Documents Suggest State Ignored Warnings About Jay Peak In 2012

State officials ignored warnings as long as four years ago that the Jay Peak developers had potentially misused immigrant investor funds, documents indicate.

Douglas Hulme, owner of the EB-5 consulting firm Rapid USA Visas, had the ear of state officials in May 2012, public records obtained by VTDigger show, and Hulme had challenged the very business practices that became part of the charges the Securities and Exchange Commission brought this year.

Emails among Hulme, Bill Stenger, who was the CEO and president of Jay Peak, and Lawrence Miller, then secretary of the commerce agency, show officials didn’t act on Hulme’s warnings and sought to discredit his company.

It wasn’t until 2015 — three years later — that the state opened an investigation. By that time, federal authorities were already a year deep into their investigation. And it wasn’t until April of this year that state and federal officials charged Stenger and Ariel Quiros with defrauding more than 700 immigrant investors in the EB-5 visa program.

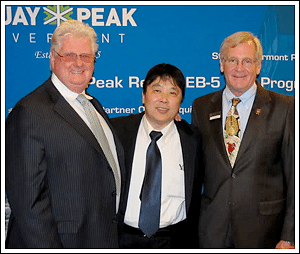

Rapid USA Visas CEO Douglas Hulme, left, and Jay Peak developer Bill Stenger, right.

Hulme’s allegations came on the heels of a very public fallout with Stenger. Hulme sent a letter to 100 immigration attorneys Feb. 28, 2012, warning that he no longer had “confidence in the accuracy of representations made by Jay Peak or in the financial status of and disclosures made by the various limited partnerships at Jay Peak.”

The press quickly picked up the story, and the breakup went viral. In response, James Candido, who was director of the Vermont EB-5 Regional Center at the time, spent a day at Jay Peak and declared in media reports that he found “no issues” with the company’s financials.

Behind the scenes there was a thread of communication between Hulme and Miller over Hulme’s concerns about whether Jay Peak’s financials were in compliance with state and federal laws.

Privately, Candido was working to arrange a telephone conversation between Hulme and Miller. In an email obtained from the state by VTDigger, Candido explained to Hulme that Miller wanted “to discuss in detail the reasons for the departure from the Jay Peak project and (Hulme’s) direct concerns about the project that led to the company’s departure.”

In advance of the conference call, an attorney for Hulme explained to Candido by email that Rapid USA had concerns about “the expenditure and use of funds by the limited partnerships and reconciliation of accounts, including the transfer of funds.”

The attorney, Eugene Lindsey, had asked Stenger in February 2012 for balance sheets, bank statements and wire transfers, as well as the source and use of funds reports for the Jay Peak projects, according to email correspondence provided by the state. He also specifically asked Stenger to verify that he had not used investor monies to obtain margin loans — one of the SEC’s accusations — and that the developer provide Rapid USA with written assurances from legal counsel that the projects were in compliance with federal and state law. Stenger apparently did not provide the assurances Hulme requested, and on Feb. 28, Rapid USA terminated all business dealings with Jay Peak.

Depositions taken by the SEC of two accountants for Jay Peak show that Hulme was apprised of concerns they had about the way Quiros was using investor funds. One of the accountants alerted Hulme and Stenger in 2009 to bank statements that showed Quiros was using investor funds as collateral for loans. The SEC has said in its lawsuit that $105 million of investor monies was leveraged for speculative margin loans from 2009 to 2012.

Another accountant told the SEC that in 2011 he found the developers were commingling funds and using money from new investors to pay for previous projects.

The scheduled phone meeting among Hulme, Miller and Patricia Moulton, who was then deputy commerce secretary, took place May 4, 2012, email correspondence shows. It is unclear what happened or what was said at the meeting. No meeting notes were released to VTDigger as part of a public records request made in 2015. In October, Vermont Attorney General William Sorrell put state communication regarding Jay Peak on litigation hold, blocking public access.

The next communication after the meeting was between Stenger and Miller.

“James briefed me somewhat on the Hulme call,” Stenger wrote May 17, 2012. “I wanted to ask your perspective on it and if you want anything from me. I have a paper trail on all our interaction. If you would like that or anything else please let me know.”

Miller replied: “I don’t feel a need for any further information at this point Bill. Everyone is fully consistent with each other.”

