- Funding Needed

- $1 (Mio)

- EB5 Funding

- $1 (Mio)

- EB-5 Investors

- 2

- Investment Amount

- $500,000

- Subscription Fee

- 25,000

- Discount Fee

- 25,000

- Job Creation per Investor

- 16.0

- Job Creation (Total)

- 32 Full time direct jobs

- Category

- Accommodation and Food Services

- Sub-Category

- Chain Full-Service Restaurants

- Structure

- Equity

- Amount of EB-5 investors anticipated for this phase?

- 2

- Expected Maturity

- 5 years

- Expected Return

- 2% net of all fees and expenses

- Principal equity in project?

- Yes

- Does this project have approved I-526's?

- No

- Does this Regional Center have approved I-526's?

- No

- Does this Regional Center have approved I-829's?

- No

- State

- New York

- Location

- 60 West 22nd Street, New York, NY 10012

- Last Update: February 05, 2021 11:18 AM

Funding

Jobs

Investment

Immigration

Location

Your Project was viewed 878 times (totally).

For the last 7 days 0 times.

By CHLOE: 60 West 22nd

- Developer Name

- ESquared Hospitality

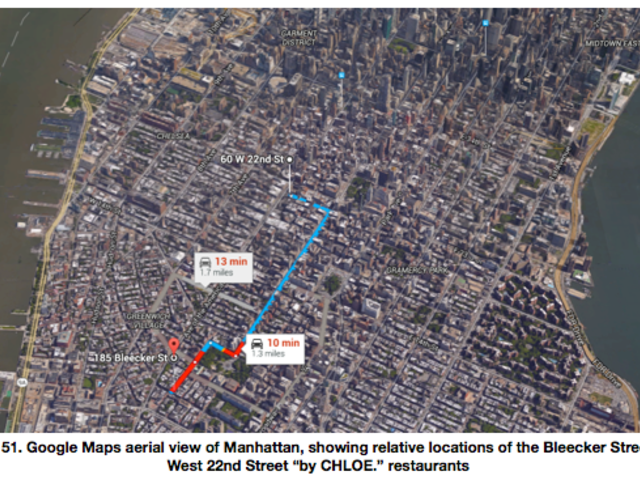

Project Description

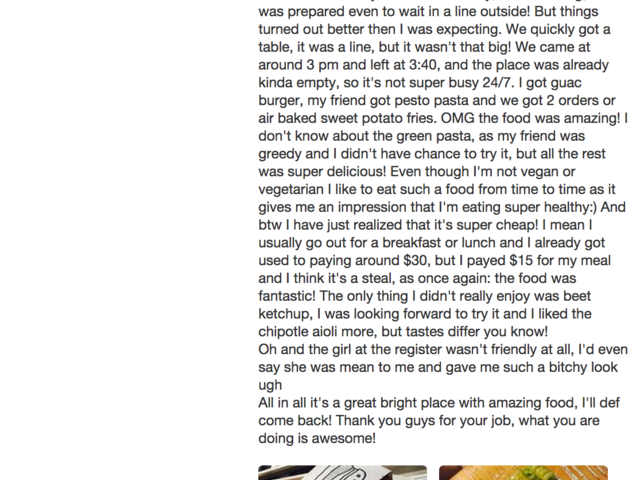

At by CHLOE., the menu is 100% plant-based using seasonal, locally-sourced ingredients whenever possible in their most natural form to create exciting, inspired and craveable dishes without compromising flavor, taste or satisfaction.

Our commitment is to bring the highest standards of freshness and quality to each meal that is served. Our menu is free of all meat, dairy and egg products in addition to any preservatives, GMO’s, saturated fats and cholesterol. We support a sustainable and vegan lifestyle, while actively contributing towards lowering our carbon footprint and preserving our planet’s water supply through our animal-free menu, mindful ingredient sourcing, and eco-friendly packaging.

by CHLOE. offers an all day menu and weekend brunch including Salads, Burgers + Sandwiches, Pastas, Fries + Sides, Sweets, Juices, Ice Cream and Grab & Go selections. All items on our menu are house-made. We only use fresh (never frozen) seasonal vegetables and herbs with ancient grains to make meat free alternatives to American classics such as burgers, creamy soups, French fries, ice creams, fresh-baked sweets and more.

In the Summer of 2015, by CHLOE. opened its flagship location in New York City’s West Village to both customer and critical-acclaim. Based on the current success of our flagship location, we are confident that by CHLOE. represents an opportunity to fill a corner of the healthy fast-casual marketplace that is on the brink of mass expanded growth. We are poised to position the full weight of the ESquared Hospitality organization to ensure its success and fulfill our goal of becoming a nationwide brand. It has operated at capacity since opening and currently averages over $100,000 per week in total sales. The restaurant has won rave reviews on traditional and social media.

The planned Restaurant in Manhattan’s Flatiron district will be the second to carry the by CHLOE brand and concept. It will replicate the menu, décor, and marketing that have made the Bleecker location successful, and will serve a neighborhood with similar demographic characteristics. The restaurant guide Zagat identifies by CHLOE’s veggie burgers among “NYC’s 8 Hottest Food Trends of 2015” and lists “by CHLOE” Flatiron as one of “NYC’s Most Anticipated Restaurant Openings of 2016.”

Project Timeline

We received building permits on February 19, 2016 from the NYC Department of Building and construction has commenced. The restaurant will have it's grand opening on May 23, 2016.

Conversations

EB-5 Investor

Information on Project 737

Mrs

Attorney

Reports

By CHLOE: 60 West 22nd: Contact Information

- Contact Person

- David Selinger

- Address (contact)

- 950 Third Avenue, 22nd Floor New York, N.Y. 10022

- Phone

- (212) 329-2680

- david@bychefchloe.com

- Web Site

- bychefchloe.com

Project Management

| First Name | Last Name | Title |

|---|---|---|

| David | Selinger | SVP |

By CHLOE: 60 West 22nd: Investments

- Reg. D?

- Yes

- Rule 506

- 506 (c)

- Reg. S?

- No

- Investment type

- Equity

- Total amount of estimated funding required for all phases of development(in Millions)?

- $1,350,000

- Number of planned phases (projects) in development?

- 1

- Expected time to complete this project or phase of overall development?

- less than 3 months

- Is this a new commercial enterprise or purchase of an existing troubled business?

