in June amid huge backlog, reopened December with wealth and investment benchmarks doubled to C$1.6million and C$800,000 respectively.

2012: All federal IIP applications halted again. Quebec application window opens in March; the target of 2,700 applications is reached in less than a month.

2013: Quebec IIP application window opens for two weeks only, attracting 5,389 applications of which 1,750 are drawn by lottery for later processing. Federal IIP remains shuttered.

2014: Federal IIP is officially terminated in June with 50,000-plus backlogged applications scrapped. QIIP 2014 application window opens in September. Strict new financial documentation benchmarks imposed.

2015: QIIP 2014 window finally closes in March 2014, having received 1,400 applications, still well short of target of 1,750.

Mentions

Securities Disclaimer

This website is for informational purposes only and does not constitute an offer or solicitation to sell shares or securities. Any such offer or solicitation will be made only by means of an investment's confidential Offering Memorandum and in accordance with the terms of all applicable securities and other laws. This website does not constitute or form part of, and should not be construed as, any offer for sale or subscription of, or any invitation to offer to buy or subscribe for, any securities, nor should it or any part of it form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. EB5Projects.com LLC and its affiliates expressly disclaim any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in the website, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting therefrom.