Aemetis, Inc. Reports Second Quarter 2015 Financial Results

Aemetis, Inc. (NASDAQ: AMTX), an advanced renewable fuels and renewable chemicals company, today announced its financial results for the three and six months ended June 30, 2015.

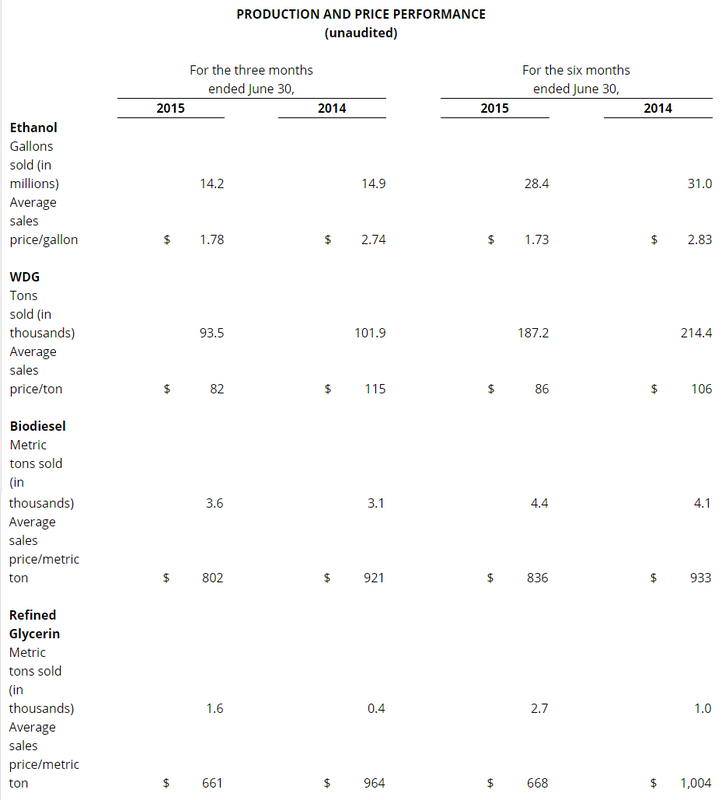

"Our US ethanol business delivered sequential improvement in profitability and revenue," stated Eric McAfee, Chairman and CEO of Aemetis. "Our India biodiesel business grew 161% sequentially through the development of a sustainable domestic customer base, which was made possible by key government policy changes earlier in the year. Continuation of this rapid customer acceptance and adoption places us on a strong path to year over year revenue growth."

"Importantly, we received an additional $2.5 million of EB-5 subordinated debt funding during the second quarter. As of July 30, 2015, escrow account holds $11.5 million of EB-5 funding and an additional $3.0 million to be received into escrow later this year. This 3% interest rate funding will redeem higher rate senior debt," said McAfee.

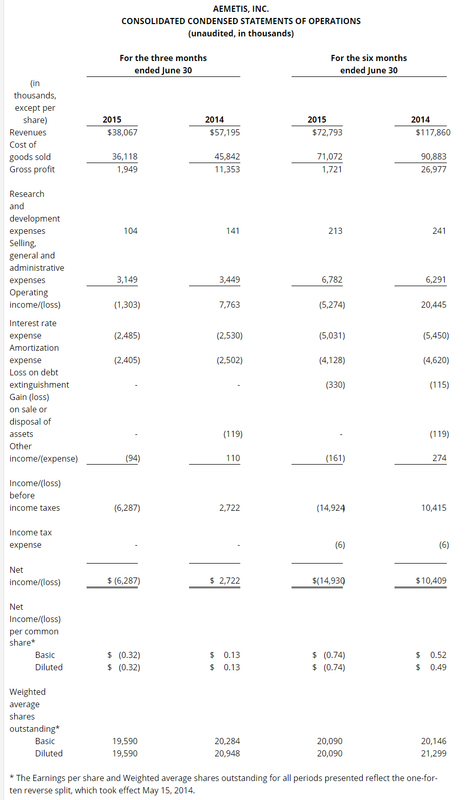

Financial Results for the Three Months Ended June 30, 2015

Revenues were $38.1 million for the second quarter of 2015, compared to $57.2 million for the second quarter of 2014. Decrease in ethanol and wet distiller's grain average selling price resulted in revenue decline during the second quarter. Gross profit for the second quarter of 2015 was $2.0 million, compared to $11.4 million in the second quarter of 2014. During this period, ethanol and wet distiller's grain pricing fell more rapidly than feedstock purchase cost.