The secretary has said in the past he didn’t recall details from that time.

Shortly afterward, Candido left his post as regional center director, and Brent Raymond, a former staffer for U.S. Rep. Peter Welch, took his place in June 2012.

Lawrence Miller

Later that month, state officials went after Hulme. Miller said Hulme was no longer authorized to use the state of Vermont logo on the Rapid USA website. (Jay Peak developers, on the other hand, continued to use the logo until the SEC stepped in.) In addition, Miller accused Hulme of marketing an EB-5 project at Mount Snow that had not yet been approved by the state. (Jay Peak marketed an office building in Newport for months without state approval.) In closing, he threatened to notify the Vermont attorney general.

In email communications, John Kessler, an attorney for the commerce agency, alleged the Florida consultant had used “Rapid’s web site to misrepresent that it is the State’s Regional Center.” The back and forth between the state and Rapid went on for a year and a half.

In September 2012, Stenger and Quiros held a daylong news conference in three locations to announce $600 million in additional EB-5 projects as part of the Northeast Kingdom Initiative. They envisioned a large trail expansion at Jay Peak, a new hotel and conference center at Burke Mountain, a biomedical facility in Newport, a window manufacturing plant, and an office building, marina and conference center in Newport. Gov. Peter Shumlin, Sen. Patrick Leahy, Sen. Bernie Sanders and Welch were all present for the event.

The media event occurred just four months after Hulme’s meeting with Miller and Moulton to discuss his concerns about potential fraud at Jay Peak.

The state began investigating the finances at Jay Peak in March 2015, and eventually helped the SEC get to the bottom of how Quiros and Stenger allegedly used 26 shell companies, more than 100 bank accounts and 100,000 bank transactions to perpetrate fraud.

Tony Sutton, part of a group of early investors in Jay Peak, is frustrated. He says the state moved too slowly to stop the activity and knowingly put immigrant investors at risk.

Tony Sutton was an investor in the Tram Haus Lodge at Jay Peak Resort.

Sutton himself began sounding alarms two years ago, and since then he has learned that the state knew much more, much earlier.

“It looked to us that back in 2012 there was enough evidence or allegations or suspicion for the state to actually mount an investigation of what was going on,” Sutton says.

Sutton says state officials lost an opportunity to conduct a “real investigation before it got out of hand.”

“Too many people seem to have turned a blind eye, and that’s the thing that (investors are) particularly aggrieved about,” Sutton says. “All this could have blown up in early 2012.”

Fifteen months after the Hulme-Miller phone meeting, Sutton and other investors in the Tram Haus Lodge lost their ownership stake when Stenger and Quiros converted their shares into unsecured loans without their knowledge in August 2013.

“From what I’ve seen on redacted emails that we’ve had access to, it’s completely clear that Lawrence Miller, especially, was very involved in the discussion between Bill Stenger and Douglas Hulme,” Sutton adds. “From my point of view, looking at that information, it seems very clear to me that Miller, particularly, knew a lot more and did nothing, which from my point of view, had he acted at that point, he could have saved our hotel from being seized.”

Miller referred VTDigger to Moulton for comment.

Moulton said the Agency of Commerce and Community Development “did raise questions back in 2012 with the projects that were within ACCD’s limited investigatory powers.”

“The project’s nonresponsiveness led, in part, to the decision to shift oversight responsibilities to the Department of Financial Regulation, which has more expansive authority in these matters,” Moulton said.

“While individuals such as Douglas Hulme may have raised questions previously, his credibility and motives in raising those concerns were marred by his ties to the projects,” she said. “For example, he was told many times to cease activity in which he falsely marketed his company, Rapid USA Visas Inc., as the Vermont Regional Center.”

When the Tram Haus investors found out in May 2014 about the conversion of their ownership stakes to IOUs, they reached out to state officials for help and complained they had been defrauded by Stenger and Quiros. But instead of acting on investors’ concerns, Raymond, at the regional center, pushed back, and Moulton, who replaced Miller as commerce secretary in June 2014, defended Stenger. In a commentary submitted later that year, Moulton insisted that a story by VTDigger was inaccurate and that “Stenger’s action was not in conflict with any federal law or regulations enacted for the EB5 program.”

