Peak Resorts, Inc. (NASDAQ:SKIS), a leading owner and operator of high-quality, individually branded ski resorts in the U.S., today reported results for its first quarter ended July 31, 2016 of fiscal 2017.

First-Quarter 2017:

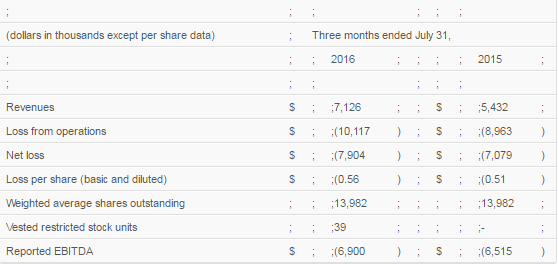

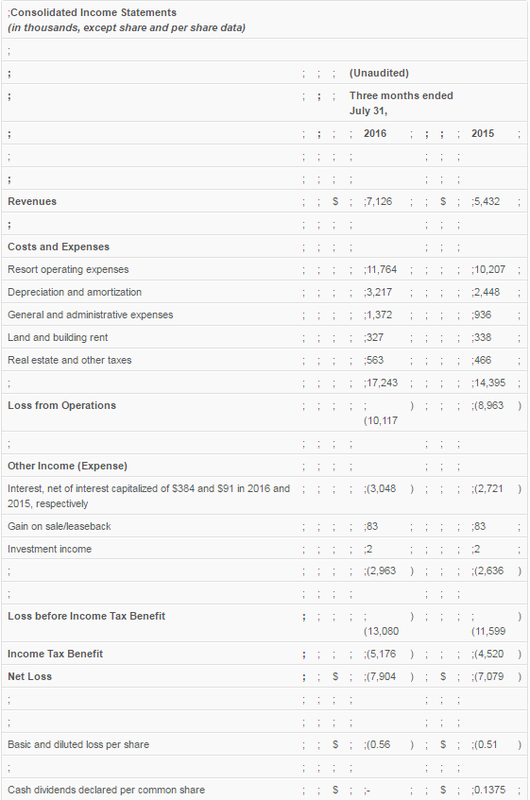

- Revenue was $7.1 million, up $1.7 million from the first quarter of fiscal 2016.

- Net loss was $7.9 million, or $0.56 per share.

- Reported EBITDA* was ($6.9) million.

- Resort operating expenses were up $1.6 million over the first quarter of fiscal 2016.

- The next deadline for 2016/2017 season pass sales occurs in mid-October; management expects season pass sales to continue to be strong, especially the new, multi-resort Peak Pass product.

Timothy ;D. Boyd, president and chief executive officer, commented, “During the first quarter, we made substantial progress in our strategic plan for the long-term, financial stability of Peak Resorts, which includes a purposeful effort to strengthen our balance sheet and capital structure. On August 22, we were pleased to announce our agreement with CAP 1 LLC (an affiliate of Summer Road) for a $20 million cumulative convertible preferred stock offering. We believe that, with the proceeds of this transaction, we will be on more solid financial footing and be well-positioned to grow the geographic footprint of our ski resort portfolio, as well as our overall market share in the regions that we serve.

Boyd added, “Summer is routinely our slowest season, and as the weather normalized over the past couple of months, our summer operations performed in line with expectations. Our various resorts hosted a robust schedule of events, including music festivals and art shows, as well as an array of family-friendly outdoor activities like zip-lines.

“We look forward to the upcoming ski season, which will include a full season with both Hunter Mountain and our new lodge at Mad River,” continued Boyd. “Further, we expect the sales of our season passes to continue to be strong during the remainder of the selling season through December.”