- New commercial enterprise

- What ratio of equity to debt would best classify the source of overall funding for the project / development?

- 100% equity : 0% debt

- What percentage of overall funding has been raised to date?

- more than 75%

- Does the investor need to be accredited to invest?

- Yes

- What are the expected financial returns for this project?

- 2% net of all fees and expenses

- On what premise are those projections made?

- Projected cash flow of business

- Are returns paid on the investment prior to maturity?

- Yes

- If Yes, when are they paid?

- Annually

- Can you describe in more detail how returns are paid, and under what conditions? For instance, are they only paid if the project is positive cash flow or profitable. What expenses must be accounted for and paid prior to distributions are paid to investors?

- Except when the Internal Revenue Code requires a different allocation, the Company will allocate its profits and losses to the Members as provided in our Operating Agreement. The Managing Member has broad discretion to adjust the application and allocation of the net proceeds of this Offering and the allocation of profits and losses of the Company. Whenever the Company makes distributions from net cash flow, the Investors, as holders of Class B Interests, will have a preferential right to receive up to 2% of their Capital Contributions per year before the Company can make any other distribution. We call these payments “Preferred Returns.” Preferred Returns begin accruing on the date we have received the Investor’s Capital Contribution and Administrative Fee and all required documentation, and we have accepted the subscription. The Class B Members’ preferential right is cumulative; that is, if we fail to distribute the full 2% in any applicable period, we must pay the shortfall amount to the Class B Members along with any current Preferred Return before we can make any distribution to any party in a later period. In general, when the Company distributes capital to members, such as following a refinancing or sale of the Company’s business or a liquidation of the Company, the Class B Members will have a preferential right to receive distributions up to the full amount of their Capital Contributions before the Company can make any other distribution from capital to the Class A Member. We call this potential payment of an amount equal to the Capital Contribution the “Return of Capital.” We do not expect a capital event to occur while any Class B Member has not yet received final adjudication of his or her I-829 petition. If that were to occur, the Company may distribute capital to the Class A Member only after providing for the retention of the full amount of the Capital Contribution of each such Class B Member. In no event will the Company repay any portion of a Class B Member’s Capital Contribution before the USCIS adjudicates his or her I829 petition. Please see Financial Considerations - How We Will Pay Cash Distributions for a more complete discussion of distributions to Class B Members, including the method of allocating partial payments if the Company distributes less than 100% of the preferential amount to all of the Class B Members. Restrictions apply to our distributions to Class B Members. To establish the Interests as qualifying investments under the EB5 Program, we have structured them as an at-risk equity investment in the Company. The Interests are not notes, bonds or any other kind of debt security. The Company cannot guarantee that it will pay distributions. If it fails to do so, the Investors will not have a right to declare a default, seek collection or pursue other typical remedies of a bondholder or noteholder.

- Can you please describe the expected exit strategy and what source(s) of debt or equity are expected to be used to repay the investor’s capital investment?

- We expect to repay each Class B Member’s Capital Contribution using retained earnings of the Company, or the proceeds of a refinancing of the business or a sale of all or part of the business. We expect this to occur, at the Managing Member’s discretion, approximately five years after we originally receive the Offering proceeds, but in no case will we repay a Class B Member’s Capital Contribution before the USCIS adjudicates his or her I829 petition. After all EB-5 immigration procedures are complete, the Company has the right, but not the obligation, to repurchase the Class B Interests at their appraised fair market value, at the discretion of the Managing Member. This right may be exercised by the Company up until the approval of the I-829 petition. While the Company is not obligated to pay the Return of Capital or repurchase the Class B Interests at any time, the Managing Member may not receive any distributions of cash from capital events while the Class B Interests are outstanding unless the Return of Capital has been fully paid or the full amount of the Class B Members’ Capital Contributions has been retained by the Company.

- Can you please describe the procedure for allowing the investor to sell his interest in the investment and who the buyer might be?

- The EB-5 Program rules prohibit an investor from receiving a return of capital until after the immigration process is complete. Therefore, until an Investor receives a final decision on his or her I829 petition from the USCIS, we will retain the full amount of the Investor’s Capital Contribution for Company use. As a result, the Investors’ Capital Contributions will continue to be used as working capital by the Company and used for the benefit of the Company and its members at the discretion of the Manager. This may include investing in sister restaurants operated by affiliates of the Managing Member. The uses of invested capital may involve unknown risks in addition to the risks described under “Risks of Our Business and the Fast Casual Restaurant Industry. Reinvestment of capital will subject Investors’ funds to additional risks and different risks than those of investment in the Project. See Risk Factors – Risks of Reinvestment of Capital.

- What is the expected term of the investment?

- 5 years

- Can you describe what procedures are in place If the investor needs to liquidate his position before the contracted maturity date of the agreement, and what penalties may be imposed?

- Investors may not transfer Interests without the consent of our Managing Member, and then may do so only in compliance with applicable securities laws and regulations. Our Operating Agreement and the requirements of the EB5 Program impose substantial additional restrictions on transferring Interests. No market for the Interests exists, and we expect no market to develop. The Interests are a highly illiquid asset, in that the holder cannot readily sell an Interest or pledge it as collateral for a loan or other obligation. We have not registered the Interests under the Securities Act or under any state securities law, and do not intend to do so. Our Operating Agreement contains additional restrictions on the transfer of Interests. An Investor may not assign, sell, or transfer his or her Interest to another party until after adjudication of the Investor’s I829 petition. Even after that time the Investor may not assign, sell or transfer the Interest without our Managing Member’s consent, and then only as provided for in our Operating Agreement and otherwise in accordance with applicable securities laws. Finally, no public market exists for the sale of the Company’s Interests, and we do not expect such a public market ever to develop. These restrictions make it unlikely that an Investor who wanted to sell or otherwise dispose of Interests could do so. Therefore, you should acquire an Interest for investment purposes only, based on returns you may receive directly from the issuer, and not with a view to resale or other distribution. We do not plan to issue certificates as evidence of ownership of our Interests, but if we do, certificates for Interests will bear a legend stating that we prohibit their transfer except pursuant to registration under the Securities Act, or pursuant to an available exemption from registration, and that holders of the interests cannot engage in hedging transactions involving the interests unless in doing so they comply with the Securities Act.

