City Council Unanimously Approves Sale of Location Formerly Occupied by Jergins Trust Building

The Long Beach City Council unanimously approved a deal that will enter it into a transient occupancy tax agreement with American Life Inc. for the purchase and development of the parcel of land that previously held the Jergins Trust Building.

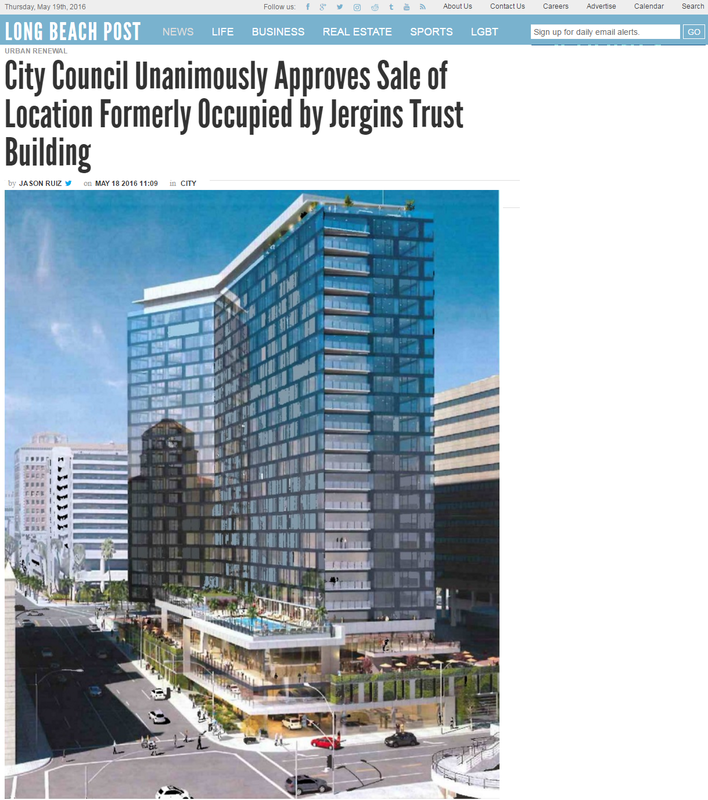

The vote makes way for the proposed 25-story, 427-room hotel development by American that seeks to activate a corner of one of the city’s busiest strips of commerce that has lain dormant for nearly three decades. The location, situated at the southeast corner of the intersection of Pine Avenue and Ocean Boulevard, currently holds “The Loop” attraction, but City Manager Pat West said the location has the potential for much more value.

After taxation and disbursement throughout the county, the $7 million dollar sale is expected to net the city about $1.2 million, which is expected to be reflected in the 2018 fiscal year budget, of which 75 percent will go toward the downtown project area and remainder used for citywide projects.

“This is perhaps one of the more prime pieces of property in the entire city of Long Beach at Pine and Ocean,” West said. “It’s really a critical piece and we have the opportunity to see a great development there.”

The property has been vacant since the Jergins Trust Building was demolished in 1988 and the city has made many attempts, like the Loop, to keep it activated, as it is part of the hub of Downtown Long Beach. It was listed for a request for proposal in July 2015 and the proposal by American was one of three received by the city in November of last year.

Mayor Robert Garcia noted the city's multiple efforts to keep the corner from falling subject to blight by installing murals and attractions like the Loop to keep it activated, but he said the development of a 25-story luxury hotel that will connect the convention center to upper-Pine has him excited for the project to be completed. Construction of the proposed hotel is expected to be completed by fall 2019.

“This lot has been [inactivated] and empty for almost 30 years now and not creating jobs, not creating convention business, not creating development for tourism and certainly has been a little bit of an eyesore over the years,” Garcia said. “I think the end product is what I think is a striking hotel project, and if you talk to any of the convention folks, they'll share with you that this is going to be incredible for convention business and the economy.”

The agreement to share the transient occupancy tax will cost the city about $27 million over the course of the 20-year agreement as it shares the roughly $5.4 million in annual revenue with the developer. That figure will not include the three percent tax earmarked for the Long Beach Tourism Business Improvement Area. Long Beach will receive 100 percent of the TOT after the 20-year agreement expires.

A staff memo pointed out that the developer has a similar project across the street from LA Live and that agreement stipulated a 100 percent share of the TOT for the City of Los Angeles, stating that splitting the revenue made the development of the Jergins site essential and mutually beneficial for the involved parties.

Director of Economic and Property Development Mike Conway noted that while the city stands to lose some revenue during the 20-year period, it’s currently receiving zero revenue as the property stands undeveloped.

“It is important to understand that the property currently generates no revenue for the city, so sharing new revenue appears to be a fiscally prudent choice,” Conway said.

The project will include up to 427 rooms, 8,000 square feet of restaurant space and 28,000 square feet of guest amenities that will include a pool and a sundeck. Because of the topography of Pine Avenue, 20 of the proposed 25 stories will exist above the elevation of Ocean Boulevard, with the remaining five stories existing above the Seaside Way elevation.

