Quiros’ lawyers attack state over asset freeze bid; state attorney fires back

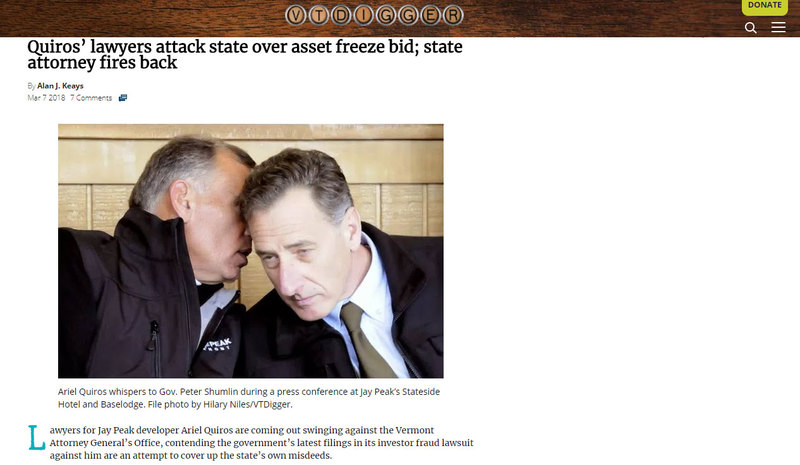

Ariel Quiros whispers to Gov. Peter Shumlin during a press conference at Jay Peak’s Stateside Hotel and Baselodge.

Lawyers for Jay Peak developer Ariel Quiros are coming out swinging against the Vermont Attorney General’s Office, contending the government’s latest filings in its investor fraud lawsuit against him are an attempt to cover up the state’s own misdeeds.

“Indeed,” the filing by Quiros’ lawyers says, “the State’s Motion appears to be a thinly veiled attempt to deflect attention away from the State’s own misconduct, which is already the target of investors’ complaints and has led to the federal government’s shutdown of the Vermont Regional Center.”

An attorney for the state is firing back.

“What are they saying, ‘You didn’t prevent us from committing fraud?’” Assistant Attorney General Kate Gallagher said Wednesday in response to the assertion from lawyers from Quiros. “That’s a silly argument.”

Gallagher said attorneys for Quiros appeared to be the ones diverting attention from the allegations of investor fraud raised in state’s case against him.

“The whole point there is to deflect attention,” she said of the accusation brought by Quiros’ lawyers against the state.

The blistering accusation leveled at the state by Quiros’ counsel is contained in a filing last week responding to a state request to a judge to freeze the Miami businessman’s assets.

The lawyers for Quiros say such a request is unwarranted, in large part because their client agreed last month to a $84 million settlement in a separate investor fraud lawsuit brought against him by the U.S. Securities and Exchange Commission.

Jay Peak owner Ariel Quiros.

His attorneys argue that settlement, paid for mostly by Quiros surrendering property to the SEC, is already more than what federal regulators accuse the developer of improperly pocketing.

Federal authorities have accused Quiros of orchestrating a “Ponzi-like” scheme over eight years to defraud foreign investors in massive EB-5 funded projects at the Jay Peak ski resort and in other Northeast Kingdom communities.

Gallagher said Wednesday that the state believes that Quiros has somewhere between $7 million and $10 million, “at most,” in assets remaining following the SEC settlement, mainly in property such as houses and condos, as well as in bank accounts.

“Maybe it doesn’t seem like that much more,” Gallagher said, “but it’s $10 million more going into the right pocket, not the wrong pocket.”

Those assets are part of a freeze put in place by a federal judge when the SEC case was brought in spring 2016. The settlement, when finalized, would unfreeze Quiros’ assets, allowing him to resolve the SEC case and surrender properties and assets he agreed to turn over.

Now, the state wants the Vermont judge handling its lawsuit against Quiros to “re-freeze” those assets that were not part of the SEC settlement when they are eventually unfrozen in that federal case.