- How is the value of the investment, once the investment has been made, measured?

- Since this is a private entity investment measuring value during the development would be difficult to do. Once operations have begun it should be easier to quantify a potential market value, but it could be years before that figure stabilizes.

- Have these strategies been used by the Regional Center principals, or project managers in the past and what was the outcome?

- No, we have not based the financial projections on actual operations. Because our business has no operating history we cannot provide a balance sheet or income statement based on actual operations. We have based the pro forma financial projections included in the Business Plan (see Exhibit C) on assumptions we believe are reasonable concerning future operations of Company, and on the experience of our Managing Member and its affiliates in the restaurant business. Because actual conditions will differ from those assumptions, and the differences may be material, we cannot assure you that these projections will prove accurate and caution you against placing excessive reliance on them in deciding whether to invest in the Company. For example, the Restaurant may not attract as many patrons as projected based on the location’s demographics, or changing consumer tastes may reduce demand. Changes in commodity prices can also significantly affect the cost of ingredients and prepared food items. Any increase in costs or decrease in revenues of the Company could affect your ability to receive a return of or on your investment.

- Have all of the permits and permissions for project development been obtained?

- Yes

- Is there any patented intellectual property essential to this project?

- Yes

- Are there any other notes or comments to make regarding this investment that would be important for the Investor to know?

- The Company must obtain permits. Before commencing operations, the Company must obtain permits from government agencies, including building and safety, handicapped access, public health, fire and safety, liquor license and others. While our Managing Member and the Company do not know of any material impediments to obtaining any necessary permits, licenses, consents or approvals, unexpected difficulties could materially delay or prevent obtaining them. In particular, liquor licenses have numerous special requirements and may be delayed or denied. While the Managing Member believes that the Restaurant can operate profitably without serving alcoholic beverages, inability to serve them would likely reduce profitability and customer traffic. Administrative Fee: In addition to the minimum investment of $500,000, each individual Subscriber will pay an Administrative Fee of $25,000. We will use the Administrative Fee to reimburse our Managing Member and the Company for the expenses of the Offering, including any listing fees of internet platforms publicizing the Offering, any commissions to brokers or agents, and otherwise to compensate our Managing Member for its efforts in setting up the Company and conducting the Offering. See Commissions and Fees. We will refund the Administrative Fee in full, without interest or deduction, if we reject the subscription, if we terminate the Offering, or if the USCIS denies the Subscriber’s I526 petition, unless the Subscriber caused the denial by misrepresentation, fraud, a failure to comply with USCIS requests, abandonment, or insufficient evidence to prove a lawful source of funds. If the USCIS denies a Subscriber’s I526 petition for one of those reasons, we will not return the Subscriber’s Administrative Fee, but will retain it to defray costs associated with the failed subscription and the need to secure a replacement Investor or other capital.

By CHLOE: 60 West 22nd: Fees

- What is the fee for subscribing to the investment (Subscription Fee)?

- 25,000

- Do potential investors need to pay a fee to obtain the operating documents, PPM or other subscription documents?

- No

- If Yes, Is that refundable in the event the investor decides not to invest?

- No

- If so, what is that Document fee?

- none

- Could you please describe the procedure for the return of any fees, or fees that are withheld?

- The only fee charged is the Administration fee of $25,000 which would be returned in the event of a denial of the I-526 by USCIS. We will refund the Administrative Fee in full, without interest or deduction, if we reject the subscription, if we terminate the Offering, or if the USCIS denies the Subscriber’s I-526 petition, unless the Subscriber caused the denial by misrepresentation, fraud, a failure to comply with USCIS requests, abandonment, or insufficient evidence to prove a lawful source of funds. If the USCIS denies a Subscriber’s I-526 petition for one of those reasons, we will not return the Subscriber’s Administrative Fee, but will retain it to defray costs associated with the failed subscription and the need to secure a replacement Investor or other capital.

- Could you please describe the procedure for return of escrow in the event of denial of the I-526 by USCIS?

- If we cancel the Offering for any reason, we will repay all Subscription Amounts to Subscribers. The Company reserves the right to accept or reject any subscription for any reason in its sole and exclusive discretion. If we reject an individual Subscriber’s subscription, or rescind acceptance of a subscription prior to the Subscriber’s filing his or her I-526 petition with the USCIS, we will repay all of that Subscriber’s Subscription Amount without interest or deduction. If the USCIS denies a Subscriber’s I-526 petition (without appeal or after denial of any appeal), we will return the Subscription Amount to that Subscriber, unless the Subscriber caused the denial by one of the actions described in the next paragraph. If the USCIS denies a Subscriber’s I-526 petition (without appeal or after denial of any appeal) because of the Subscriber’s misrepresentation, fraud, failure to comply with the USCIS’ requests, or abandonment, or failure to provide sufficient evidence to prove a lawful source of funds, we will return no portion of that Subscriber’s Administrative Fee and retain 25% of the Capital Contribution as a termination fee before returning the remainder. The retained funds will be used to defray costs associated with the failed subscription and the need to secure a replacement Subscriber or other capital. When funds are returned to a Subscriber as a result of denial of the Subscriber’s I-526 petition, the repayment will be made from Company funds as soon as practicable, as a priority distribution based on funds available for such purpose. Repayments may be delayed by the need to secure a replacement subscription or other sources of capital. When funds are returned to a Subscriber as a result of cancellation or termination of the Offering or rejection of a subscription, the funds will be returned within 30 days of such event.

- Does that include the processing of the I-526, I-829 or any other legal fees associated with the immigration application?

- No

- What is required for escrow payment at the time of submission of the I-526?

- Once the Company accepts the Subscription, the Subscriber will be obligated to remit the $500,000 Capital Contribution and $25,000 Administrative Fee to the Company by check or wire transfer.

- What is the policy for reimbursing the escrow payment in the event of denial?

- N/A

- What fees do you pay to 'finders' or agents?

- None

- If there is no finder or agent, would you reimburse that fee to the investor?

- No

- What would be the procedure for reimbursing this fee?

- N/A

- Do you pay finder’s fees to attorneys?

- No

- Do you pay fees to unlicensed broker’s or agents?