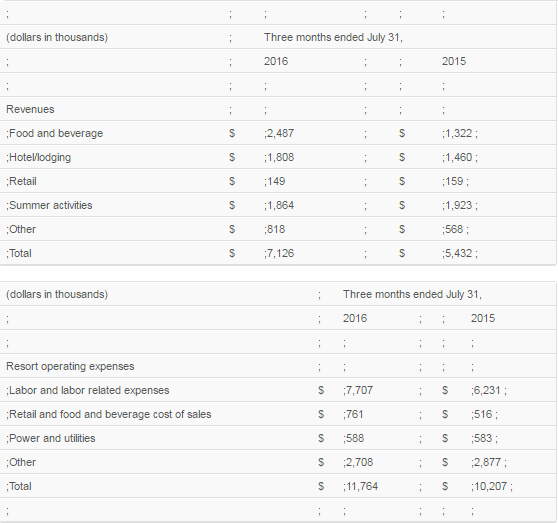

First-Quarter FY2017 Resort Operating Results

Stephen ;J. Mueller, Peak Resorts’ chief financial officer, noted, “Total revenue and operating expenses increased during the first quarter primarily driven by the impact of the Hunter Mountain acquisition.”

“We are looking forward to this upcoming ski season, with indicators like the positive response to our new Peak Pass product,” added Mueller. “We are also excited about the debut of our new base lodge at our Mad River property, which will stand at 46,000-square-feet, about twice the size of the previous building. The two-level structure will feature a more spacious upper loft area, with elevator access, a live-music stage, and a slope-side deck with views of the mountain, as well as seating for more than 300 skiers and snowboarders. Also, the dining area will contain more than 800 seats, almost double the available seating of the previous facility.”

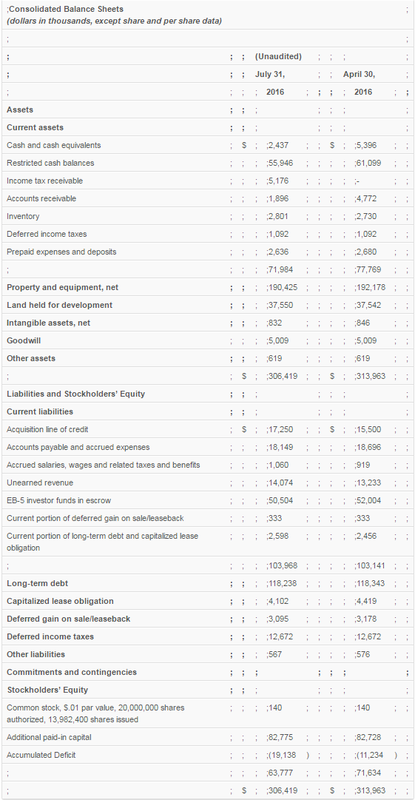

Financial Position

Mueller continued, “As we noted during our recent fourth-quarter conference call, we have been diligently exploring long-term sources of financing to fund our future working capital needs.

“As such, we were glad to announce our agreement with CAP 1 ; LLC (an affiliate of Summer Road) for the preferred stock offering,” stated Mueller. “This investment is expected to provide us with increased financial flexibility, as well as ensure that we are well-positioned to execute on our strategy to grow our company, both organically and through strategic acquisition.”

The transaction is expected to be completed in early November, subject to the approval of the company’s shareholders and fulfillment of certain conditions.

Mueller continued, “In order to meet our current liquidity needs, the Company borrowed additional funds from its existing lenders. During the quarter, we borrowed an additional $1.75 million, and subsequent to the quarter, we pulled the remaining $2.75 million of the $20 million line of credit with Royal Banks of Missouri for working capital purposes. In addition, we have also, subsequent to the quarter, borrowed $4.0 million from the $5.5 million currently available under our new bridge loan with EPR, one of our primary lenders. These short term borrowings will help to ensure that we have the liquidity necessary to manage through our slower season until the 2016/2017 ski season begins.” ;

Boyd concluded, “We remain committed to providing value for our shareholders. However, as we’ve discussed previously, our Board continues to believe that it is not prudent to consider the issuance of a dividend while the EB-5 funds remain in escrow.”

Richard K. Deutsch, vice president, business and real estate development, and president of Mt. Snow, Ltd., added, “Although the United States Citizenship and Immigration Services (USCIS) approved our EB-5 program this past May, we are still waiting for the first Petition to be approved. As we’ve noted, the escrowed funds will be released once the first Petition is approved; however, we still have no direct insight into the government’s approval timeline during this final stage of the process.”