Selling, general and administrative expenses were $3.1 million in the second quarter of 2015, compared to $3.4 million in the second quarter of 2014. The decrease in selling, general and administrative expenses was driven by improved efficiencies and lower spending compared to the same period of the prior year.

Operating loss was $1.3 million for the second quarter of 2015 compared to operating income of $7.8 million for the same period in 2014.

Net loss of $6.3 million for the second quarter of 2015 compared to net income of $2.7 million for the second quarter of 2014.

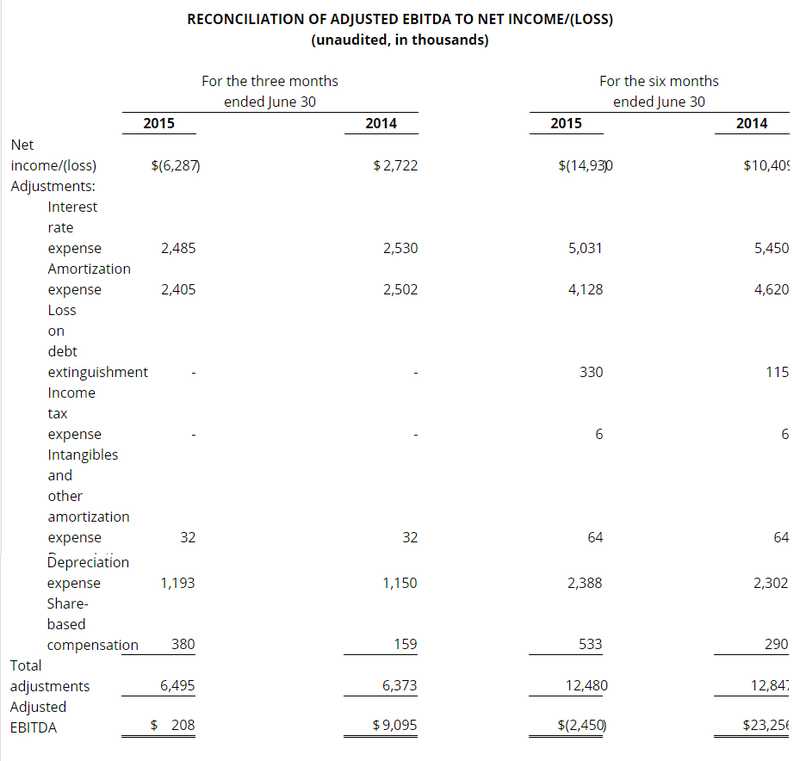

Adjusted EBITDA for the second quarter of 2015 was a loss of $0.2 million, compared to Adjusted EBITDA of $9.1 million for the same period in 2014.

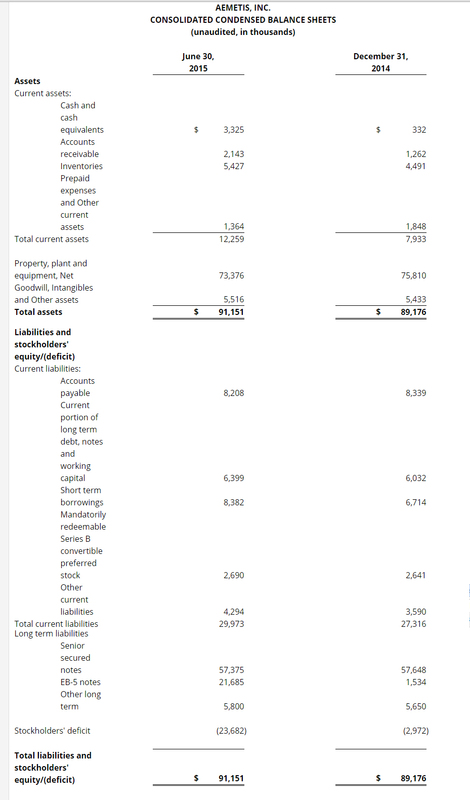

Cash at the end of the second quarter of $3.3 million compared favorably to $0.3 million at the close of 2014.

During the second quarter of 2015, the EB-5 program provided $2.5 million of low-cost debt funding. Interest costs during the second quarter of 2015 were $4.9 million, slightly lower than the interest costs during the second quarter of 2014.

Financial Results for the Six Months Ended June 30, 2015

Revenues were $72.8 million for the first half of 2015, compared to $117.9 million for the first half of 2014. Decrease in ethanol and wet distiller's grain average selling price resulted in revenue decline for the first 6 months. Gross profit for the first half of 2015 was $1.7 million, compared to $27.0 million during the first half of 2014. During this period, ethanol and wet distiller's grain pricing fell more rapidly than feedstock purchase cost.