- No

By CHLOE: 60 West 22nd: Risks

Risk Factors

| Risk Factor | Description |

|---|---|

| Risks Related to “Best Efforts” Offering | If this Offering does not yield projected proceeds we must obtain other financing. We are conducting this Offering on a “best efforts” basis with no underwriter, no advance agreement that any number of Interests will be purchased, and no minimum amount of subscriptions required to close. Subscribers may not revoke their subscriptions, which we will accept on a rolling basis. Potential Investors should be aware that after our closing on the first subscription there is no assurance that a second subscriber will invest the remainder of our target Offering proceeds of $1,000,000. We have based our business plan on a projection of $1,000,000 in funds from this Offering. If we fail to raise that amount, we expect our Managing Member or an affiliate to lend or invest the remainder of funds needed to launch the Restaurant. We have not determined the terms of such financing, which may affect the Class B Member’s financial interests and risk in connection with the investment in the Company. For example, if the Company borrows the needed capital the lender’s rights to loan service and repayment of the loan will be senior to the Class B Member’s distribution rights as an equity holder in the Company, increasing the risk that returns to Class B Member’s will be delayed or reduced if the Restaurant does not perform as anticipated. |

| Risks Related to the EB-5 Immigrant Visa Program and Immigration Proceedings | Your purchase of an Interest does not guarantee that the USCIS will grant you conditional or unconditional permanent U.S. residency. Even after you make a Capital Contribution to purchase an Interest, the USCIS may not grant you permanent residency, whether conditional or unconditional. In this memorandum we have described the immigration-related risks known to our Managing Member after consulting with third parties whom our Managing Member deems reliable. However, we cannot assure you that this information is complete, accurate or current, that it includes risks that may apply to your particular circumstances, or that it includes all of the risks you will bear relating to the EB5 Program. |

| General immigration risks | If you obtain conditional permanent residence status in connection with an investment in the Company, you must intend to make the U.S. your primary residence. If a permanent resident continues to live abroad, the Department of Homeland Security may revoke his or her residence status. The process of obtaining conditional and unconditional permanent resident status involves numerous factors and circumstances that lie beyond our control and the scope of this memorandum. Among these are your particular personal history and quotas established by the U.S. government limiting the number of immigrant visas available to qualified individuals seeking conditional or unconditional permanent resident status under the EB5 Program. Congress may change immigration laws, and the USCIS may change its regulations or its interpretations of the law and regulations, without notice and in a manner that may be detrimental to you or the Company or both. Among other things, these changes could lengthen processing times or make approval more difficult. Moreover, Congress could make changes to the laws governing the EB5 Program with retroactive effect, which could have a materially adverse effect on pending and even previously approved I-526 petitions or adjustments to your immigration status. |

| To apply for residency, you will need to retain an attorney and must expect delays | Only a qualified U.S. immigration attorney approved by us should file an I-526 petition with the USCIS on your behalf. As of the date of this document, our Managing Member has been advised that USCIS reports it is taking approximately 15-18 months to approve or deny an I-526 petition. We cannot predict the USCIS’ processing times, or assure you that the USCIS’s report on processing times is accurate or up to date. Its processing times fluctuate and the times reported on the USCIS website are not always accurate. In addition, the USCIS may issue a Request for Evidence (“RFE”) or a Notice of Intent to Deny (“NOID”) during adjudication of an investor’s I-526 petition. An RFE or NOID can significantly delay an individual’s I-526 petition adjudication. Similarly, the USCIS may put an entire EB-5 Program offering on hold to consider policy issues related to, among other things, the terms of the offering, any bridge financing, the EB-5 business plan for the offering, or the economic impact and job creation analysis for the offering, which may delay adjudication of I-526 petitions submitted by investors in the offering significantly. USCIS delays could also result in long lapses between subscriptions from potential investors for an offering, which could in turn delay job creation, reducing the likelihood that the USCIS will approve his or her I-829 petition. Moreover, such delays may result in an Investor receiving approval of his or her I-526 petition at a point in time when no EB-5 immigrant visas are available to investors from a particular country, further delaying the ability of an investor who subscribes to the Offering to obtain conditional permanent resident status. Any of these delays could impair the success of our Offering and your ability to achieve expected immigration benefits. Once approved, the USCIS will either forward the case to the U.S. State Department’s National Visa Center and then to a U.S. Consulate selected by the Investor for processing, or, if you are already in the U.S., you may adjust your status to that of conditional permanent resident. Depending on which option you choose, it may take an additional six months or longer for a U.S. Consulate to process the immigrant visa application, or for the USCIS to adjust your status and issue an EB-5 immigration visa. Unless you have another visa legally permitting U.S. residency, you should not physically move to the U.S. until your EB-5 immigration visa has been issued. |

| The project may not produce enough jobs to satisfy requirements for all Investors | For EB-5 Investors to convert their conditional permanent resident status to unconditional permanent resident status within the allotted two years’ time, the Company must directly create ten full-time U.S. jobs for each $500,000 investment. For example, if the Company raises the Maximum Offering amount of $1,000,000, the Company must directly create and sustain no less than 20 jobs. The Company may not succeed in doing so. While our projections indicate that the Project will directly create a total of 31 jobs to be allocated to the two investors in a Maximum Offering, we cannot assure you that the Project will succeed in creating that many jobs. Depending on the size of any shortfall in jobs actually created, the Project may not generate sufficient employment to remove conditional visa status, resulting in a delay or denial of permanent residency for one or more Investors. In the event of a shortfall in jobs, to the extent permitted by law and the practices of the USCIS, we will allocate the qualifying jobs created by the Project on a first-in, first-out basis, tied to the date on which the Investor submits his or her petition for removal of conditions to permanent residency on Form I-829 to the USCIS. If the Company’s business fails before USCIS adjudicates the Investors’ I-829 petitions, or if the Project fails to create qualifying jobs within two years of the Investors’ investments, it is likely that none of the Investors could secure approval of an I829 petition for removal of conditions on permanent residence. |

| We cannot guarantee that Investors have the requisite policymaking position | The EB5 Program requires an Investor to hold a policymaking or management position within the Company. Members have the rights, powers, and duties normally granted to limited partners under the Uniform Limited Partnership Act, which include limited involvement in management of the Company and limited voting rights as described in our Operating Agreement. We believe, but cannot guarantee, that these rights are sufficient to meet the USCIS requirement of active participation in policymaking or management of a new commercial enterprise. If the USCIS determines that our Class B Members lack a sufficient policymaking or management position, it will likely reject all I-526 petitions. |

