Reg D & General Solicitation

In the United States under the Securities Act of 1933, any offer to sell securities must either be registered with the United States Securities and Exchange Commission (SEC) or meet certain qualifications to exempt them from such registration. Regulation D (or Reg D) contains the rules providing exemptions from the registration requirements, allowing some companies to offer and sell their securities without having to register the securities with the SEC.[1] A Regulation D offering is intended to make access to the capital markets possible for small companies that could not otherwise bear the costs of a normal SEC registration. Reg D may also refer to an investment strategy, mostly associated with hedge funds, based upon the same regulation. The regulation is found under Title 17 of the Code of Federal Regulations, part 230, Sections 501 through 508. The legal citation is 17 C.F.R. §230.501 et seq.

On July 10th, 2013, the SEC issued new final regulations allowing public advertising and solicitation of Regulation D offers to accredited investors.

Reg D is composed of various rules prescribing the qualifications needed to meet exemptions from registration requirements for the issuance of securities. Rule 501 of Reg D contains definitions that apply to the rest of Reg D. Rule 502 contains the general conditions that must be met to take advantage of the exemptions under Regulation D. Generally speaking, these conditions are (1) that all sales within a certain time period that are part of the same Reg D offering must be "integrated", meaning they must be treated as one offering, (2) information and disclosures must be provided, (3) there must be no "general solicitation", and (4) that the securities being sold contain restrictions on their resale. Rule 503 requires issuers to file a Form D with the SEC when they make an offering under Regulation D. In Rules 504 and 505, Regulation D implements §3(b) of the Securities Act of 1933 (also referred to as the '33 Act), which allows the SEC to exempt issuances of under $5,000,000 from registration. It also provides (in Rule 506) a "safe harbor" under §4(2) of the '33 Act (which says that non-public offerings are exempt from the registration requirement). In other words, if an issuer complies with the requirements of Rule 506, it can be assured that its offering is "non-public," and thus that it is exempt from registration. Rule 507 penalizes issuers who do not file the Form D, as required by Rule 503. Rule 508 provides the guidelines under which the SEC enforces Regulation D against issuers. On April 5, 2012 President Obama signed into law the Jumpstart Our Business Startups Act, also known as the JOBS Act, which for the first time in over 80 years relaxes investment securities offering rules first enacted during the Great Depression.

Rule 506

A company that satisfies the following standards may qualify for an exemption under this rule:

- Can raise an unlimited amount of capital;

- Seller must be available to answer questions by prospective purchasers;

- Financial statement requirements as for Rule 505; and

- Purchasers receive restricted securities, which may not be freely traded in the secondary market after the offering.

The rule is split into two options based on whether the issuer will engage in general solicitation or advertising to market the securities.

If the issuer will not use general solicitation or advertising to market the securities then the sale of securities can be issued under Rule 506(b) to an unlimited number of accredited investors[3] and up to 35 other purchasers. Unlike Rule 505, all non-accredited investors, either alone or with a purchaser representative, must be sophisticated – that is, they must have sufficient knowledge and experience in financial and business matters to make them capable of evaluating the merits and risks of the prospective investment.

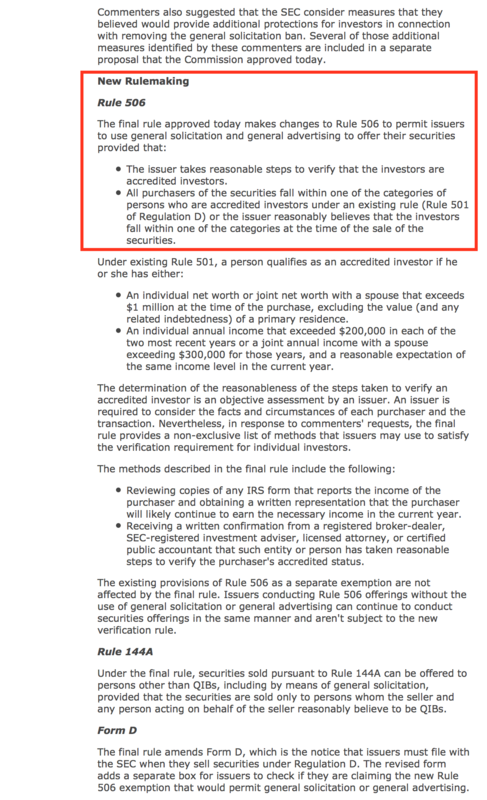

In July 2013, the SEC issued new regulations as required by 2012 Jumpstart Our Business Startups Act.[4] These new regulations add Rule 506(c) to allow general solicitation and advertising for a private placement offering. However, in a Rule 506(c) private offering all of the purchasers must be accredited investors and the issuer must take reasonable steps to determine that the purchaser is an accredited investor.

Securities Disclaimer

This website is for informational purposes only and does not constitute an offer or solicitation to sell shares or securities. Any such offer or solicitation will be made only by means of an investment's confidential Offering Memorandum and in accordance with the terms of all applicable securities and other laws. This website does not constitute or form part of, and should not be construed as, any offer for sale or subscription of, or any invitation to offer to buy or subscribe for, any securities, nor should it or any part of it form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. EB5Projects.com LLC and its affiliates expressly disclaim any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in the website, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting therefrom.