“While they paid $80 million and that may seem like a lot,” Gallagher said, “we still don’t think it’s appropriate for him to walk away with $10 million in assets when people have been defrauded and haven’t received full restitution.”

Melissa Visconti, a Miami attorney representing Quiros, said Wednesday that she doesn’t anticipate the federal court lifting the asset freeze in that case any time soon.

“It takes some time. It can’t lift until all the property has been transferred, and that’s going to take a while,” Visconti said.

Bill Stenger, left, and Ariel Quiros at a ribbon cutting.

Attached to their 15-page filing arguing against the freeze, attorneys for Quiros included a copy of a lawsuit brought by investors against state agencies and departments on behalf of a handful of EB-5 investors.

That lawsuit filed by the Barr Law Group of Stowe claims lax oversight and management of the state-run regional center over the years led to massive investor fraud allegations leveled by the state and federal regulators against Quiros, the resort’s owner at the time, and Bill Stenger, Jay Peak’s former CEO.

The lawsuit alleges the EB-5 regional center and those in charge of overseeing it were essentially partners in carrying out the fraud scheme.

According to that lawsuit, state officials promoted the developers’ projects to new investors after becoming aware of the misuse of funds, falsely claimed the projects were audited by the state, and then engaged in a coverup.

The state entities listed as defendants include the Vermont EB-5 Regional Center, the Vermont Agency of Commerce and Community Development and the Department of Financial Regulation.

That lawsuit, which remains pending in Lamoille County Superior Court in Hyde Park, also names as defendants 10 current and former state officials.

The Vermont Attorney General’s Office, which represents the state in that case, has filed a motion to dismiss the lawsuit outright, citing sovereign immunity as a defense. Attorney General TJ Donovan has said the state employees were acting in good faith as they carried out their duties.

Last summer, the state received notice of termination for the regional center from the U.S. Citizenship and Immigration Service. The notice cited a “preponderance of the evidence” that state officials failed to properly manage and monitor the center.

The state is appealing that notice of termination, seeking to “wind down” its operation rather than abruptly shutter the regional center. State officials say that regulatory controls put in place over the regional center in 2015 by the state Department of Financial Regulation were sufficient to protect investors.

Michael Goldberg, the court-appointed receiver in the EB-5 fraud case, speaks at a Statehouse news conference Thursday.

According to the recent filing by Quiros’ attorneys, all of the assets that have been “disgorged” by him to the SEC will be distributed by the federal court-appointed receiver now overseeing those properties for the “sole benefit on investors and creditors of the Jay Peak projects.”

That receiver, Michael Goldberg, has said he plans to put Jay Peak up for sale in May and at the same time start to market another Northeast Kingdom ski area, Burke Mountain, that had been owned by Quiros and will be surrendered as part of that same SEC settlement.

Attorneys for Quiros say in their filing that when they settled the SEC case, they also sought to resolve the state case against their client.

“The allegations in the State’s (lawsuit) are nearly identical to the SEC allegations,” the filing stated. “The State does not allege any other conduct that may have resulted in ill-gotten gains beyond those alleged in the SEC action.”

According to the filing, attorneys for the SEC had argued at an earlier hearing in that federal case that Quiros took approximately $55 million “in excess of the amounts allowed pursuant to the various offering documents in connection with the Jay Peak projects.”

Quiros, the filing stated, disputed that amount, calling it “exceedingly high” and challenged it through the litigation with the SEC. He eventually agreed on a settlement following lengthy negotiations.

As part of the “consideration for the significant disgorgement” by Quiros, the SEC agreed to “continue efforts to include the state in the settlement negotiations and to include the state in the final settlement,” the filing stated.

“Although the SEC, the receiver and Mr. Quiros attempted to bring the state to the table to participate in a global settlement by explaining the benefits to creditors and investors, the State refused,” according to the filing. “Instead, the State threatened Mr. Quiros that if he did not accede to their own demands, they would seek to freeze his assets — despite the lack of any legal basis for doing so.”