| Investments must remain at risk | As part of the application for residency under the EB-5 Program, an Investor must show evidence that he or she has placed the required amount of capital “at risk” for the purpose of generating a return on that capital. We believe that an investment in the Interests, will place an Investor’s investment in the Company at risk because, as we have described in this memorandum, our ability to pay distributions or return any portion of an Investor’s investment depends on the success of the Restaurant. Nevertheless, a purchase of Interests does not guarantee conditional or permanent residency in the U.S. Furthermore, Project conditions could arise under which the Company finds it commercially necessary to enter into a transaction that removes Investors’ capital from active “at risk” use. We cannot assure that the USCIS will remove conditions to an Investor’s residency under the EB5 Program. Additionally, as more fully described below, if the volume of visa applications continues to exceed the number of visas available under the EB-5 Program, delays in the processing of an Investor’s EB-5 immigrant visa or adjustment of status application will continue, and Subscribers will have to wait longer to begin conditional permanent resident status after receiving I-526 approval. Because an Investor’s period of conditional permanent resident status does not begin until an Investor enters the U.S. on his or her EB-5 immigrant visa or receives approval of his or her adjustment of status application, the commencement of an investor’s conditional permanent resident status may not occur for years. Because the EB-5 Program requires that the new jobs created by our company must be sustained throughout the period of an investor’s conditional permanent resident status and each Subscriber’s Capital Contribution be at “at risk” throughout the entire period of conditional permanent residency, we may be required to sustain such jobs for a period of time greater than an Investor’s conditional permanent resident status, which may result in our inability to maintain the necessary jobs for all Subscribers in the Offering. The failure to sustain jobs for the requisite time period or ensure an Investor’s Capital Contribution remains “at risk” could cause Investors to fail to obtain unconditional permanent resident status. |

| The USCIS will suspend the issuance of new EB5 visas if it reaches the annual limit | The EB-5 Program was created as an employment-based preference, immigrant visa category for certain qualified individuals seeking permanent resident status on the basis of their investment in a new commercial enterprise that creates jobs and benefits the U.S. economy. Under the current provisions of the EB-5 Program, 10,000 immigrant visas are available per year. Of the 10,000 immigrant visas available annually, 3,000 are specifically set aside for those who apply under the EB-5 Regional Center Program. USCIS has stated in informal quarterly stakeholder meetings that all 10,000 of the EB-5 immigrant visas are available to regional center associated investors, notwithstanding the reservation for 3,000 in the regulations. However, the USCIS’s interpretation of how the EB-5 immigrant visas can be allocated to regional center associated investors can change at any time. Further, when allocating EB-5 immigrant visas, U.S. law limits each country to an aggregate maximum of 7% of the total number of EB-5 immigrant visas available each fiscal year (the “Visa Cap”). If a country does not fill the allocable number of available EB-5 immigrant visas, those EB-5 immigrant visas may be available to other countries that have exceeded their Visa Cap. For example, if there is high demand from investors born in mainland China and a lack of demand from other countries, individuals born in mainland China may be allocated EB-5 immigrant visas in excess of the Visa Cap. If demand for an EB-5 immigrant visa from one particular country exceeds both the Visa Cap and the surplus of EB-5 immigrant visas available to other countries, the U.S. Department of State (the “State Department”) may determine that the country is exceeding the number of EB-5 immigrant visas available. If so, the State Department will likely stop granting EB-5 immigrant visas to individuals from that country for the remainder of the then current U.S. government’s fiscal year. In fact, in 2014 the State Department stopped granting EB-5 immigrant visas to individuals born in mainland China for the remainder of the 2014 fiscal year, which ended on September 30, 2014. While availability resumed when the U.S. government’s next fiscal year began on the next day, October 1, 2014, USCIS has warned that the State Department may again stop granting EB-5 immigrant visas to individuals born in mainland China. Accordingly, a Subscriber who receives approval of his or her I-526 petition during a U.S. government fiscal year in which the Visa Cap is reached for that fiscal year will be unable to apply for an EB-5 immigrant visa or apply for adjustment of status in the United States until the State Department resumes granting EB-5 immigrant visas or the USCIS resumes granting approval of applications for adjustment of status. Accordingly, there can be no assurance that there will be a sufficient number of EB-5 immigrant visas available in the future to account for all Subscribers who subscribe to this Offering. If applicants continue to seek more visas than are available, delays in the processing of a Subscriber’s immigrant visa or adjustment of status to permanent resident will occur. We cannot predict such a delay or the length of time a Subscriber or a Subscriber’s eligible dependents could wait until a visa becomes available. Under certain circumstances, delays may result in the ineligibility of a Subscriber’s dependent to obtain conditional permanent resident status. Furthermore, the visa wait time after the Visa Cap is met is established by the date of I-526 petition filing with the USCIS. |

| The Project’s location may not be considered a TEA at the time of investment or I-526 petition filing | USCIS regulations and interpretations hold that targeted employment area (TEA) status is not decided until the time of investment or I-526 petition filing, whichever is earlier. The unemployment statistics used to determine the TEA could change based on new data with respect to unemployment rates and, at the time of the investor’s investment or I-526 petition filing (whichever is earlier), the area may no longer qualify as one that has experienced unemployment at a rate that is at least 150% of the national average. |

| The USCIS may not continue to accept the State of New York’s designation of the Project location as a TEA. | In the future the USCIS may not continue to give deference to state authorities, who have considerable discretion in aggregating geographical areas or census tracts to define a TEA. The New York State Department of Labor has certified the Project location as a TEA in a letter dated February 23, 2016, certifying that the Project is within an area of contiguous census tracts within New York City having an unemployment rate of at least 150% of the U.S. national average. The letter also notes that unemployment rate within the single census tract where the Project is located has a significantly lower unemployment rate than the national average. TEA status is determined at the time an Investor files the I-526 petition. If the USCIS abandons its current policy of deferring to state authorities in defining the boundaries of a TEA the USCIS may determine that the Project is in fact not within a TEA, which would result in the EB5 Investors not meeting the at-risk capital requirement of the EB-5 Program with a $500,000 investment, and their I-526 petitions would be denied unless they contributed additional funds to the Company. New laws governing the EB-5 program could also change the method of deterring TEA status. |