Selling, general and administrative expenses were $6.8 million during the first half of 2015, compared to $6.3 million during the first half of 2014. The increase in selling, general and administrative expenses was primarily attributable to a one-time EB-5 charge taken during the first quarter of 2015.

Operating loss was $5.3 million for the first half of 2015, compared to operating income of $20.4 million for the same period in 2014.

Net loss of $14.9 million for the first half of 2015 compared to net income of $10.4 million during the first half of 2014.

Adjusted EBITDA for the first half of 2015 was $2.5 million, compared to Adjusted EBITDA of $23.2 million for the same period in 2014.

During the first half of 2015, the EB-5 program provided $20.0 million of low-cost EB-5 debt funding. Interest costs during the first half of 2015 were $9.5 million, compared to $10.2 during the first half of 2014 due to the lower cost of EB-5 funds in the capitalization structure.

About Aemetis

Headquartered in Cupertino, California, Aemetis is an advanced renewable fuels and renewable chemicals company focused on the acquisition, development and commercialization of innovative technologies that replace traditional petroleum-based products by the conversion of second-generation ethanol and biodiesel plants into advanced biorefineries. Founded in 2006, Aemetis owns and operates a 60 million gallon per year ethanol production facility in the California Central Valley near Modesto. Aemetis also owns and operates a 50 million gallon per year renewable chemical and advanced fuel production facility on the East Coast of India producing high quality distilled biodiesel and refined glycerin for customers in India and Europe. Aemetis operates a research and development laboratory at the Maryland Biotech Center, and holds a portfolio of patents and related technology licenses for the production of renewable fuels and biochemicals. For additional information about Aemetis, please visit www.aemetis.com.

NON-GAAP FINANCIAL INFORMATION

We have provided non-GAAP measures as a supplement to financial results based on GAAP. A reconciliation of the non-GAAP measures to the most directly comparable GAAP measures is included in the accompanying supplemental data. Adjusted EBITDA is defined as net income/(loss) plus (to the extent deducted in calculating such net income) interest and amortization (income)/expense, depreciation expense, income/(expense) from share-based compensation and (gains)/losses resulting from debt extinguishment.

Adjusted EBITDA is not calculated in accordance with GAAP and should not be considered as an alternative to net income/(loss), operating income or any other performance measures derived in accordance with GAAP or to cash flows from operating, investing or financing activities as an indicator of cash flows or as a measure of liquidity. Adjusted EBITDA is presented solely as a supplemental disclosure because management believes that it is a useful performance measure that is widely used within the industry in which we operate. In addition, management uses Adjusted EBITDA for reviewing financial results and for budgeting and planning purposes. EBITDA measures are not calculated in the same manner by all companies and, accordingly, may not be an appropriate measure for comparison.

Safe Harbor Statement

This news release contains forward-looking statements, including statements regarding our assumptions, projections, expectations, targets, intentions or beliefs about future events or other statements that are not historical facts. Forward-looking statements in this news release include, without limitation, expectations for year over year revenue growth driven by increasing sales in India, expectations for uses of EB-5 funding and expectations for receipt of additional EB-5 funding. Words or phrases such as "anticipates," "may," "will," "should," "believes," "estimates," "expects," "intends," "plans," "predicts," "projects," "targets," "will likely result," "will continue" or similar expressions are intended to identify forward-looking statements. These forward-looking statements are based on current assumptions and predictions and are subject to numerous risks and uncertainties. Actual results or events could differ materially from those set forth or implied by such forward-looking statements and related assumptions due to certain factors, including, without limitation, competition in the ethanol and other industries in which we operate, commodity market risks including those that may result from current weather conditions, financial market risks, customer adoption, counter-party risks, risks associated with changes to federal policy or regulation, and other risks detailed in our reports filed with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2014, our Quarterly Report on Form 10-Q for the quarter ended June 30, 2015 and in our subsequent filings with the SEC. We are not obligated, and do not intend, to update any of these forward-looking statements at any time unless an update is required by applicable securities laws.

Mentions

States

- California

Securities Disclaimer

This website is for informational purposes only and does not constitute an offer or solicitation to sell shares or securities. Any such offer or solicitation will be made only by means of an investment's confidential Offering Memorandum and in accordance with the terms of all applicable securities and other laws. This website does not constitute or form part of, and should not be construed as, any offer for sale or subscription of, or any invitation to offer to buy or subscribe for, any securities, nor should it or any part of it form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. EB5Projects.com LLC and its affiliates expressly disclaim any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in the website, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting therefrom.