Fifty percent of the funding for the project is expected to come from equity raised by the federal EB-5 Investor Program which allows foreign investors to apply for a green card after making contributions to United States developments. The 25-year old program has been under scrutiny from congress because some see it as a way for wealthy foreigners to buy their way into citizenship.

Earlier this week it was announced that the newest Major League Soccer (MLS) franchise in Orlando would utilize the EB-5 program to help finance the construction of a new stadium at a price of $500,000 per investor, a first for an American professional sports franchise. The investment minimum for the EB-5 investors contributing to the new hotel project in Long Beach was not immediately known.

In the language of the agreement, the city retains a unilateral termination right to cancel the project if it’s not happy with the selection of the hotel chain picked to take up residence at the project site. However, if the developer secures a 4-star hotel for the site, the city will relinquish that right. The city has 120 days from the opening of escrow to pull the plug on the agreement if a 4-star hotel is not secured for the site or if the chain selected is not to its liking.

According to analysis by city staff, based on economic figures of competitive hotels already existing in the city, a similar or better hotel that is constructed at the project site could expect a revenue per available room of up to $203 dollars per room by 2023 if the project exceeds the market average of 80 percent occupancy by that year. Currently the project site has attracted the interest of several 3-star hotel brands including Starwood, Radisson, Hilton and Marriot.

The RFP also required a redevelopment of Victory Park, restoring public access to the Jergins Tunnel, a project labor agreement related to construction and a card-check agreement that could allow the hotel employees to unionize. It’s estimated that the project will create about 1,700 short term jobs related to the construction of the project and about 360 long-term jobs once the hotel is up and operational.

“I think that it’s important to take pause and say how many thousands of jobs are going to be generated and what this looks like to the economic fabric of downtown Long Beach and for our city as a whole,” said Fifth District Councilwoman Stacy Mungo. “Many of our residents, no matter where they live, commute downtown to go to work and these are going to be not only construction jobs, but once these hotels are built, they will be long term jobs.”

Whether or not those jobs will be union jobs was the subject of concern from many members of the public who commented prior to the vote last night. While the agreement with the city required a “card-check” agreement—a method for employees to determine by a majority sign-up process whether the jobs will be union—it does not outright require that the hotel chain employees be unionized.

They pressed the council to require that a labor agreement be in place before the motion was approved to make sure that the permanent jobs that are created are quality jobs that protect those employees that end up working in the hotel.

“This new hotel development—I’ve been very proud of the labor standards in Long Beach for the most part—and this new hotel development should uphold the city’s standard for projects with community benefits especially if we’re going to negotiate a tax subsidy,” said Third District resident Naida Tushnet. “I urge the city council at this time to vote for this agreement only if a labor piece agreement is in place.”

Jose Soto who works at the Hyatt in Downtown added that it’s important to “do things right the first time” because if an agreement isn’t in place before the hotel is completed, it can make it very difficult for employees to seek union protection after the fact. Soto outlining things like tips and wages can also help limit opportunities for employers to commit wage theft down the road and could also lead to better worker retention rates.

“A lot of people think that the turnover in hotels is due to something very minimal but it’s actually due to workloads being excessive and companies exploiting the workers,” Soto said. “All these labor disputes can be mitigated earlier if you do it right the first time. We need benefits to keep LBC standards high.”

Conway said that he's been advised by the developer that "a card-check agreement generally almost 100 percent of the time results in a unionized hotel."

As has been the case with other recent development plans in the city, the development of the Jergins Trust site will be the subject of litigation from local advocates.

Warren Blesofsky, president of Citizens Against Downtown Long Beach Giveaways, a group formed this year over concerns of the sales of redevelopment properties in the city, announced that his group had filed a lawsuit yesterday at Stanley Mosk Courthouse in Los Angeles to block the sale to American. He questioned the RFP process as a whole and named exemptions from the environmental review process as the ground for which the lawsuit was filed.

“The basis of this suit is the improper process of how the city has been selling property, especially the environmental review waiver,” Blesofsky said. “Your class-one and class-eight waivers do not suit this project at all. Class-one waivers say that no developments will be done, how can you use a class-one waiver when you’ve got an empty lot? Class-eight waiver is specifically for legislative items and is accepted for any construction process. Your one page exemption fro CEQA (California Environmental Quality Act) is not valid and that’s what we’re suing you against. ”

Mentions

States

- Washington

Securities Disclaimer

This website is for informational purposes only and does not constitute an offer or solicitation to sell shares or securities. Any such offer or solicitation will be made only by means of an investment's confidential Offering Memorandum and in accordance with the terms of all applicable securities and other laws. This website does not constitute or form part of, and should not be construed as, any offer for sale or subscription of, or any invitation to offer to buy or subscribe for, any securities, nor should it or any part of it form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. EB5Projects.com LLC and its affiliates expressly disclaim any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in the website, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting therefrom.