| The USCIS may determine that EB-5 capital has not been properly used towards job creation | The Project Company intends to borrow up to $1 million in bridge financing to commence development and construction of the Project while proceeds from this Offering remain pending. We will use the proceeds of this Offering to repay the outstanding principal balance of the bridge loan. Although the Project Company has sought to structure the bridge loan in accordance with stated USCIS policies, the USCIS may determine that the Project Company’s repayment of a portion of the bridge financing does not satisfy the job creation requirements of the EB-5 Program. If that occurs, Investors would receive no credit for job creation associated with expenditures used to repay the bridge financings. The resulting shortfall in job creation would result in an insufficient number of jobs to support approval of the I-526 petitions and I-829 petitions of all Investors. |

| The Company may change the Project’s direction, which may be considered a material change. | The Company’s business, including the development, build-out, launch and operation of the Project, may not proceed according to the Business Plan submitted with the Investor’s original I526 petition if unforeseen economic conditions, weather conditions, labor conditions, competitive conditions, regulatory changes or other factors arise. A material change from the Project’s original business plan between the time of I-526 petition approval and I-829 petition approval could cause the USCIS to deny an Investor’s I-829 petition, adjustment of status application or application for an immigrant visa. The May 30, 2013 USCIS EB-5 Adjudications Policy Memorandum states that the USCIS will review I-829 petitions for compliance with the I829 petition regulations even if a material change in the business plan has occurred. However, it is not known whether USCIS will follow this new policy and the USCIS has not defined a “material change.” If it denies an I-829 petition on this basis, the USCIS can place the investor into removal proceedings where the investor’s conditional lawful permanent resident status may be terminated, making the investor removable from the United States. |

| An investor who chooses to file a new I-526 petition in the case of material change will face additional immigration risks. | Current USCIS policy allows a conditional lawful permanent resident in the U.S. to file a new I-526 petition containing a new business plan if the investor or the regional center believes that the Project has materially changed and that the USCIS will likely deny an I-829 petition. On approval of the new I-526 petition, the investor begins a new two-year period of conditional permanent resident status and a new five-year period towards naturalization. The investor would still have to proceed with the timely filing of the I-829 petition or risk falling out of status. Any children with conditional permanent resident status who have reached age 21 before the filing of the new I-526 petition cannot be included in the new I-526 petition and are removable from the U.S. If the investor and his or her spouse become divorced between the date of approval of the initial I-526 petition and the subsequent I-526 petition filing, the spouse with derivative status will no longer be able to obtain lawful permanent resident status through the investment. |

| Subscribers have no guarantee of positive adjudication of I526, I829, or I485 petitions. | The USCIS has sole and exclusive authority to adjudicate all I-526 petitions and I-829 petitions, along with any I485 Petitions. Although our Managing Member believes that an investment in the Interests should enable an Investor to qualify for a positive determination of his or her I-526 petition, and, if applicable, his or her I485 Petition, and that a successful conclusion to the investment in full satisfaction of all requirements of the EB5 Program ought to qualify Investors for I-829 petition approval, we cannot guarantee that ultimately the USCIS will positively adjudicate each of these petitions, or any of them. |

| Subscribers have no guarantee that the State Department will grant each Subscriber an immigrant visa. | The State Department has sole and exclusive authority to grant immigrant visas based on approved I-526 petitions. Although our Managing Member believes that an investment in the Interests should enable an Investor to receive his or her EB-5 immigrant visa, we cannot guarantee that ultimately the State Department will grant an immigrant visa. |

| Project delays can impede the immigration process. | Circumstances outside of our control can delay the planned construction, commencement and operation of the Project. These delays could, in turn, delay our creation of jobs. Delays, if severe, could impede the favorable adjudication of an Investor’s I-829 petition. In particular, the Company must create the requisite jobs within each Investor’s period of conditional permanent residency, or the jobs will not count at all toward that Investor’s qualification for removal of conditions to permanent residency. |

| The Company has no operating history. | We recently formed the Company for the specific purpose of developing, building out, launching and operating the Restaurant. The Company has no operating history. We have based the description of the future operations of the Project and the projections for its performance contained in this memorandum on the knowledge and experience of our Managing Member at a similar restaurant, which is limited, and cannot be verified as applicable to the Project until well after it has actually begun operations. |

| We have not based the financial projections on actual operations. | Because our business has no operating history we cannot provide a balance sheet or income statement based on actual operations. We have based the pro forma financial projections included in the Business Plan (see Exhibit C) on assumptions we believe are reasonable concerning future operations of Company, and on the experience of our Managing Member and its affiliates in the restaurant business. Because actual conditions will differ from those assumptions, and the differences may be material, we cannot assure you that these projections will prove accurate and caution you against placing excessive reliance on them in deciding whether to invest in the Company. For example, the Restaurant may not attract as many patrons as projected based on the location’s demographics, or changing consumer tastes may reduce demand. Changes in commodity prices can also significantly affect the cost of ingredients and prepared food items. Any increase in costs or decrease in revenues of the Company could affect your ability to receive a return of or on your investment. |

| Unfavorable changes in government regulation could harm our business. | The Project must comply with various federal, state and local laws, regulations and administrative practices, and the Company must comply with provisions regulating health, sanitation, food and occupational safety, the sale of alcoholic beverages, equal employment, minimum wages and other wage and hour rules. Difficulties or failures in our obtaining or maintaining required approvals or licenses under these laws and regulations could delay or prevent the launch of the Restaurant or hamper its continued profitable operations. We cannot predict the nature and timing of future laws, regulations, interpretations or applications, or their potential effect. They could, however, require us to change add staff, alter our facilities or make other changes. Any or all of such requirements could have an adverse effect on our results of operations and financial condition. |