In correspondence, Moulton told investors that the developers had not violated partnership agreements and there was nothing the state could do to help. She recommended the investors seek recourse in the courts.

Sutton says the investors chose not to pursue a legal challenge because “it would be heard in Stenger’s backyard.”

At the same time, Moulton asked Sutton to provide proof of the investors’ allegations. A month later, Sutton sent bank statements to the state that showed loans secured against investor funds and transfers of Tram Haus money to Q Resorts, one of Quiros’ companies. Moulton never responded, according to Sutton.

“The whole time, they [Raymond and Moulton] were just defending Jay Peak,” Sutton says. “There was never a point where I was thinking they’re actually going to take us seriously and carry out an investigation.”

Emails released by the state in 2015 showed that Moulton and Raymond suspended two projects — Q Burke and AnC Bio Vermont — in the summer of 2014 after the Jay Peak developers refused to respond to requests for financial documents. Lacking subpoena power, the agency was unable to obtain bank statements.

Frustrated by the lack of financial documentation, the agency and Shumlin decided to bring in the Department of Financial Regulation to oversee the projects. In January 2015, the agency signed an agreement with DFR and asked securities regulators to manage oversight of AnC Bio and Q Burke.

Also in January 2015, Mike Pieciak, the deputy commissioner of financial regulation, asked Stenger’s lawyer a general question about Treasury bill purchases and outstanding margin loans listed on a statement from the financial services firm Raymond James.

Mark Scribner, of Primmer Piper Eggleston and Cramer, who represented Jay Peak, made a statement in a letter a month later that piqued Pieciak’s interest: “I want to emphasize that all of the projects are standalone. None share financials or financial returns.”

Michael Pieciak, the former deputy commissioner of financial regulation, is now the commissioner.

Pieciak, who is now commissioner of financial regulation, said in an interview last week that a statement made by David Gordon, an attorney for Jay Peak who is now representing Quiros in the SEC suit, provided another clue. Gordon advised that the developers used Treasury bills because the FDIC insures funds only up to $250,000 and they wanted to protect investors in the event of a bank failure.

That didn’t add up, Pieciak said, because bank accounts are fully protected.

That was the watershed moment for Pieciak in which “trust was starting to erode,” and DFR began subpoenaing bank statements from Raymond James, Citibank, People’s United Bank, JPMorgan, Merrill Lynch, HSBC and Sun Trust.

From March 10, 2015, until April 14 this year, Pieciak and a team of six staffers worked with SEC investigators and pored over more than 130,000 pages of financial documents.

The ongoing investigation, however, didn’t stop the state from allowing the developers to solicit new investors for the AnC Bio and Q Burke projects.

On April 4, 2015, the Department of Financial Regulation gave Stenger and Quiros partial approval to market AnC Bio overseas. Shumlin helped to negotiate the deal, told the developers they would be able to continue the project, and promised to issue a news release reprimanding VTDigger for alleged inaccuracies in a story about the biomedical facility.

Susan Donegan, the commissioner of financial regulation at the time, required that the new investor money be placed in escrow and that the developers obtain permission from the state for expenditures. Donegan declined to issue the news release Shumlin requested.

The partial approval process was designed to protect investor funds, but it’s unclear whether the 34 people whose $500,000 investments were put in escrow for AnC Bio Vermont will get their money back anytime soon.

ANC Bio, the last project proposed, drew $500,000 investments from 197 investors, making it by far the largest of the proposed projects. The original 163 investors put their money in before the escrow requirement.

The project hasn’t been built. When the SEC filed charges, federal litigators declared ANC Bio “nearly a complete fraud.”

The court-appointed receiver overseeing Stenger’s and Quiros’ holdings in Vermont, Michael Goldberg, said the federal district court in Miami will decide how the $17.5 million collected from the investors whose money the state held in escrow will be disbursed.

The immigration status of more than half of all the investors in the Jay Peak projects is in jeopardy.

Despite the investigation, the Department of Financial Regulation also gave partial approval to a hotel and fitness center at Q Burke in July 2015. The state, Pieciak said, wanted to make sure there were funds to complete the hotel construction. Under EB-5 rules, investors cannot get permanent U.S. residency or get their money back unless each development meets job creation targets.

Moulton said “hindsight can be 20/20.”

Commerce Secretary Pat Moulton is stepping down soon.