Gallagher, the assistant attorney general handling the state’s case, offered a different take on that matter.

“What essentially happened is we were told there was a settlement and asked if we wanted to sign on,” she said. “They negotiated the deal and asked if we wanted to sign on and we said, ‘No.’”

Asked why the state didn’t sign on, Gallagher replied, “Because he had $10 million in assets.”

The state, according to the filing by Quiros’ lawyers, has not provided any proof for additional disgorgement by the former Jay Peak owner.

“And to the extent the State seeks to freeze any assets for purposes of disgorgement, the State bears the burden of proving a nexus between the assets and the remedy of disgorgement,” the filing stated. “It has not and cannot do so here.”

Quiros’ attorneys also point out in their filing that Goldberg, the receiver, had reached a $150 million settlement with Raymond James & Associates Inc., a financial institution used by Quiros.

The receiver had earlier filed a lawsuit against Raymond James alleging the financial services firm “aided and abetted” the “Ponzi-like” scheme regulators accused Quiros of operating. In the settlement, Raymond James admitted no wrongdoing.

Jay Peak Resort.

The settlement calls for the money to be used for a variety of purposes, such as paying contractors and vendors for services that went unpaid, completing projects that remain unfinished, and compensating some of the investors who put $500,000 each into developments that never materialized.

Gallagher said Tuesday she believed that there is “at least another $50 million” needed to fully compensate all the investors. Quiros’ attorneys dispute that figure.

Also, while Quiros had agreed to surrender properties to the SEC, Gallagher added, there is no guaranteeing how much money they will fetch once put on the open market to compensate investors.

“We don’t know what they’re going to be sold for,” the assistant attorney general said.

The state filed its motion asking for an asset freeze on Feb. 13. A hearing that had been scheduled Feb. 23 was put off after a joint filing by the state and lawyers for Quiros.

No new hearing date has been set, but attorneys for the state have been given until March 19 to respond to the latest filing by Quiros’ counsel.

“We believe that a hearing is not necessary because it is so clear on the papers as a matter of law that they are not entitled to an asset freeze under these circumstances,” Visconti, Quiros’ attorney, said Wednesday.

The state and federal lawsuits accused the two developers of raising more than $350 million through the EB-5 visa program for immigrant investors. The lawsuits say more than half of that money was misused, with funds from investors meant to pay specific projects used to backfill earlier projects experiencing shortfalls.

Quiros, the lawsuits alleged, looted about $55 million, using the money to pay personal expenses, including taxes and the purchase of a New York City luxury condo.

Both Quiros and Stenger have reached settlements with the SEC, with neither admitting or denying the allegations against them.

The state case remains pending against both men.

Mentions

- Jay Peak Resort - State Side Hotel and Baselodge

- Vermont EB5 Regional Center

- UNITED STATES SECURITIES AND EXCHANGE COMMISSION

- Ariel Quiros

- Jay Peak - Q Burke Mountain Resort, Hotel and Conference Center L.P.

- Barr Law Group

- Peter Shumlin

- Bill Stenger

Litigation Cases

- MICHAEL I. GOLDBERG vs The AM Wealth Management Group of Raymond James & Ariel Quiros & Joel Burstein

- State of Vermont vs Bill Stenger & Ariel Quiros

- UNITED STATES SECURITIES AND EXCHANGE COMMISSION vs Ariel Quiros & Bill Stenger

States

- Vermont

Videos

Subscribe for News

Site Digest

Join Professionals on EB5Projects.com →

Securities Disclaimer

This website is for informational purposes only and does not constitute an offer or solicitation to sell shares or securities. Any such offer or solicitation will be made only by means of an investment's confidential Offering Memorandum and in accordance with the terms of all applicable securities and other laws. This website does not constitute or form part of, and should not be construed as, any offer for sale or subscription of, or any invitation to offer to buy or subscribe for, any securities, nor should it or any part of it form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. EB5Projects.com LLC and its affiliates expressly disclaim any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in the website, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting therefrom.