| Food safety and food-borne illness concerns could harm our business | While food safety and good kitchen hygiene will be of paramount importance at both the Restaurant and the commissary that supplies much of our food, we cannot guarantee that our internal controls and training will be fully effective in preventing all food safety issues at our restaurants, including any occurrences of food-borne illnesses such as salmonella, E. coli or hepatitis A. In addition, the Company will have no control over operations at other by CHLOE locations, where any food safety issues would also affect perceptions of our Restaurant. In addition, we will rely on third-party vendors, making it difficult to monitor food safety compliance. Some food-borne illness incidents could be caused by third-party vendors and transporters outside of our control. New illnesses resistant to our current precautions may develop in the future, or diseases with long incubation periods could arise, that could give rise to claims or allegations on retroactive basis. One or more instances of food-borne illness in any by CHLOE restaurant could negatively affect our sales if publicized on traditional media outlets or through social media. This risk exists even if it were later determined that the illness was wrongly attributed to us or to another by CHLOE restaurant. A number of other restaurant chains have experienced incidents related to food-borne illnesses that have had a material adverse effect on their operations. A report of a similar incident at a by CHLOE restaurant, whether or not accurate, could reduce our revenues and ability to continue as a profitable business. |

| Outbreaks of contagious illness could harm our business. | The United States and other countries have experienced, and will likely experience in the future, outbreaks of contagious diseases such as norovirus, influenza, SARS, Ebola virus, H1N1 and Zika virus, and public warnings about the threat of such diseases. An outbreak of a dangerous or debilitating illness, or heightened concern about the threat of illness, will discourage customers from gathering in public places like restaurants, and could reduce the availability of staff at our restaurants. If serious or prolonged, those conditions could materially harm our business. |

| Increases in commodity prices can make us less profitable. | Many of the ingredients the Restaurant will use to prepare our food, as well as packaging and serving materials, are commodities or ingredients that are affected by the price of other commodities, exchange rates, foreign demand, weather, seasonality, production, availability and other factors outside our control. We expect the commissary, through its bulk purchasing, to provide opportunities to work closely with suppliers and seek to stabilize prices through the use of long-term agreements, but the Company may not be successful in such endeavor. In addition, the prices of a majority of the goods the Restaurant will purchase can fluctuate with market conditions. The Restaurant can benefit when market prices of ingredients and supplies drop. But when the price of ingredients and supplies increases, the Restaurant must choose either to absorb the cost and decrease profit margins, or to increase its menu prices and possibly discourage customers, either of which can harm our performance. |

| New information or attitudes regarding diet and health could result in changes in regulations and consumer consumption habits that could reduce our sales. | Regulations and consumer eating habits may change as a result of new information or attitudes regarding diet and health. Such changes may include federal, state and local regulations that affect the ingredients and nutritional content of the food and beverages offered at the Restaurant, as well as consumer trends in food consumption. If consumer health regulations or consumer eating habits change significantly, we may modify or delete menu items, which may make our restaurants less attractive to new or returning customers. If we fail to respond with appropriate changes to our menu offerings, our sales and business performance could decline. Government regulation and consumer eating habits may impact our business as a result of changes in attitudes regarding diet and health or new information regarding the adverse health effects of consuming certain menu offerings. These changes have resulted in, and may continue to result in, laws and regulations requiring us to disclose the nutritional content of our food offerings, and they have resulted, and may continue to result in, laws and regulations affecting permissible ingredients and menu offerings. For example, New York requires chain restaurants having fifteen or more locations to list calorie counts on menus, while federal law requires nutritional statements on menus of restaurants with more than 20 locations. The Restaurant will be exempt from those laws, but future expansion of by CHLOE restaurants or broadening of the laws could require the Restaurant to comply with burdensome testing and disclosure and possibly conflicting requirements. While by CHLOE’s offerings are designed to appeal to health-conscious customers, an unfavorable report on our menu ingredients, the size of our portions or the nutritional content of our menu items could reduce the demand for our offerings. |

| The Company will rely on a single supplier. | The Company’s business will rely significantly on a commissary in Jersey City that is scheduled to open in April 2016 to make supply purchases and prepare food items for the Restaurant. The commissary is designed to take advantage of scale economies and to help standardize menu offerings and streamline operations across locations. However, the Restaurant will depend on the commissary’s ability to successfully meet by CHLOE’s standards of quality and service. Its failure to perform in accordance with expectations, or a delay in its opening, could cause delay or disrupt supplies, increase costs, and lead to other disruptions if the Company needed to seek an alternate supplier. |

| The Company must obtain permits. | Before commencing operations, the Company must obtain permits from government agencies, including building and safety, handicapped access, public health, fire and safety, liquor license and others. While our Managing Member and the Company do not know of any material impediments to obtaining any necessary permits, licenses, consents or approvals, unexpected difficulties could materially delay or prevent obtaining them. In particular, liquor licenses have numerous special requirements and may be delayed or denied. While the Managing Member believes that the Restaurant can operate profitably without serving alcoholic beverages, inability to serve them would likely reduce profitability and customer traffic. |

| Construction related to the Project may face delays or cost increases. | The Project depends on the successful completion of build-out of the interior of the restaurant. Use as a restaurant will be new for the leased space. The lease allows the Company to undertake tenant improvements to rebuild the space for restaurant use and to install furnishings, equipment, décor, and signage consistent with “by CHLOE” brand standards. The property’s interior construction will include the installation of a state-of-the-art kitchen as well as a dining area for the patrons of by CHLOE. Many factors can increase the time and expense of construction substantially, including shortages of materials, equipment, necessary technical skills and skilled labor, adverse weather conditions, natural disasters, labor disputes, disputes with contractors, accidents, changes in government priorities and policies, delays in obtaining the requisite licenses, permits, and approvals from the relevant authorities, and other unforeseeable problems and circumstances. Construction delays would delay the restaurant’s launch, delaying cash flow and job creation and increasing costs. |

| Natural or human-made disasters or other catastrophic events could interrupt the Project. | Telecommunications failures, power or water shortages, fires, floods, hurricanes, tornadoes, other extreme weather conditions, medical epidemics or pandemics and other natural or human-made disasters or catastrophic events could disrupt our operations or the Project. Severe damage from these events could interrupt our business for a significant period while we rebuild or while the Project is rebuilt. The Company plans to maintain casualty loss insurance to cover our respective losses from some of these events, including coverage to compensate for business interruption. However, insurance generally does not cover 100% of these losses. In addition, following a business interruption it may be difficult to re-enter the market. For example, a disaster that disrupts the Project may also negatively affect customers or suppliers throughout an entire region, or an interruption that primarily affects only the Project could give competitors an opportunity to capture customers. A prolonged interruption, especially an interruption after which the Company is unable to resume some or all of its operations, could cause our results to fall materially short of our projections. That would reduce your ability to receive a return of or on your investment, and could render the Company unable to maintain employment at a sufficient level for all Investors to have restrictions on residency removed under the EB5 Program. |