“As the governor said when the state and federal governments filed the complaints in this matter, we all wish we could have caught the alleged fraud earlier,” Moulton said Monday. “However, no one should forget that it is because of state and federal investigations that this alleged fraud was discovered and that filings were made. It is because of state oversight that the expenditures for the Burke hotel were rigorously examined and AnC Bio investor funds were placed in escrow where they remain to this day. Many people have been harmed by the alleged fraud in the Northeast Kingdom, including investors, subcontractors and entire communities.”

More than a dozen investors interviewed by VTDigger say the primary reason they bought into the Jay Peak, Burke and AnC Bio Vermont developments was because of the state’s stamp of approval. They believed the state was monitoring the projects and reviewing the developers’ finances. Stenger and Quiros told them their money would be held in escrow.

Investors were told the state was monitoring the projects; marketing materials from the developers bore the state’s logo; and prominent state politicians vouched for the projects. Gov. Jim Douglas, Leahy and Shumlin traveled overseas to talk with investors about Jay Peak and the state’s EB-5 program. Shumlin appeared in a promotional video for Jay Peak in which he said the projects were “audited” by the state. The governor has since said he “misspoke.”

In an August 2014 interview with the Argus Leader, a newspaper in Sioux Falls, South Dakota, Raymond, the regional center director, said once a project is approved “we look for any evidence of improper marketing, any evidence of anything even becoming potentially questionable, and we quickly seek out solutions to immediately take care of any concerns that we have.”

Raymond told the Argus Leader that by running its own program, Vermont accepts liability for investor risk.

Documents show the state did not require quarterly reports from Jay Peak until late 2014 and did not obtain financial information until 2015.

Sutton, who is the unofficial spokesman for the Tram Haus Lodge investors, says they are contemplating a lawsuit against the state.

Sutton says the state has not taken responsibility for its lack of oversight and disregarding information Hulme brought to their attention in 2012. Moulton continues to say the state has the best EB-5 regional center in the country.

The Jay Peak scandal is the biggest EB-5 fraud case ever brought by the SEC, according to the Center for Immigration Studies.

“I don’t want to speculate on the potential motivation (state officials) might have had,” Sutton says. “You’d like to believe they had the best of intentions and the whole project from their point of view was of great benefit to the state of Vermont. But that’s not what they were paid to do. The offices they held meant they had an obligation to really find out if there was a problem or not.”

Instead, Shumlin has portrayed his administration as champions who played a key role uncovering the alleged fraud.

Moulton, now the commerce secretary, who is stepping down at the end of this month, deflected blame onto Quiros and Stenger in an interview with Vermont Public Radio last week.

“Let’s put the anger at the folks who actually committed the crime,” Moulton said.

http://vtdigger.org/2016/07/25/documents-suggest-state-ignored-warnings-about-jay-peak-in-2012/

Mentions

- Vermont Agency of Commerce and Community Development RC

- Vermont EB5 Regional Center

- Jay Peak Resort - Tram Haus Lodge

- Jay Peak - AnC Bio Vermont

- Jay Peak - Q Burke Mountain Resort, Hotel and Conference Center L.P.

- UNITED STATES SECURITIES AND EXCHANGE COMMISSION

- Ariel Quiros

- Bill Stenger

- Brent Raymond

- Peter Shumlin

- Patrick Leahy

Litigation Cases

- State of Vermont vs Bill Stenger & Ariel Quiros

- UNITED STATES SECURITIES AND EXCHANGE COMMISSION vs Ariel Quiros & Bill Stenger

States

- Vermont

Securities Disclaimer

This website is for informational purposes only and does not constitute an offer or solicitation to sell shares or securities. Any such offer or solicitation will be made only by means of an investment's confidential Offering Memorandum and in accordance with the terms of all applicable securities and other laws. This website does not constitute or form part of, and should not be construed as, any offer for sale or subscription of, or any invitation to offer to buy or subscribe for, any securities, nor should it or any part of it form the basis of, or be relied on in any connection with, any contract or commitment whatsoever. EB5Projects.com LLC and its affiliates expressly disclaim any and all responsibility for any direct or consequential loss or damage of any kind whatsoever arising directly or indirectly from: (i) reliance on any information contained in the website, (ii) any error, omission or inaccuracy in any such information or (iii) any action resulting therefrom.