Quarterly Investor Call and Webcast

Peak Resorts will hold its first-quarter investor conference call/webcast on Thursday, September 8, 2016, at 11 a.m. ET.

A replay will be available on the Peak Resorts investor relations website (ir.peakresorts.com) after the call concludes.

Definitions of Non-GAAP Financial Measures

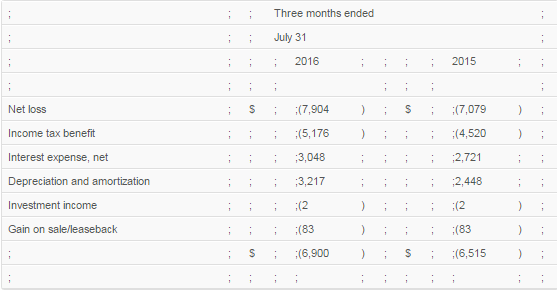

Reported EBITDA is not a measure of financial performance under U.S. generally accepted accounting principles (“GAAP”). The company defines reported EBITDA as net income before interest, income taxes, depreciation and amortization, gain on sale/leaseback, investment income, other income or expense and other non-recurring items. The following table includes a reconciliation of reported EBITDA to the GAAP related measure of net loss:

We have chosen to specifically include reported EBITDA as a measurement of our results of operations because we consider this measurement to be a significant indication of our financial performance and available capital resources. Because of large depreciation and other charges relating to our ski resorts, it is difficult for management to fully and accurately evaluate our financial results and available capital resources using net income. Management believes that by providing investors with reported EBITDA, investors will have a clearer understanding of our financial performance and cash flow because reported EBITDA: (i) is widely used in the ski industry to measure a company’s operating performance without regard to items excluded from the calculation of such measure, which can vary by company primarily based upon the structure or existence of their financing; (ii) helps investors to more meaningfully evaluate and compare the results of our operations from period to period by removing the effect of our capital structure and asset base from our operating structure; and (iii) is used by our management for various purposes, including as a measure of performance of our operating entities and as a basis for planning.

Reported EBITDA is not a measure of performance defined by GAAP. Items excluded from reported EBITDA are significant components in understanding and assessing financial performance or liquidity. Reported EBITDA should not be considered in isolation or as alternative to, or substitute for, the GAAP related measure of net income, net change in cash and cash equivalents or other financial statement data presented in the consolidated financial statements as indicators of financial performance or liquidity. Because reported EBITDA is not a measurement determined in accordance with GAAP and is susceptible to varying calculations, reported EBITDA as presented may not be comparable to other similarly titled measures of other companies.

Forward Looking Statements

This news release contains forward-looking statements including statements regarding the future outlook and performance of Peak Resorts, Inc., and other statements based on current management expectations, estimates and projections. These statements are subject to a variety of risks and uncertainties, are not guarantees and are inherently subject to various risks and uncertainties that could cause actual results to differ materially from the forward-looking statements. These risks and uncertainties include, without limitation, those discussed under the caption “Risk Factors” in the company’s Annual Report on Form 10-K for the year ended April 30, 2016, filed with the Securities and Exchange Commission, and as updated from time to time in the company’s filings with the SEC. ; The forward-looking statements included in this news release are only made as of the date of this release, and Peak Resorts disclaims any obligation to publicly update any forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

http://forextv.com/top-news/peak-resorts-reports-results-for-first-quarter-fy2017/

Mentions

- Peak Resorts Inc.

- U.S. Citizenship and Immigration Services

- UNITED STATES SECURITIES AND EXCHANGE COMMISSION

- Mount Snow

States

- Missouri

Videos

Subscribe for News

Site Digest

Join Professionals on EB5Projects.com →

Securities Disclaimer

This website is for informational purposes only and does not constitute an offer or solicitation to sell shares or securities. Any such offer or solicitation will be made only by means of an investment's confidential Offering Memorandum and in accordance with the terms of all applicable securities and other laws. This website does not constitute or form part of, and should not be construed as, any offer for sale or subscription of, or any invitation to offer to buy or subscribe for, any securities, nor should it or any part of it form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. EB5Projects.com LLC and its affiliates expressly disclaim any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in the website, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting therefrom.