| The project will have environmental risks | Operating a business on real property exposes the owner to risks relating to hazardous waste and toxic contamination of the property or adjacent properties, including the potential cost of remediating subsurface and underground water contamination. A business owner can bear environmental liability from the actions of others, such as previous occupants, contractors, patrons, visitors, or adjacent property owners, over whom the Company would have little or no control. If the Company is required to pay for any part of the cleanup or other abatement of environmental contamination, or to pay damages to persons injured by contamination, the Company could lose some or all of the capital raised by the Offering. The discovery of unknown contamination on the Project site could make it undesirable or unusable for restaurant purposes, which would likely cause the Project to fail. |

| General economic conditions may adversely affect the Restaurant | Negative conditions in the general economy can affect the Restaurant’s operations, especially when potential customers decrease discretionary spending. Increased unemployment, reduced wages or reduced consumer confidence in our communities could cause customers to reduce their spending on dining out and take-out food or shift their patronage to less expensive competitors or cheaper alternatives. The restaurant industry can be highly affected by reduced consumer spending and/or reduced confidence in the economy. For example, the recent Great Recession caused many restaurants to fail or to struggle to remain in business with greatly reduced customer traffic. If the U.S. economy falls back into decline, the Company’s performance may not reach projected levels or may be unable to remain in business, reducing your ability to receive a return of or on your investment, and potentially rendering the Company unable to maintain employment at a sufficient level for all Investors to have restrictions on residency removed under the EB5 Program. The price point for by CHLOE is somewhere between 50% to 100% higher than fast food restaurants. Well-known examples of fast casual restaurants include Chipotle, Panera Bread, and Corner Bakery. Although this has been the fastest-growing segment of the restaurant industry, this industry could also see a downturn if the economic buying power of our target market decreases (young professionals between the ages of 16-40 who live and/or work in Manhattan). |

| We may suffer uninsured losses | Some of the risks connected to the Project are either uninsurable or not insurable at commercially reasonable rates. Examples of uninsurable losses are those arising from flood, war, terrorism, public health emergencies and acts of God, among others. Should an uninsurable loss occur, its damage to the Company’s cash flow and financial condition could cause a substantial, if not total, loss of your investment. Additionally, the Company could lose some or all of the capital invested in the Project, as well as losing any potential distributions or profits from the Project’s operations. |

| Increased competition may reduce profitability | Competitors of the Project include limited service restaurants such as Ashby’s, Tres Carnes and Chipotle. There is one other possible direct competitor that also offers vegan options, Terri restaurant. Although they offer vegan options, they are not a full-service vegan restaurant such as by CHLOE. These businesses compete with the Project in one or more product categories. Some of these competitors have well established reputations or may have greater financial or marketing resources than the Company does. They may have greater resources than the Company available for sourcing, promoting and selling their products, or may be better able to sustain operating losses for a significant period while building market share. Increased competition may reduce the Company’s profitability by lowering sales, lowering gross profits, or forcing it to increase spending on advertising or marketing. |

| Labor union activities could disrupt the Company’s business and increase its costs. | Based on the Managing Member’s experience at its Bleecker Street location, it expects the Company to establish and maintain good employee relations and morale with an enthusiastic non-unionized work force. Some fast casual restaurant chains have recently been subject to union organizing efforts, and if by CHLOE restaurants become successful and expand they may face similar efforts seeking increased pay, fringe benefits or work rules that could reduce management flexibility. Responding to union organizing attempts would require substantial management and team member time and could disrupt operations. In addition, trade unions could target the Restaurant for informational picketing or negative publicity campaigns, discouraging customer traffic. If a union succeeds in organizing all or part of the Restaurant’s team, strikes could disrupt its business and the Company may find it necessary to enter into a labor contract that increases employee related costs substantially. Any of these union activities could have a negative financial effect on the Company’s business and therefore impair its ability to pay distribution or repay the Capital Contributions. |

| Unfavorable publicity could harm the Project’s reputation. | Bad publicity or bad word-of-mouth regarding the quality or safety of service or facilities has harmed other food service businesses and could undermine the success of the Restaurant. While we generally expect the expansion of the by CHLOE concept into additional locations to enhance the business at our Restaurant, our association with the brand also means that negative publicity arising at any by CHLOE restaurant could affect us as well. As a result we may face negative publicity relating to food quality, restaurant facilities, customer complaints or litigation alleging illness or injury, health inspection scores, integrity of our or our suppliers’ food processing, employee relationships or other matters, regardless of whether the allegations are valid or whether we are held to be responsible. Social media can also amplify any negative publicity that could be generated by such incidents. Whether bad publicity has a factual basis or not, it can harm public perception of the Restaurant and damage its business by discouraging future customers. If loss of reputation from bad publicity financially harms the Company, you could see a substantial, if not total, loss of your investment. |

| Legal proceedings could materially affect our results | From time to time, we or the Company may be party to legal proceedings including matters involving personnel and employment issues, personal injury, intellectual property and other proceedings arising in the ordinary course of business. Although management does not know of any current basis for a legal claim against the Company, should claims arise in the future the expense of defending them, or paying settlements or judgments, could materially affect the Company’s results. |

| The loss of key personnel could adversely affect the Restaurant. | Chef Chloe Coscarelli has played an instrumental role in the development of the by CHLOE brand and its menu, and it is expected that she will continue to work with the Managing Member and the individual by CHLOE restaurants in the future as required. In addition, the Managing Member has the right to use Ms. Coscarelli’s name, face and likeness pursuant to a license agreement between them, which the Managing Member will sublicense to the Company. The license agreement is designed to allow the Managing Member to allow the by CHLOE restaurants to continue using her name, face and likeness even if Ms. Coscarelli ceases providing services or no longer owns an interest in Managing Member. However, if she ceases to provide services, or if Managing Member (and the Restaurant) were to lose the right to use her name, face and likeness in its operations, it could adversely affect the Restaurant’s results and the expansion plans of the Company. |

| Other | Additional risk factors apply, please refer to Offering Documents for a more comprehensive list of additional Risk Factors |

- Can you please describe what conditions could occur in the market that would negatively affect profitability and commercial operations or job creation?